Edited by SilentOne, 21 September 2009 - 05:27 PM.

Posted 21 September 2009 - 05:22 PM

Edited by SilentOne, 21 September 2009 - 05:27 PM.

Posted 21 September 2009 - 11:47 PM

Posted 22 September 2009 - 09:22 AM

Edited by SilentOne, 22 September 2009 - 09:26 AM.

Posted 23 September 2009 - 02:17 PM

Edited by SilentOne, 23 September 2009 - 02:21 PM.

Posted 24 September 2009 - 10:48 PM

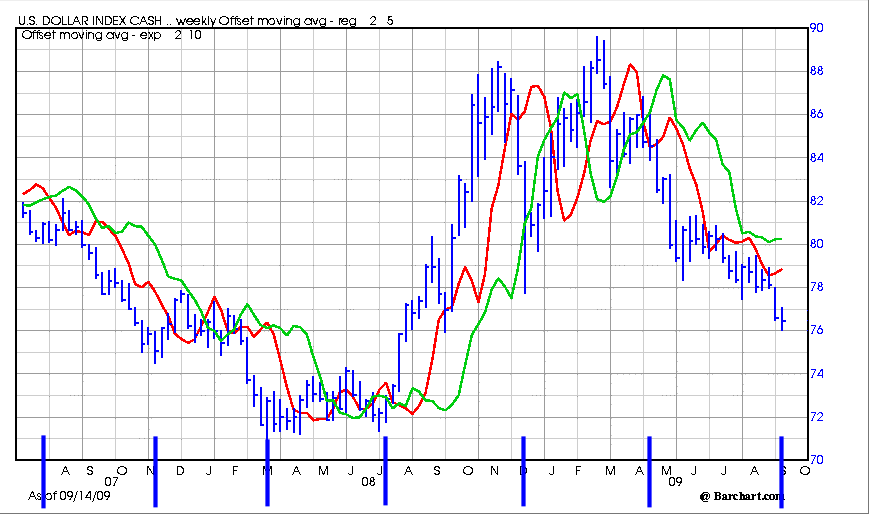

Added an inital position in UUP here at 22.61 this afternoon. My mental stop is a Euro (EURUSD) close over $1.50. Will add on confirmation of a reversal in precious metals.

cheers,

john

Posted 25 September 2009 - 09:20 AM

Hopefully this doesn't reverse at 22.95-23. I'm thinking very short term here.

Edited by SilentOne, 25 September 2009 - 09:23 AM.

Posted 25 September 2009 - 12:56 PM

Edited by SilentOne, 25 September 2009 - 12:58 PM.

Posted 25 September 2009 - 01:07 PM

Posted 05 October 2009 - 10:50 AM

Edited by SilentOne, 05 October 2009 - 10:53 AM.

Posted 05 October 2009 - 02:25 PM

Edited by SilentOne, 05 October 2009 - 02:30 PM.