Here's your chance to fame

#31

Posted 08 July 2010 - 01:42 AM

http://www.motherboa...e-thorium-dream

http://energyfromthorium.com/ http://maps.thefullw...en_salt_reactor

#32

Posted 08 July 2010 - 01:43 AM

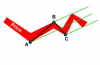

NAV, you mean a fake poke over 1100 not 1000

That's right.

#33

Posted 08 July 2010 - 03:11 AM

i find it funny that option 1 has no range for price, just down now. option 2 has a 20 point range for tippers to be right, and option 3 has a 120 point range for tippers to be right...talk about skew!

Edited by dasein, 08 July 2010 - 03:13 AM.

klh

#34

Posted 08 July 2010 - 04:05 AM

i find it funny that option 1 has no range for price, just down now. option 2 has a 20 point range for tippers to be right, and option 3 has a 120 point range for tippers to be right...talk about skew!

The probability of success diminishes as you go from option #1 towards option #4, as the larger trend is still down. So that should offset the larger latitude allowed for those options.

#35

Posted 08 July 2010 - 04:18 AM

Edited by dasein, 08 July 2010 - 04:18 AM.

klh

#36

Posted 08 July 2010 - 07:17 AM

There's always someone who would claim. I (was the only one who

) predicted the top in 2000, 2007, 1987 et al. Just for fun, let's see how many of you get a medium term projection right. No Ifs and Buts allowed. The options are:

1) We topped out today. The sucker is done and it was a classic bear market squeeze. Short the crap out of it. We are headed for new lows.

2) We may have slightly more upside to the 1070-1090 area. But that would be a gift from the bear godz. We are headed for new lows from there.

3) We may see some pullback near term (or not), but we have started a multi-week rally which should take us above 1100, but not to new recovery highs above SPX 1220. We won't see new lows for a few weeks.

4) To the moon baby ! New highs above 1220 is a given.

Roll your dice. Let's see how many of you get it right. Like Yogi Berra says, "It's difficult to predict, especially the future"

I will go with option 3.

I'll have to go with #3, but SPX goes no higher then 1125.

cap.

Edited by capgain55, 08 July 2010 - 07:19 AM.

#37

Posted 08 July 2010 - 05:13 PM

#38

Posted 04 November 2010 - 09:35 PM

Out

Thanks for all the responses. Come'n guys, we need more participation. There's nothing to lose except a prediction going wrong, which is not unusual in this business. Roll the dice !

OK, #4 sometime by year end, though it may not close there. Hey, it's an election year and the dems are big spenders!!

Out