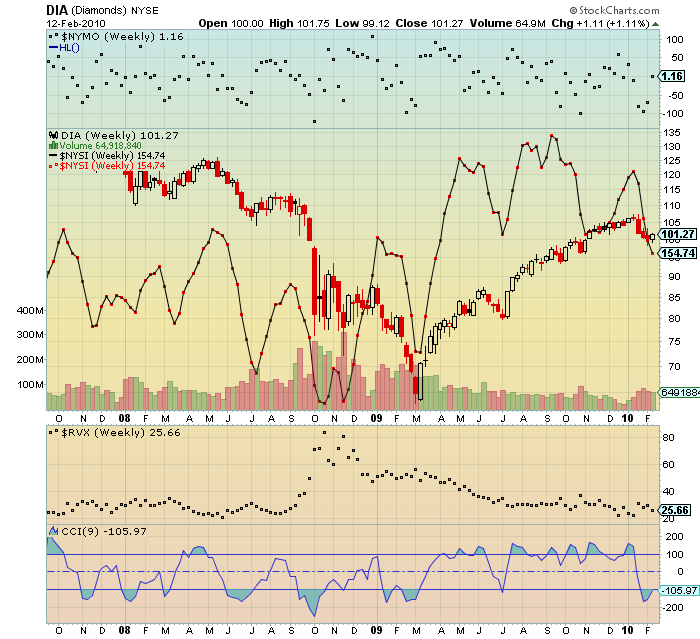

Just posted this on a Fearless Forecasters thread about how splendidly simple the NYSI signals are, especially the current Sell signal which is taking no prisoners. Posting it here for the record of this thread,

I like the basic signal. And certainly this one has worked out well. The problem is that there are generally alot of whipsaws prior to one of these extended moves in the NYSI. And these whipsaws can add up to a significant total loss, especially if your style is to trade the leveraged ETFs. Have you done any backtesting based on actual trades in the ETFs? Could you post the results if you have?

IT

I have back tested it, and I trade those leveraged ETFs.

You are right, the whipsaws make it inconsistent and sometimes pricey. In addition the NYSI lags the turns. Return are dependent on what you trade in conjunction with the NYSI. Remarkably the leveraged ETFs are more likely to make money than non leveraged ETFs, mainly because you want the trading vehicles to out perform on the winning signals while being stopped out quickly on the losing trades. Oftentimes, stock selection using the market signal as an entry is quite profitable.

However, none of that much matters.

I have written extensively on Swing Waves about the NYSI and NASI as the context for trading -- when the NYSI is rising play the long side, when it falling, play the short side. Context is all the matters -- that and persistence, discipline and experience, which is all that the ******* of trading actually rewards. I would suggest taking the trade in the direction of the NYSI and playing defense (using stops) the second the trade is on. For example there was NYSI sell on the 15th that was stopped out for a loss on the 19th (actually with the weekend and holiday that was one day later). Then this current move began...needless to say, that loss is a blip in history (as I said in the header, when you are on the right side of the market context sometimes you just get lucky).

There are many traders here on Fearless Forecasters who's goal appears to be catching the exact bottom or the exact top. I am always amazed at how many try to short a rising NYSI and now are trying to go long a falling NYSI, and then express their frustration over how the market is treating them, but to each his own trading style. But, back test or no back test, my experience is that there is plenty of time to trade and plenty of profitable opportunities when the NYSI's direction is known.

Linda Raschke, who every trader ought to read repeatedly, once said: "I don't want the top. I don't want the bottom. I want the big fat safe thing in the middle." Given that came from the same woman who also once said "never take a loser to bed", I've often wondered if she was actually talking about a trade or not.

Good trading to you.

This topic is locked

This topic is locked