venezuala , after calling back all its gold under chavez is now positioned to sell all its gold. and has chosen gs as its intermediary to do so. this is a factor weighing on the market

december contract 1st delivery notice is wednesday, and there is a much larger than usual amount of open interest in the contract. are these folks speculators? or are they about to take delivery? comex would not be able to deliver that much gold

i too follow the miners. and i own pvg , i bought and held my nose w/all the bad news that came out. it seems management was correct in their forecast. they have an extraordinary high grade gold strike. their pea should be interesting

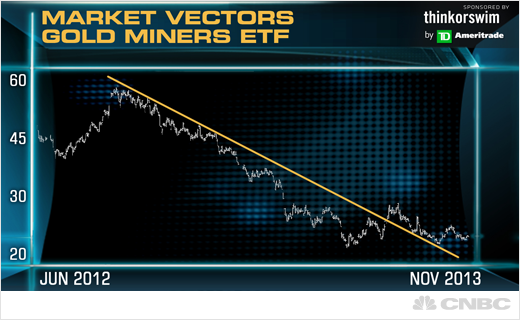

the miners could very well bottom 1st . sinclair taught me in the last bull, the big money buys the miners 1st then they buy gold which makes sense if you think about it. i do think the miners have a good possibility of bottoming 1st and in this area. keeping the cash i have and will deploy it when i feel it makes better sense.

which is to say the technicals line up better. i am not convinced the 6/28 lows will hold

todays cot should reveal some things. it will be interesting to see who is putting on the shorts

dharma

when the market does bottom the miners should have a spectacular rise thereafter. some are in the blues of the present. i understand.but, it does make action difficult/impossible

sinclair interviewed

http://www.sprottmon...r-november-2013

Edited by dharma, 22 November 2013 - 03:59 PM.