Posted 01 March 2009 - 09:27 PM

Posted 02 March 2009 - 11:01 AM

Posted 02 March 2009 - 11:08 AM

Posted 02 March 2009 - 06:11 PM

Posted 02 March 2009 - 06:22 PM

Posted 05 March 2009 - 10:27 PM

Posted 06 March 2009 - 09:47 AM

Posted 06 March 2009 - 08:15 PM

Posted 07 March 2009 - 02:01 PM

Posted 12 March 2009 - 11:32 AM

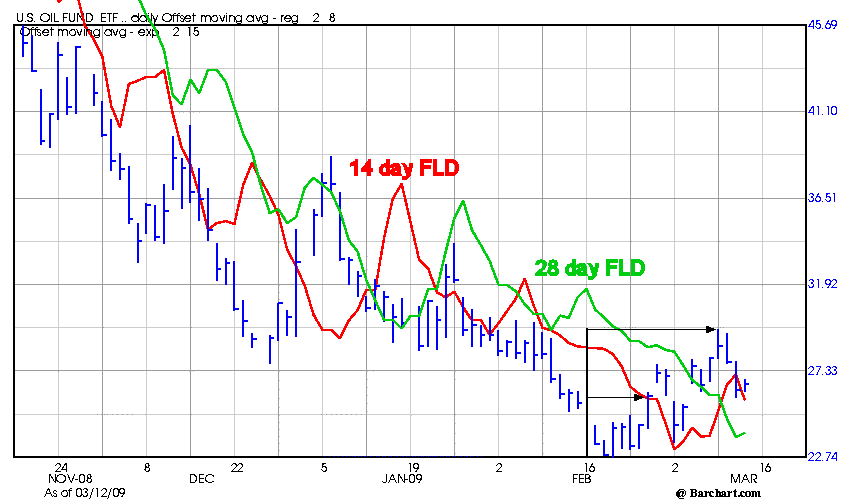

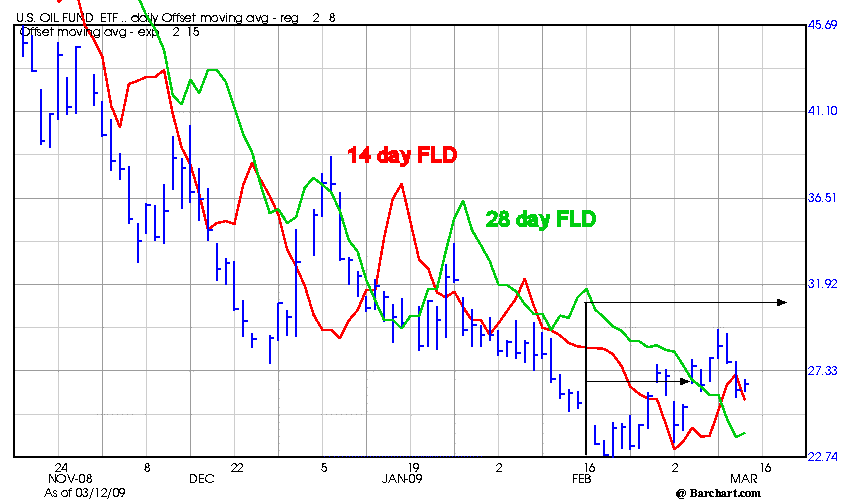

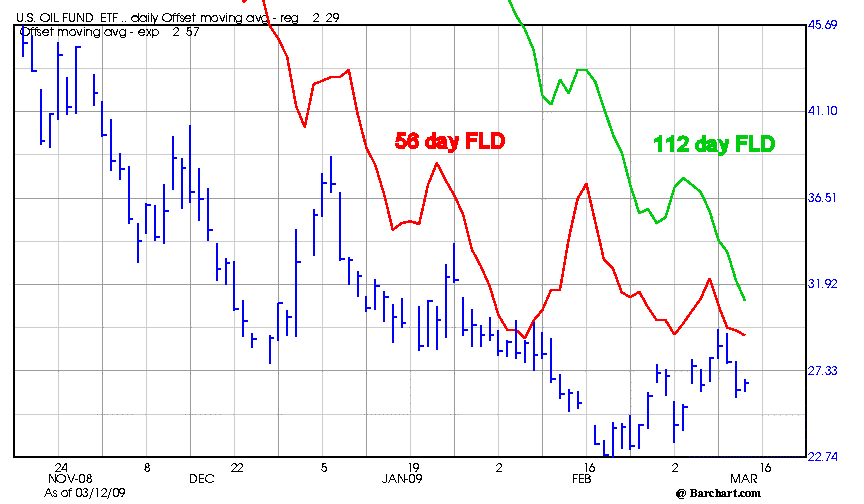

The 28 day FLD has also generated a target 31 - 32 and if crude is bullish, this target should be met or exceeded.

The 28 day FLD has also generated a target 31 - 32 and if crude is bullish, this target should be met or exceeded.

A follow through rally would also possibly generate a 56 week FLD target. Let's first see if crude can find a bullish trend here.

Note the 112 day (22/23 week cycle) FLD sits directly on top of the 28 day FLD. So for the moment the FLDs appear to be in cascade position. But the 112 day FLD will begin to rise in a couple of days and will likely not generate an upside target until at least 2 weeks from now.

A follow through rally would also possibly generate a 56 week FLD target. Let's first see if crude can find a bullish trend here.

Note the 112 day (22/23 week cycle) FLD sits directly on top of the 28 day FLD. So for the moment the FLDs appear to be in cascade position. But the 112 day FLD will begin to rise in a couple of days and will likely not generate an upside target until at least 2 weeks from now.

Make no mistake. If crude rallies today/tomorrow, bullish targets will be generated and will confirmthe larger cycles have bottomed for a good rally.

We're long from yesterday's lows and adding today. This is a swing trade.

cheers,

john

Make no mistake. If crude rallies today/tomorrow, bullish targets will be generated and will confirmthe larger cycles have bottomed for a good rally.

We're long from yesterday's lows and adding today. This is a swing trade.

cheers,

john

Edited by SilentOne, 12 March 2009 - 11:34 AM.