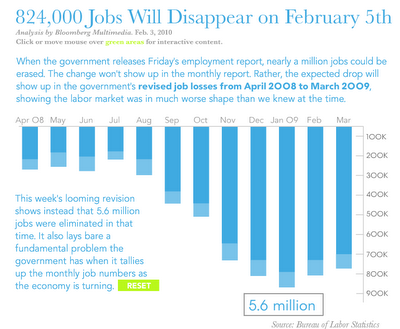

2. 824,000 Will Disappear On February 5; BLS Admits Flawed Model But Plans No Changes

On Friday, expect to see the BLS revise job creation estimates down by a whopping 824,000 jobs. The culprit, as I have been harping on for a couple years is a birth-death model far out of sync with reality. MISH Shedlock

Originally the BLS said 4.8 million jobs were lost between April 2008 and March 2009.

This is what it looks like now. (chart below)

At this point in the cycle Birth/Death Model numbers should have been massively contracting for months. The BLS is going to keep adding jobs through the entire recession. (when everyone knows that few jobs are really being added, and the jobs are still in contraction.

3. Reuters reports in "More Consumers Pay Credit Card Before Mortgage: Study":

More and more consumers are giving greater priority to paying credit card debt than making a mortgage payment, showing increased financial duress, according to a report released on Wednesday.

As the economy climbs out of the worst recession in decades and unemployment remains high, financial strains have forced consumers to prioritize monthly debt payments in order to maximize cash flow.

The percentage of consumers delinquent on mortgages, but current on credit cards rose to 6.6 percent in the third quarter of 2009 from 6.3 percent in the previous quarter and 4.9 percent in the same quarter a year earlier, a new study developed by TransUnion showed.

The trend first emerged in the first quarter of 2008 when it was at 4.3 percent, Chicago-based TransUnion said.

Less emphasis on mortgage payments could portend higher delinquency rates and perhaps even more foreclosures. That does not bode well for the hard-hit housing market, which remains highly vulnerable to setbacks.

"This goes against conventional wisdom and that has always been that, when faced with a financial crisis, consumers will pay their secured obligations first, specifically their mortgages," Sean Reardon, the author of the study and a consultant in TransUnion's analytics and decisioning services business unit, said in an interview.

By making a minimum payment on a credit card before a full mortgage payment it gives consumers monetary leeway to go about their daily activities, especially if they have lost a job.

"You cannot buy groceries with your house," he said. NSS.

People are still in houses they can't afford, and despite the decline in prices, there needs to be a far larger adjustment downward in home. If that happens, more people will be in jeopardy, and more foreclosures will hit the fan, than just the millions of ARM reserts coming due in next 2 years.

I think the markets are way ahead of themselves, and I think we are really at a point similar to 1930. (see chart below). Point of recognition of just how bad things are, and how far ahead the markets have gotten in this bear rally will become very apparent here in February.