Let's shaft the next generation!

#1

Posted 17 June 2010 - 01:14 AM

Compulsory education. What would you do if you wanted to make youngsters tractable and demoralized? You'd lock them up in custodial facilities for their entire childhood and adolescence.

Academic education. Most people, studies show, learn by doing. So let's structure education to benefit kids that learn from listening to teacher and from books.

Child labor. Let's keep kids out of the labor force so they can't learn any practical skills.

Minimum wage. Let's make it really hard for people without skills to get a job. (But unpaid internships for the rich kids are OK).

Regulated labor market. Kill the common law "employment at will" concept, and tangle up the labor market with all kinds of laws to prevent employers from hiring and firing without cause. You wouldn't want an employer to take a risk on hiring some young uncredentialed nobody.

Mandated benefits. One way to keep inexperienced young people from competing in the labor market is to mandate all kinds of benefits from health insurance to unemployment to retirement. These are things that young people don't need and shouldn't have to pay for. They just make it more expensive to hire young people.

I could go on. We could discuss Fannie and Freddie, which crank up housing prices, making it hard for young people without family means to buy houses, and then devastate the economy with a credit crisis. But let's not get into that.

http://roadtothemidd...illennials.html

Defenders of the status quo are always stronger than reformers seeking change,

UNTIL the status quo self-destructs from its own corruption, and the reformers are free to build on its ashes.

#2

Posted 12 August 2010 - 09:45 AM

What do you think would be the total overall effect of implementing strict lending standards (20 percent down payment, verified employment income, etc.) to not only the housing market but the U.S. economy over the next 5 years?

Patrick Killelea: I think the overall effect of implementing strict lending standards would be that a lot of rich people would lose a lot of money, but the economy overall would be much healthier and more sustainable. Banks depend on loose lending to prop up the market value of their collateral.

But an even larger and more powerful group is all those who own a house and hope to sell it for a profit later. This is probably more than half the population of the US, but they have varying degrees of involvement. ... senior citizens in particular, those who have a paid-off house and want to downsize and take the bubble price of their house in cash, they definitely want to avoid strict lending standards because it would reduce the amount of cash they would get. Those seniors follow politics, and theyíre organized, and they vote, which makes them powerful.

So while higher lending standards would harm the rich and the elderly wanting to sell, the resulting lower prices would greatly benefit everyone else. Disposable income would be higher because mortgages would be smaller. This disposable income would benefit the economy tremendously.

http://patrick.net/forum/?p=496842

Defenders of the status quo are always stronger than reformers seeking change,

UNTIL the status quo self-destructs from its own corruption, and the reformers are free to build on its ashes.

#3

Posted 12 August 2010 - 10:04 AM

the more power you give government the more it will discriminate against young people. That is simply because young people haven't had time to organize into special interests like older adults.

Compulsory education. What would you do if you wanted to make youngsters tractable and demoralized? You'd lock them up in custodial facilities for their entire childhood and adolescence.

Academic education. Most people, studies show, learn by doing. So let's structure education to benefit kids that learn from listening to teacher and from books.

Child labor. Let's keep kids out of the labor force so they can't learn any practical skills.

Good advice!

If the world didn't suck, wouldn't we all just fly off?

#4

Posted 12 August 2010 - 10:26 AM

Good advice!

Every great movement begins as a cause, eventually becomes a business, & then degenerates into a racket -- (but not much longer)

I have never let my schooling interfere with my education

Mark Twain

it costs $74,000 to put $44,000 in Sally's pocket and to give her $12,000 in benefits. Bottom line: Governments impose a 33% surtax on Sally's job each year.

http://online.wsj.co...ODEwNDgyWj.html

Defenders of the status quo are always stronger than reformers seeking change,

UNTIL the status quo self-destructs from its own corruption, and the reformers are free to build on its ashes.

#5

Posted 12 August 2010 - 10:42 AM

... the resulting lower prices would greatly benefit everyone else....

Really? How many times do we have to see this moive?

In 1930, Secretrary of Treasurer Andrew Mellon advised Herbert Hoover to "liquidate labor, liquidate stocks, liquidate farmers, liquidate real estateÖ it will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people."

Yep, 15 years later, disposable income started getting good again - let's just hope we don't have to do that whole world war thingee again - bad on the kids, you know.

If the world didn't suck, wouldn't we all just fly off?

#6

Posted 12 August 2010 - 10:51 AM

Good advice!

That was then, this is now:

Back at the beginning of the summer, I had a column in this space in which I predicted that higher education is in a bubble, one soon to burst with considerable consequences for students, faculty, employers, and society at large.

My reasoning was simple enough: Something that canít go on forever, wonít. And the past decadesí history of tuition growing much faster than the rate of inflation, with students and parents making up the difference via easy credit, is something that canít go on forever.

For the past several decades, colleges and universities have built endowments, played moneyball-style faculty hiring games, and constructed grand new buildings, while jacking up tuitions to pay for things (and, in the case of state schools, to make up for gradually diminishing public support).

But a college degree is an expensive way to get an entry-level credential. New approaches to credentialing, approaches that inform employers more reliably, while costing less than a college degree, are likely to become increasingly appealing over the coming decade.

Read more at the Washington Examiner: http://www.washingto...l#ixzz0wPIRpLnL

Defenders of the status quo are always stronger than reformers seeking change,

UNTIL the status quo self-destructs from its own corruption, and the reformers are free to build on its ashes.

#7

Posted 12 August 2010 - 10:53 AM

it costs $74,000 to put $44,000 in Sally's pocket and to give her $12,000 in benefits. Bottom line: Governments impose a 33% surtax on Sally's job each year.

Okay kids, stay out of school and don't make much money because the govt will take some. Let's starve the beast (i.e., roads, schools, water, military, police, firemen, medicare, social security, etc) by being poor -that will really show 'em! Oh, and we're going to hold our breath too!

If the world didn't suck, wouldn't we all just fly off?

#8

Posted 12 August 2010 - 10:56 AM

Good advice!

That was then, this is now:

Back at the beginning of the summer, I had a column in this space in which I predicted that higher education is in a bubble, one soon to burst with considerable consequences for students, faculty, employers, and society at large.

My reasoning was simple enough: Something that canít go on forever, wonít. And the past decadesí history of tuition growing much faster than the rate of inflation, with students and parents making up the difference via easy credit, is something that canít go on forever.

For the past several decades, colleges and universities have built endowments, played moneyball-style faculty hiring games, and constructed grand new buildings, while jacking up tuitions to pay for things (and, in the case of state schools, to make up for gradually diminishing public support).

But a college degree is an expensive way to get an entry-level credential. New approaches to credentialing, approaches that inform employers more reliably, while costing less than a college degree, are likely to become increasingly appealing over the coming decade.

Read more at the Washington Examiner: http://www.washingto...l#ixzz0wPIRpLnL

I'm okay with alternatives - once shown to actually work. We'll see.

If the world didn't suck, wouldn't we all just fly off?

#9

Posted 12 August 2010 - 11:01 AM

... the resulting lower prices would greatly benefit everyone else....

Really? How many times do we have to see this moive?

Over and over

This Time Is Different: Eight Centuries of Financial Folly

This is quite simply the best empirical investigation of financial crises ever published. Covering hundreds of years and bringing together a dizzying array of data, Reinhart and Rogoff have made a truly heroic contribution to financial history. This single marvelous volume is worth a thousand mathematical models.

(Niall Ferguson, author of "The Ascent of Money: A Financial History of the World" )

Reinhart and Rogoff's book provides a quantitative history of financial crises derived from over 600 years and 66 nations. The basic message from all their data is that there are remarkable similarities in today's financial crises with experience from other countries and nations. The common theme is that excessive debt accumulation by government, banks, corporations, or consumers often brings great risk. It makes government look like it is providing greater growth than it is, inflates housing and stock prices beyond sustainable levels, and makes banks seem more stable and profitable than they really are. Large-scale debt buildups make an economy vulnerable to crises of confidence - especially when the debt is short-term and needs to be refinanced (the usual case).

http://www.amazon.co...l/dp/0691142165

Defenders of the status quo are always stronger than reformers seeking change,

UNTIL the status quo self-destructs from its own corruption, and the reformers are free to build on its ashes.

#10

Posted 12 August 2010 - 11:10 AM

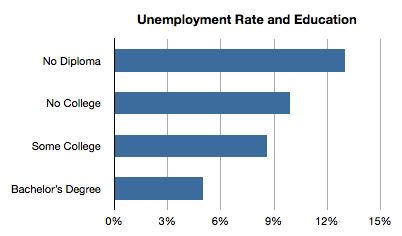

- this is the current unemployment situation

If the world didn't suck, wouldn't we all just fly off?