RARE

#21

Posted 08 July 2013 - 09:13 AM

Youtube JBCycles

#22

Posted 08 July 2013 - 10:18 AM

Edited by bigbud, 08 July 2013 - 10:19 AM.

Youtube JBCycles

#23

Posted 08 July 2013 - 11:23 AM

the setup is ripe for Norway today

we had the first close just above 50MA

my equal weighted index was in red, and so the Advance-decline data

And my scenarios are pretty much in phase suggesting the next decline begins Tuesday or Wednesday

-unless something else is going on

---

pretty high p/c-ratio today in US?

so whats ur ewave count on the norway index

#24

Posted 08 July 2013 - 11:30 AM

Youtube JBCycles

#25

Posted 08 July 2013 - 11:37 AM

ewave= elliot wave?

have no idea, dont use it

But i do often look after ABC-patterns, and if my setup is correct, then the SPX 1560 low was A, and now we are close to top-B, before C-down. Same for Norway of course

The normal bullish pattern is a 3-4 week ABC-correction. And SPX has done such one.

But if this is a higher degree of correction, it was just the first phase.

WeŽll see... first we need to see some signs of topping and breaking support.

My ~1month solar cycle i bearish, and today is new moon

And last weeks major geomagnetic storm projects a top just around today-tomorrow.

>ewave= elliot wave?have no idea, dont use it<.....to bad because without knowlege of it you will just spin your wheels.. ewave and fibinocci is what the floor traders, exchange insiders and the back rooms of the wire houses use.....allways have

#26

Posted 08 July 2013 - 11:39 AM

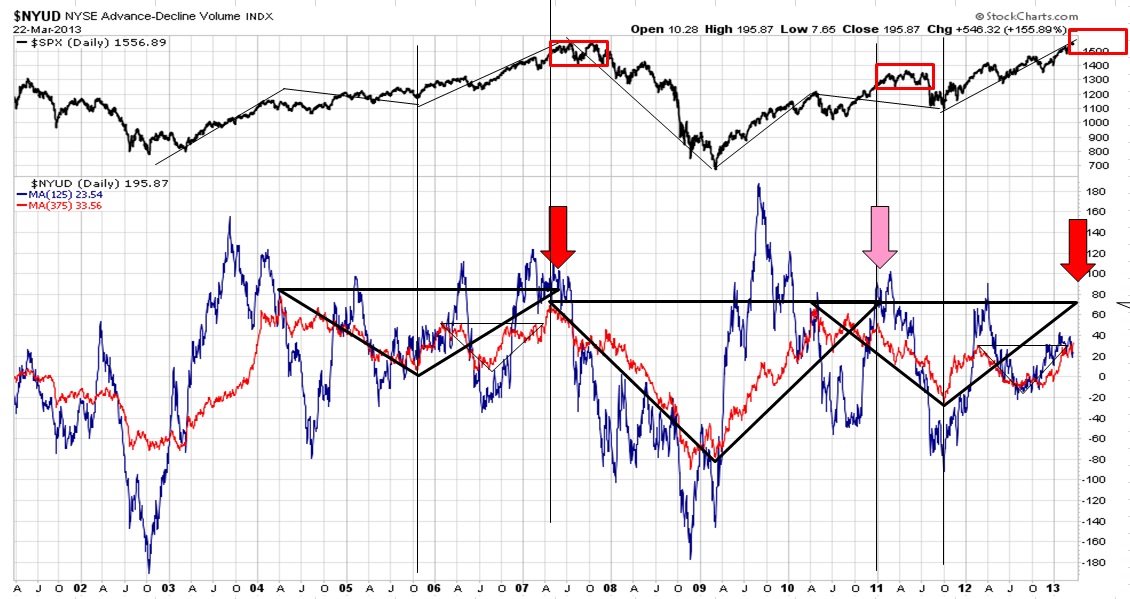

For SPX this is my big ABC since 2009

Edited by bigbud, 08 July 2013 - 11:40 AM.

Youtube JBCycles

#27

Posted 08 July 2013 - 12:01 PM

I use mainly wavelets, in combination with the solar cycles

For SPX this is my big ABC since 2009

and how long have you been doing this?

#28

Posted 08 July 2013 - 12:18 PM

Youtube JBCycles

#29

Posted 08 July 2013 - 04:07 PM

#30

Posted 08 July 2013 - 05:14 PM

...twas just a small taste of whats coming.....388 Nasdaq new highs today, according to the preliminary WSJ data, matched the high of 4/15/2010.

And, somehow the NDX managed to pick up a few points to close in positive territory today. That makes it only the 4th time since 1997 the NDX has ever had at least 9 consecutive up-days.

More later...

heres even a bigger taste.....

http://finance.yahoo...urce=undefined;