I agree TA and you can tell by listening to the cnbc traders. they keep saying everyone is skeptical and they are taking profits below that big 875 number but the market is not going down. that should tell you all you alot right there.

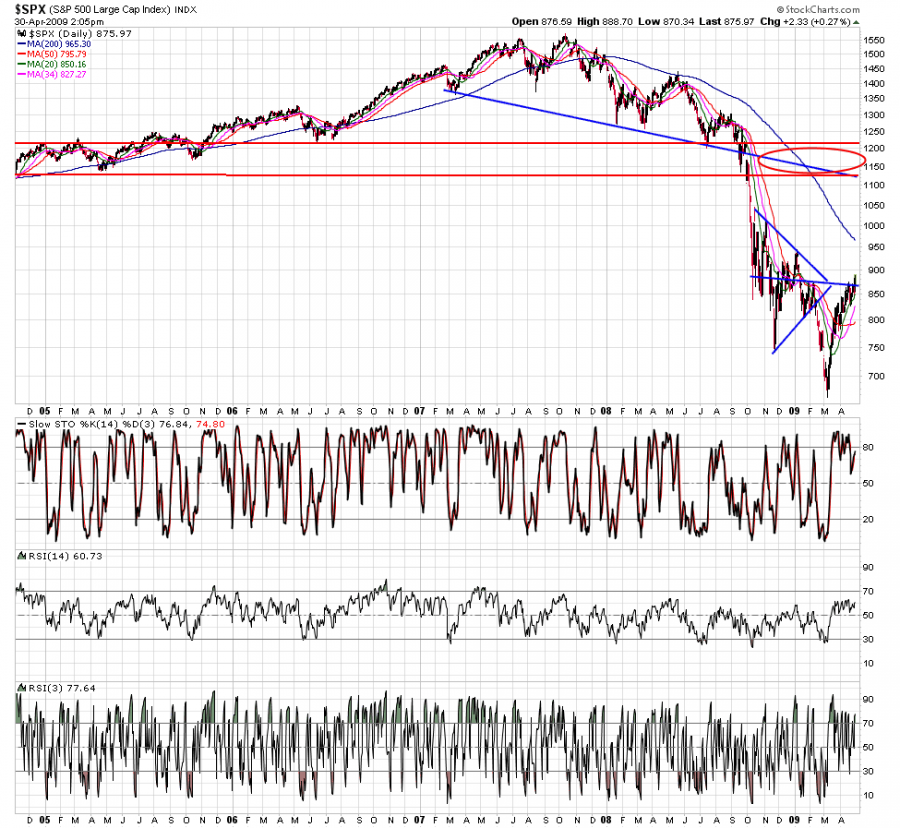

Yes, the high might be tomorrow. A gap up would be a gift to the bears. If it stops at 900, Moneyfriend should auction off his coffee cup.