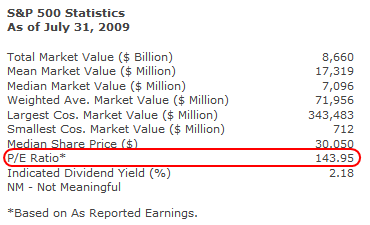

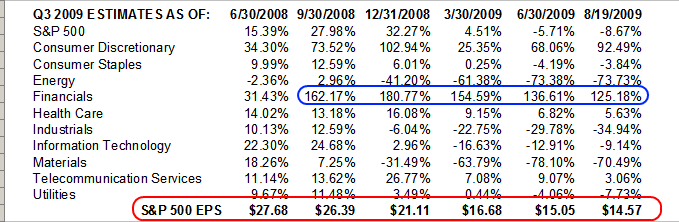

Highest Recorded P/E Ratio EVER on S&P 500

#1

Posted 23 August 2009 - 09:11 PM

#2

Posted 24 August 2009 - 07:21 AM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#3

Posted 24 August 2009 - 07:40 AM

Has anyone ever known a short-term trader to make money consistently trading off P/E's?

I never traded on P/E.. unless intending to buy and hold stocks for long trm investment wihich i do.

Say I'll starting buy 100 lots at crash bottom first ten percent rise I'll sell 30 lots 20% rise another 30 lots 30% rise 30 lots...

I'll keep the last ten lots... and look at P/E... Will consider selling when they reach that super duper over price line.

#4

Posted 24 August 2009 - 07:44 AM

#5

Posted 24 August 2009 - 12:54 PM

True, but there are a lot of short term traders getting their heads handed to them even during this nice rally.Has anyone ever known a short-term trader to make money consistently trading off P/E's?

Problem is, when is the turn, will they react fast enough, and after the turn will they ride it the right direction to make money consistently ?

I'm not that good. Hence why I trade IT mostly.

I think Gary's comments hit the nail on the head for many people going forward:

"A great many investors and money managers have been surprised by the stock market's relentless march higher. But as you look at the charts of the Nikkei we see that’s exactly what happened in Japan. Every rally unfolded in under a year. Almost every decline took much longer. For the impatient trader you were better off playing the long side because the gains came much faster than the losses.

There’s probably a pretty good chance that something similar is in our future for the next decade or two. This is going to be a market timers nightmare. History has already shown that the majority of market timers don’t make much if any lasting long term gains in the market. Add in extreme volatility and ever greater government intervention and you end up with a market that’s going to be next to impossible to trade effectively. Sure a few may get lucky from time to time but over the next 10-20 years I dare say almost no one is going to make any lasting money trying to guess the markets volatile gyrations as it gets pulled back and forth by the deflationary forces and the governments attempts to thwart them. Traders are probably going to be running up a mountain of sand for years to come."

Are you that good to have traded the Japan market well during the 90's ? Are you absolutely positive all of your TA is going to work properly in this type of environment ? have you considered that what worked well during a bull market, will work equally as well during a deflationary environment of epic proportions that the globe has never seen before - possibly far worse and more confusing than Japan even saw ? or maybe it wont work as well, or at all ?

Japan had numerous mega rallies just like we are seeing now. I'm not saying TA won't work, or that anyone here isn't that good, but you simply can't ignore the backdrop, and the P/E's and the global environment we are in. American's,by nature are extreme optimist's. Our ancestors ALL came here to seek a better life. We are a country of immigrants, not natives. We succeed in many cases becuase of that optism. Its how we got to the moon. Its how we won World Wars. We have endured and prevailed in many circumstances that others would have wilted away.

If you want to diss me on P/E ratios not being relevant, or allowing you to make money, that is certainly your perogative. I just point out this rally is based on something other than organic growth, sustainable fundementals and can turn on a dime without warning. There simply far too many distortions in the market place, and manipulation by the Fed, and new High frequency, or front runnign trades with far more powerfull computers,algorithms, and situations the trader has never seen before. Someone who was succesful in the 70's, 80's, 90's or even early part of this decade, may not necessarily keep up his mojo right now. The cocky ones are especially susceptible as in any endeavor in life. have you ever heard of the Peter Principal ?

#6

Posted 24 August 2009 - 10:32 PM

1576 ONO. Upside down, reverse, inside out, snort...

#7

Posted 26 August 2009 - 08:14 AM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter