Crafting the rhythms series II

The is the first post for the “Crafting the rhythms series II” 12/25/2010

About 2 months ago, the closing post for “Crafting the rhythms series” made the following speculation:

---------------------

Crafting the rhythms series – 10/17/2010.

link

The wave structure since March 2009, in my perception, looks bullish. There is no sign it will terminate in near term. In other words, this wave series may reach 1256-1310

----------------------

One December 22, index crossed over 1256

Overall summary:

(1) Bullish gauge is 1265, target 1291-1310 with a few attempts.

(2) first support is 1197-1205, to be followed by the major cluster zone 1173

(3) bearish gauge is 1138.

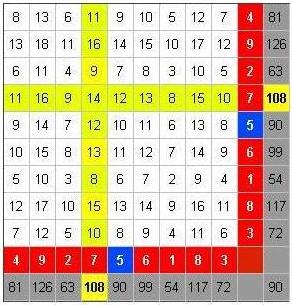

(4) Timing chart

-link-, be aware of leading/lagging possibility.

“Trend is up until it is not”

"It ain't over 'til the fat lady sings" (

http://en.wikipedia.org/wiki/It_ain't_..._fat_lady_sings )

“Patience is a virtue”

How to identify the trend top is a challenging task, basic criteria provides good hints, for example:

“3 Key Signs Of A Market Top”

You may skip the following lengthy details

Dec 23 2010, 11:04 AM

http://indexcalls.co...o...st&p=622527

The significance of 1256.98 is very clearly revealed in the following chart.

chart:

http://indexcalls.co...29464_thumb.jpg

On 03/17/08 index marked 1256.98 intraday low then bounced off. A few E-wave technicians labeled that was the end of wave "1" to complete the total 5 waves ending at 667 on 03/06/09. Now, the current wave "climbs over" wave "1", signals an

overlap condition, the whole wave count needs to be reconciled. it implies a bullish development, [refer to post, dated Dec 21 2010, 07:56 PM].

A mechanic gauge sometimes is subjective. On 12/22, index plotted an intraday high 1,259.39, a few points higher than 1256.98. We may debate whether a few points "violation" is a decisive signal or not. Bear this “argument” in mind, let's dig a step deeper:

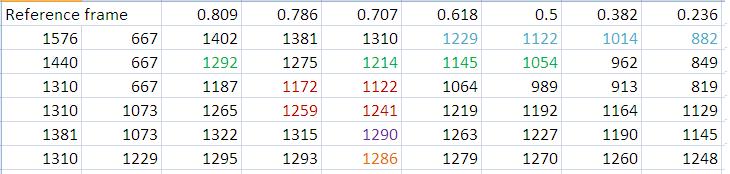

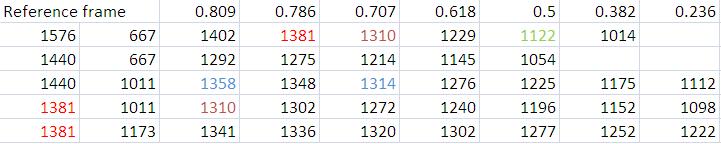

I saw an E-wave technician labeled the wave bounced off 1010 on July/01 as a 5 waves series. Use the wave count as is, the following chart shows a few possible terminal points.

chart:

http://indexcalls.co...30831_thumb.jpg

The index is joggling around 1256, "peeking" at 1265. this is a very "annoying" condition. So, let's go one more step deeper:

----------------------------

Dec 7 2010, 07:40 PM

link

My works suggest that the SPX 1265 (intraday low 03/17/08) is a critical pivot. As long as the index can surmount this pivot, next target is 1310 or even higher

summary (Jim Curry's) : (Jim Curry's chart:

http://static.safeha...rry/19234_c.png )

Upper resistance 1310.55

Lower support 1136.04 ( has been tested on 12/15 (1234), 12/16 (1233) )

target 1243.16 - 1286.36 [SPX Cash]

----------------------------

Jim Curry set 180-day cycle target 1243.16 - 1286.36, The mean value for 1243.16 and 286.36 is 1264.76 (1265). so, 1265 is a reasonable gauge to say whether the index can reach 1310 or not. I see the pullback will be mild, the obvious support is 1200-1207, the bearish gauge is 1138.

Dec 21 2010, 10:12 AM

http://indexcalls.co...o...st&p=621998

By surmounting 1256.98, the wave since March 2009 gains one hierarchical level higher. Index takes out pivot 1265 also opens the gate to see 1310.

Apr 13 2010, 09:58 AM link

Crafting the rhythms series, No. 1 post

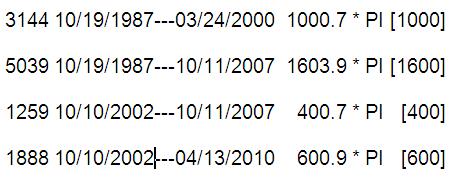

When index exceeds 1256.98 the wave status since March 09 may “separate” from the prior one (1756-->667) and become an individual segment. When the wave is becoming a separate segment, it is capable of reaching 1300 level. The half power point 0.707 from 667 to 1576 is 1310, very close to the High 1313.15 marked on 08/11/08

SemiBizz Dec 23 2010, 11:16 AM

http://indexcalls.co...o...st&p=622528

1265.12 SPX last high from 9/19/08

Lehman Bros Crash.

(insert 1: Lehman Brothers filed for Chapter 11 bankruptcy protection on September 15, 2008)

(insert 2: U.S. Stocks Rise, Erasing Decline Since Lehman Brothers Bankruptcy in 2008

Dec 21, 2010 1:40 PM PT

link )

Dec 21 2010, 07:56 PM

http://indexcalls.co...o...st&p=622149

For academic discussion propose, I put here two of the charts from Michael Eckert,aka-Columbia1

(1) Posted by Michael Eckert,aka-Columbia1 on 12/21/10 at 1:04 PM

( web site:

http://ewtrendsandcharts.blogspot.com/ )

chart:

http://indexcalls.co...90211_thumb.jpg

(2) Michael Eckert,aka-Columbia1 - SPX, Long-term count

( chart link can be found in

http://ewtrendsandcharts.blogspot.com/ title SPX, Long-term count )

chart:

http://indexcalls.co...90232_thumb.jpg

The 5 wave count in (1) is part of the long term wave structure in (2).

wave 2 and wave 4 in (1) may not comply with the “RULE OF ALTERNATION” (II and IV are not the same structure (

http://www.wavecount...Application.pdf ). However, there is some ambiguity in the semantic of the definition that gives leeway for arguments. In additional, Wave 1 is a rising wedge, this seems a rare case in terms of a 5 wave structure. Anyway, in a straight forward read, let’s take this count as is. Wave 1 is from 1011 to 1129, length 118. Assume wave 5 top is 1256 (intraday high as of 12/21), an equal length (but not necessary has to be this way) wave will put index at 1256 – 118 = 1138 ... [the rest of it is into too details, skip]

Dec 13 2010, 11:25 AM

http://indexcalls.co...o...st&p=620341

An obvious RSI/Price divergence shows in the SPX weekly chart.

chart:

http://indexcalls.co...68671_thumb.jpg

Dec 9 2010, 08:57 AM

http://indexcalls.co...o...st&p=619444

(A viewer AK2 reply to me): Contrary to Mr. Caldaro, McHugh says we approach the end game....

“[(Robert McHugh ) There is the alternate possibility that wave (5) up has topped, however if so, we should have seen more power behind the decline over the past two days. So that remains an alternate possibility, not our top labeling. However, with the Daily, Weekly, and Monthly Full Stochastic all at overbought levels, we need to remain alert for a premature end to (5) up.”

Thank You for your inputs

Wave truncation is rare. since the index marked an intraday high 1227.08 (11/05) and 1235.05 (12/07) respectively, the latter one is 8 points higher than the former one, so it does not favor a truncation. There is a margin for this kind comparison, If we allow 3%, the gauge come to the number I have mentioned, 1229 * 1.03 == 1265. 1229 * 0.97 == 1197, However, for bearish scenario, I prefer to see if the pullback can break 1138 decisively.

In September, McHugh did two public commentaries:

A History of Autumn Declines In the Dow Industrials

By: Robert McHugh | Sun, Sep 19, 2010

http://www.safehaven...dow-industrials

Trend-channel Analysis Suggest Stocks Are About to Fall

By: Robert McHugh | Sat, Sep 25, 2010

http://www.safehaven...e-about-to-fall

Dec 8 2010, 09:35 PM

http://indexcalls.co...o...st&p=619364

Tony Caldaro bull market call validation:

breach/surmount 1310, pullback but hold 1229 (rough number). why 1229/1310? (refer to the post, dated Dec 7 2010, 07:40 PM)

chart:

http://indexcalls.co...41212_thumb.jpg

SPX bull market projection - by tony caldaro September 26, 2010

http://caldaro.wordp...ket-projection/

" (Tony Caldaro ) My best estimate, at this stage of the wave structure, is for a top around the previous SPX 1576 high by February 2012."

chart: http://indexcalls.co...73319_thumb.jpg

Dec 7 2010, 07:40 PM

http://indexcalls.co...o...st&p=618948

Jim curry

Technical Warning Signs Brewing!

http://www.safehaven...g-signs-brewing

For academic discussion, I made the following quotes from Jim Curry's work:

quote:

the primary focus for mid-term players should be on the 180-day wave, which, as noted above, has a current upside target to 1243.16 - 1286.36 SPX CASH - a target that was originally triggered back in October. This range is not only the upside target for this wave - but is also the favored range to complete the current upward phase of this same cycle. Here is what this 180-day component looks like right now:

The bottom line with all of the above is this: the SPX should make a move into the 180-day target in the days/weeks ahead. However, the technical indications are starting to suggest internal weakness - which is consistent with what we should expect to see as this larger cycle starts to roll over, ideally occurring some point between now and early-January, 2011. Once this cycle does turn down, then once again we will be set up for the largest percentage correction seen since coming off the late-August low, a correction that is likely to be in the range of 7-10% off the top before bottoming out. end quote

summary (Jim Curry's) :

Upper resistance 1310.55

Lower support 1136.04

target 1243.16 - 1286.36 [SPX Cash]

calculations

1229 = [0.618:1576|667]

upper resistance 1310 = [0.707:1576|667]

target 1286 = [0.707:1310|1229]

target 1243 = [0.707/4:1310|1229]

lower support 1136 = [0.5:(1286+1243)/2|1011]

(these calculations provide hints how index performs the Zig-Zag)

Discussions:

The scope should not only focus on how low the index can reach but also what will happen when the expected secondary low is reached; My works suggest that the SPX 1265 (intraday low 03/17/08) is a critical pivot. As long as the index can surmount this pivot, next target is 1310 or even higher. In near term, No matter index will surmount 1243 or not, the pullback will be mild. Supports are 1205, 1167, 1138 (rough estimate, 0.236.0.382,0.5 of [1265|1011]) and 1108-1085. I believe the market is under cross currents, unsettling, therefore, the index behavior after January/2011 is premature to speculate. Two time windows in 2011 (

this chart ) will give good hints.

[the rest of this post is into too details, skip]

Astro:

The Entertainment Department

Bradley Model, Siderograph by year, 1993 - 2019

http://www.robertew....l/bradley.shtml

Constructing The Siderograph

http://gamma.dhs.org...es/bradley.html

Dec 21 2010, 10:12 AM

http://indexcalls.co...o...st&p=621998

Free Amanita Newsletter 12/21/10 : Amanita Investor’s Guide 2011 Before the End of Times

7. Stock markets: bears will be slaughtered

http://www.amanita.a...ewsletter-e.pdf

Dec 18 2010, 11:23 AM

http://indexcalls.co...o...st&p=621428

complied info:

in terms of human life span , the historical event has a large aberration (to a specific time mark.) For example: Time mark December 21, 2012.

The precise alignment of the solstice point (the precise center-point of the body of the sun as viewed from earth) with the Galactic equator was calculated to occur in 1998 (Jean Meeus, Mathematical Astronomy Morsels, 1997). The solstice point slowly but surely moves westward through the stars at about one degree per every 72 years. Put sun’s diameter (equals about 1/2 degree.) into consideration, the Galactic Alignment "zone" is 1998 +/- 18 years = 1980 - 2016. This is "era-2012." ( From Ronald Reagan, 1981 -- ???? 2016, end of an empire? )

http://alignment2012.com/whatisga.htm

http://earthsky.org/...c-plane-in-2012

Dec 17 2010, 12:32 PM

http://indexcalls.co...o...st&p=621273

Here is a web site shows the current date in the Mayan Date

http://www.sacred-te...cal/mayacal.htm

Current Mayan Date in Long Count format

baktun 12 katun 19 tun 17 uinal 17 kin 5 == December 17, 2010

The "roll over" of the most significant number (Baktun) from 12 to 13 will take place on December 21 2012. The date draws lots attention. To know more about what this means it is interesting to make an astrological chart of the December solstice of 2012 ....

Due to the long period (precessional cycle, 25800 years – 26000 years) of the Earth axis rotation, the position of the December solstice moves towards the Galactic Equator.

"Position A is where the December solstice sun was in relation to the Milky Way some 3,000 years ago. Position B is 1,500 years ago. And position C is "era-2012", when the December solstice sun has converged, as a result of the precession of the equinoxes, with the exact center-line of the Milky Way (the Galactic equator).

chart:

http://indexcalls.co...18769_thumb.jpg

precessional cycle

http://en.wikipedia....wiki/Precession

The Earth goes through one such complete precessional cycle in a period of approximately 26,000 years, during which the positions of stars as measured in the equatorial coordinate system will slowly change; the change is actually due to the change of the coordinates. Over this cycle the Earth's north axial pole moves from where it is now, within 1° of Polaris, in a circle around the ecliptic pole, with an angular radius of about 23.5 degrees (or approximately 23 degrees 27 arc minutes [2]). The shift is 1 degree in 72 years, where the angle is taken from the observer, not from the center of the circle.

2012 AD - Mayan Calendar Galactic Alignment

http://www.ancient-w...s.com/2012.html

What is the Galactic Alignment?

http://alignment2012.com/whatisga.htm

Precession of the Equinoxes

http://www.crystalin...precession.html

The Precessional Cycle of the Holy Cross

http://www.lunarplan...ie300Frame.html

Celestial Alignments

http://www.crystalinks.com/2012.html

THE ASTROCARTOGRAPHY OF THE DECEMBER WINTERSOLSTICE OF 2012

http://www.astrology...cartography.htm

The End of Mayan Civilization

http://www.thenagain...as/endmaya.html

The Mayan calendar

http://www.webexhibi...ndar-mayan.html

http://www.crystalin...ancalendar.html

What is the Long Count?

http://www.webexhibi...ndar-mayan.html

Current Mayan Date

http://www.sacred-te...cal/mayacal.htm

Mesoamerican Long Count calendar

http://en.wikipedia...._Count_calendar

Dec 17 2010, 11:31 AM

http://indexcalls.co...o...st&p=621257

'The dragon exceeds the proper limits;—there will be occasion for repentance"

when things have been carried to extremity, calamity ensues.

Yi Jing [I Ching]: The Book of Changes

http://www.yellowbri...it/yijing01.php

perpection: Year of Dragon (2012) becomes Year of Snake (2013), from “flying” to “crawling”

chart:

http://indexcalls.co...14763_thumb.jpg

Dec 10 2010, 10:37 AM

http://indexcalls.co...o...st&p=619712

3 February 2011 – 22 January 2012: Metal Rabbit

http://en.wikipedia....Rabbit_(zodiac)

Nov 30 2010, 11:37 AM

http://indexcalls.co...o...st&p=617104

Nov 30 2010, 11:37 AM

http://indexcalls.co...o...st&p=617104

The End of the Middle Ages - May 22, 1453 AD

The 10 Greatest Eclipses in History

http://www.mendhak.c...in-history.aspx

Fall of Constantinople

http://en.wikipedia...._Constantinople

Nov 28 2010, 01:29 PM

http://indexcalls.co...o...st&p=616717

THE HERBST NEWSLETTER

Bill Herbst, Issue #125 – August 2010

An excerpt

full text:

http://www.billherbst.com/News125.pdf

Having studied in depth the various cycles of civilization astrology for nearly a decade, I’ve deciphered enough of the symbolic coding to know that the pair of successive long-term alignments [see Note] that make up the primary symbolic indicators of the archetype field from 2008-2020 present us with a two-step dance whose second phase is very different from its first.

(first phase)

From 2008 through 2011, during the life of the Saturn-Uranus-Pluto T-square, whatever happens to push civilization closer to the edge will be resisted by the powers-that-be to the point of denial of anything changing at all in the way we live our lives and conduct our affairs. [ skip..... ]

(Second Phase)

Then, from 2012 on, when the Uranus-Pluto first-quarter square finally hits critical mass and takes over center stage, the second phase repudiates the first as we enter an extended period of real and dramatic change............

Note:

In the first phase, other than those nature disasters, the world experienced:

The collapse of the US housing bubble, European sovereign debt crisis..... ( Financial crisis of 2007–2010

http://en.wikipedia....ign_debt_crisis )

Overall picture

The Next 15 Years: 2005 to 2020

http://www.astrology...ext15years.html

First Phase:

The Saturn-Uranus Opposition Series -- 2008 - 2010

Exact: 5 times

http://www.astrology...turnuranus.html

11/04/08 02/05/09

09/15/09 04/26/10

07/26/10

Second Phase:

Uranus-Pluto Squares - 2008 to 2019

Exact: 7 times, 7 exact conjunctions is fairly unusual.

http://www.astrology...ranuspluto.html

06/24/12 09/19/12

05/20/13 11/01/13

04/21/14 12/15/14

03/17/15