Jobless Claims

Highlights

The outlook for the August employment report is off to a bad start in what can't be good for today's stock market. Initial jobless claims for the August 7 week came in at 484,000, far above expectations for 460,000 and the highest level since February. The four-week average, up a steep 14,250 to 473,500, is also the highest since February. There are no unusual factors affecting the results.

In a partial offset, continuing claims fell 118,000 in data for the July 31 week. The four-week average fell 64,000 to 4.519 million. The unemployment rate for insured workers came down one tenth to 3.5 percent. These numbers do look good but do reflect, to a degree, the expiration of benefits as the unemployed simply fall out of the insured labor pool.

Import and Export Prices

Highlights

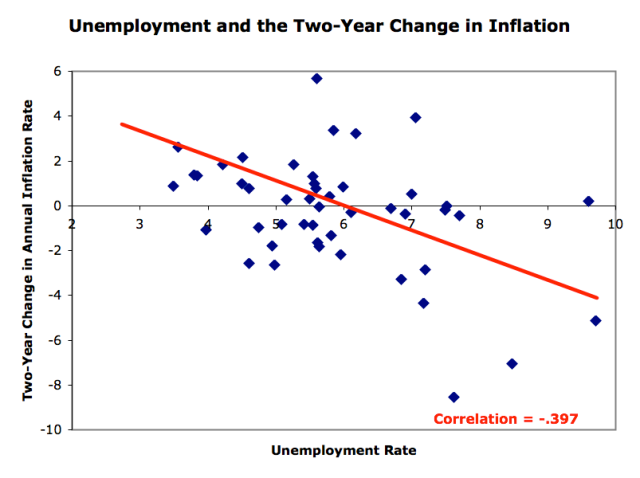

Today's import/export price report is likely to deepen emerging concern over deflation. Import prices did rise 0.2 percent in July but reflect a 2.1 percent rise in fuel. Excluding fuel, import prices fell 0.3 percent following June's 0.5 percent contraction.

Export prices, which fell 0.7 percent in June, fell another 0.2 percent in July with declines posted in most components. Price weakness for capital-goods exports extended to a third straight month in July. Prices for consumer-goods exports contracted steeply in June but bounced slightly back in July.

Import prices for capital goods slipped slightly for a second month as they did for consumer goods. This price weakness for capital and consumer goods, on both the export and import side, hints at price competition at the finished goods level. Today's report points to disinflation elements for tomorrow's consumer price report and Tuesday's producer price report.

LINK:

http://www.nasdaq.co...asp?cust=nasdaq

Edited by Rogerdodger, 12 August 2010 - 09:07 AM.