Crude Oil Hurst Cycles

#41

Posted 05 June 2009 - 02:10 PM

I think the USD is key here and could begin a strong rally. I have a potential 80 week Hurst low here this week. The last one was March 2008. The cycle would have run about 64 weeks versus what seems to be an average 68 week cycle. Note this cycle is shorther than the Hurst nominal 80 week cycle and if bullish, should be even shorter. So if the USD has bottomed, I am not bullish crude, gold or commodities here. I leaning into the USD in investment accounts and some bonds for the first time in a long time.

http://www.traders-t...howtopic=106580

cheers,

john

#42

Posted 16 June 2009 - 01:16 PM

#43

Posted 08 July 2009 - 10:57 AM

#44

Posted 08 July 2009 - 12:19 PM

#45

Posted 08 July 2009 - 02:29 PM

#46

Posted 10 July 2009 - 09:25 AM

Edited by SilentOne, 10 July 2009 - 09:30 AM.

#47

Posted 11 July 2009 - 05:39 PM

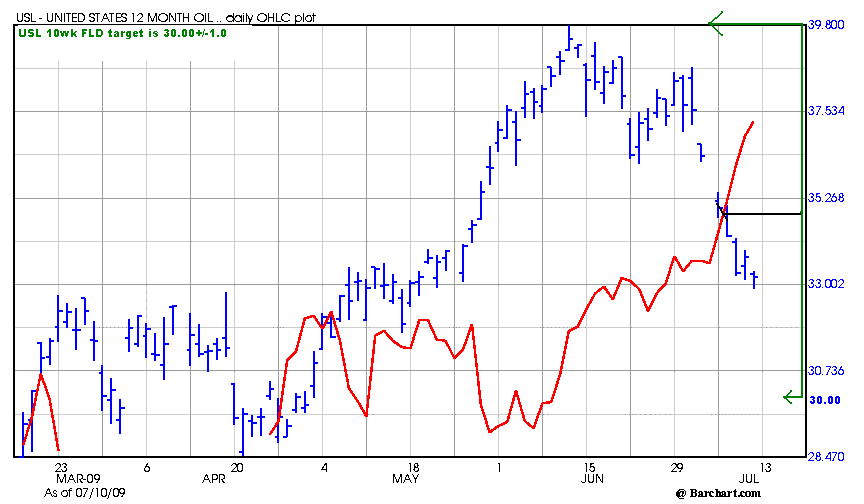

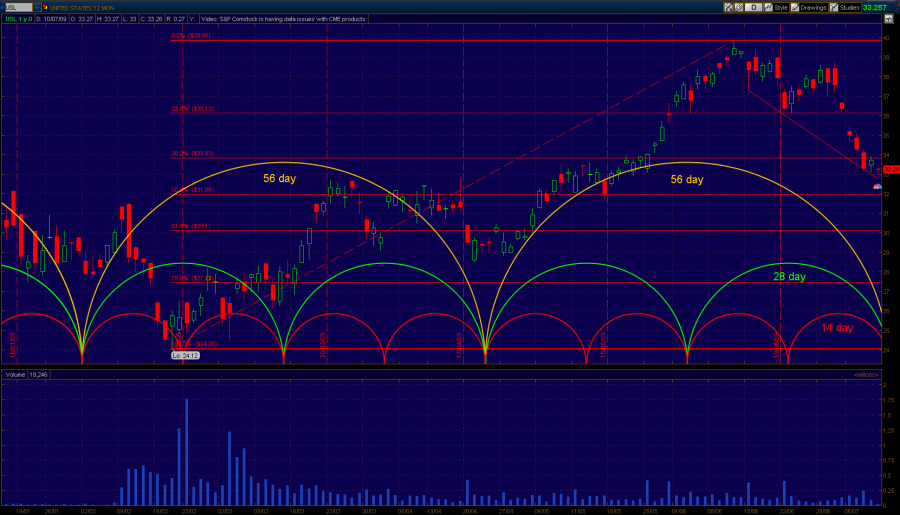

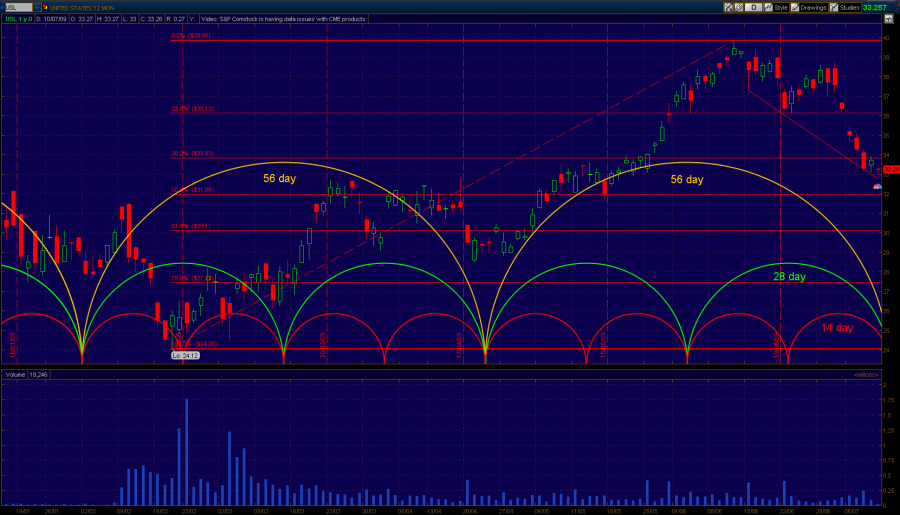

Taking an initial position in USL today here near $33. A 14 day low is due here or early next week. Crude may not get going until the next 14 day cycle low is in. A 50% retracement to 32 may still be the better buy and will add more there.

I should mention that the larger daily cycles (56 day and 128, or 11 and 22/23 week cycles) have been very right translated here. So crude has a bullish posture until proven otherwise.

cheers,

john

Hey John,

Nice analysis.

I opened positions in USO and DIG midday Friday. Glad to be on the same page with you. Do you have any price/target projections for USL? Time frame?? Thanks!

#48

Posted 11 July 2009 - 07:25 PM

#49

Posted 11 July 2009 - 11:32 PM

#50

Posted 12 July 2009 - 01:38 PM

I've only taken a partial position in USL, but will add more at the next 14 day cycle low. The 14 day cycle has been very distinct so I am going with that rather than the bearish FLD target. I count that the current 14 day cycle should have bottomed on Friday, or possibly Monday.

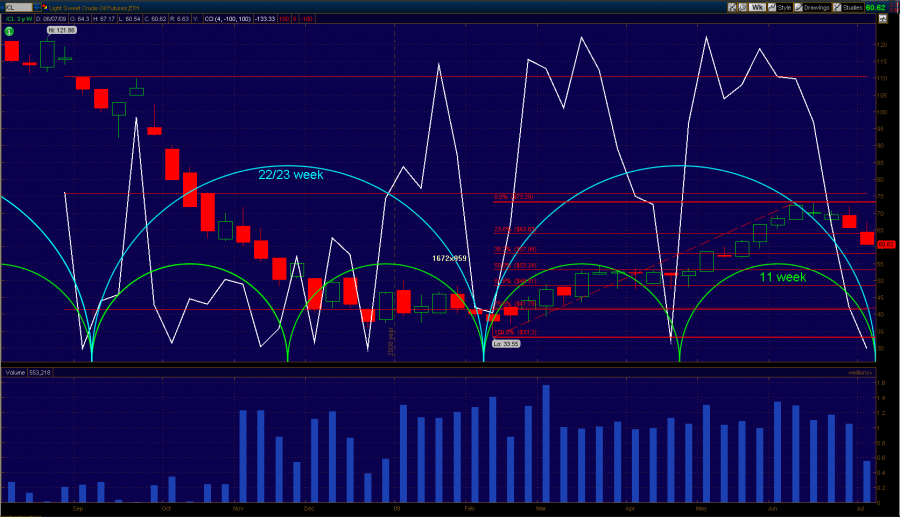

But it is the longer cycles that are of interest here. The last phasing I posted early this year was correct IMO. That had the 44/45 and 88/90 week cycles nest of lows mid-Feb. Now while the 44/45 week cycle will be topping out soon, we still have the start of a new 22/23 week cycle coming in here and the 88/90 week cycle pointing up. So crude can start a rally anytime and last for a few weeks, but possibly it could rally until the 88/90 week cycle tops out late this year. For now there is no way to forecast this on my part. I do feel that crude will be about the last thing to top out before we enter a bearish cycle in commodities and equities next year. Crude oil for exampe will be heading into a 4.5 year Hurst cycle low late next year as the next 44/45 week and the current 88/90 week cycles find a bottom.

cheers,

john

P.S. denmo, it's been a while. Hope you are well.

Edited by SilentOne, 12 July 2009 - 01:45 PM.