by Mark Young

The stock market has been inordinately strong for a long time now. This despite a number of indicators going negative over the past few months. The MACD alone has given 3 sell signals since November and so has Summation--two pretty decent indicators. So what gives? Why should we have been Bullish for this long rally?

Well, there are a couple of key factors here, the first being that we're in a Bull market. Obviously, though, that's not enough. As we all know, Bull markets do have corrections. So what else? The next thing we need to check is the seasonality. We know that if you only invest during the best 6 months, from somewhere in late October to late November through mid April to late May, you're very likely to out perform. Now, that's a bit of a blunt tool (albeit, still pretty good), so what else should we have been looking at?

Well, we aren't going to give you all of our secrets, but suffice it to say that we have a robust trend indicator that's just a bit better than most. That gives us just a solid price-based reality check. In addition to that, we like using something that will give us a clue as to whether there serious money flowing into the market. Cumulative breadth is, for us, a very good tool. Take a peek.

http://stockcharts.com/c-sc/sc?s=$NYAD&p=D&b=5&g=0&i=p80311535616&a=68178819&r=1361395500331.png

Now, you might note that there was a very clear "Sell" Signal in November. I'm sure the question arises, "Why didn't you sell?" Here again is where the context is a savior. We already knew we were in a Bull market and we already knew that we were in the positive part of the seasonality. We've also learned, from 30 years of hard experience, that we want to be long for the end of the year, from just before Thanksgiving until at least the 2nd of January. As such, instead of worrying about selling, we were looking to BUY.

I'm sure this sounds like cheating. But here's a challenge for you. Take a peek at every November-January chart in any Bull market. See how many times you would have been hurt buying any sort of oversold Buy signal from, say, the CCI even when the MACD is Negative. Almost every time, you're going to end up smelling like a rose by Christmas.

And the upshot of this is that here we are, looking pretty good in February with plenty of long profits.

So, what now?

Without giving away the farm, we have to tell you, the market looks pretty risky. Sentiment is way overdone. The market is very overbought, and our proprietary trend indicator just marginally flashed a caution indicator. That's sort of a pre-sell. Caution is indicated, but my read is that we're still in a Bull market. Cumulative breadth is still positive, and the current weakness is the first weakness off new highs. There's a pretty darned good shot that it will be bought.

Remember, Tops are built. They take time. It's best to give them a bit of room before you turn too Bearish.

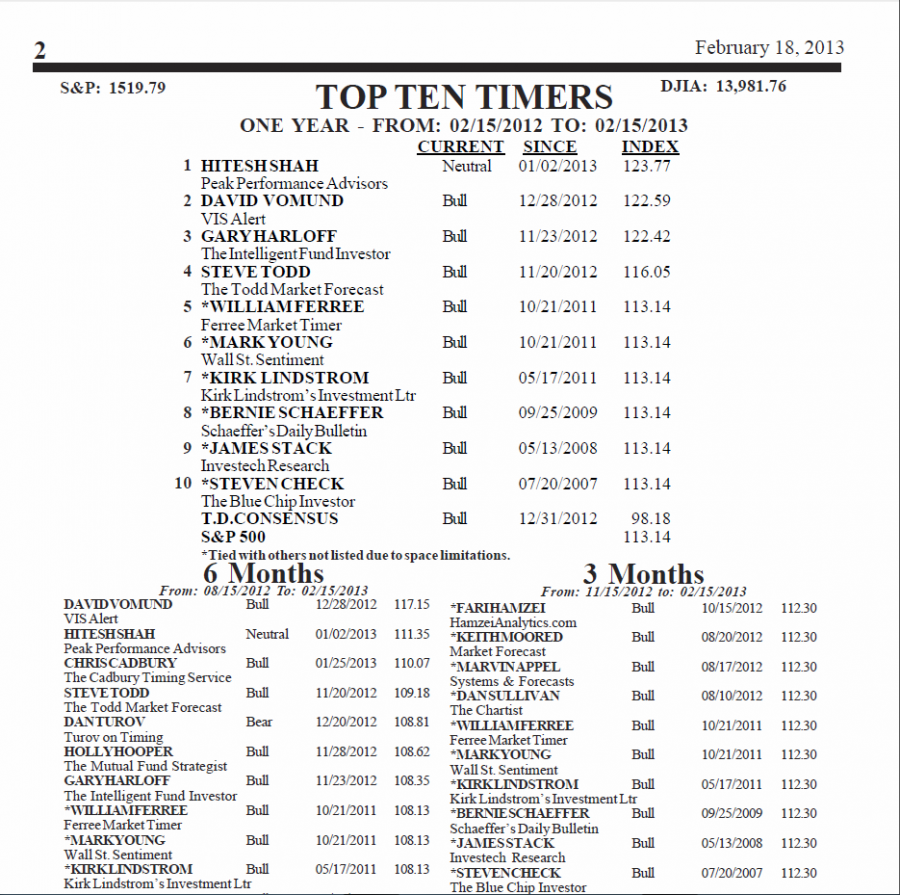

Oh and in case you think we don't know what we're talking about, we're currently tied for the #1 ranking for the past 3 months by Timers Digest and we're not looking too bad for the last 12 months, either.

http://www.traders-talk.com/mb2/index.php?showtopic=144791

If you would like to see a sample of our work, you can get a trial here:

http://wallstreetsentiment.com/trial.htm

or just order here:

http://www.wallstreetsentiment.com/order.html

Good luck and good trading,

Mark Young

Publisher

Wall Street Sentiment