Sentiment Commentary for 3-9-14

By Mark Young

Publisher

Wall Street Sentiment

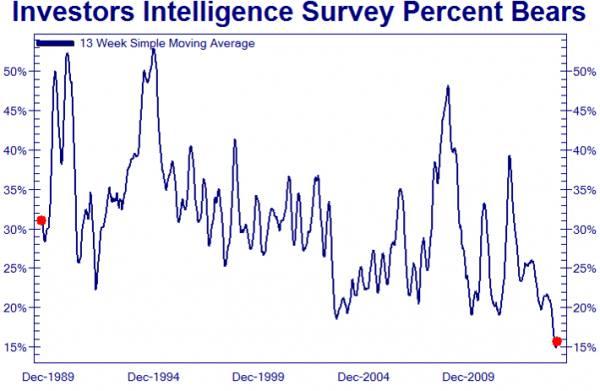

This week, a chart of Investors Intelligence Survey Bearishness has been making the rounds on the internet this week. It seems that the 13-week average has fallen to about 15%, an alarmingly low level, much lower than the tops in 2007 and 2000. And it does alarm us. Not many Bears means that there's nobody short the market, and THAT means if the market should fall there are few natural Buyers below. A decline could get out of hand (below is the chart that is making the rounds. I have no idea what the original source is, otherwise I would credit the author).

That's pretty scary!

So, we should be liquidating all stocks now, and buying treasury bills until this all blows over, right?

Not so fast. This is when a little experience and a little gray hair comes in handy. Let's take a look at a bit longer scale. Below is Decisionpoint.com's long term chart of Investors Intelligence Advisor Sentiment. It seems that such low percentages of Bears are not at all unheard of.

[chart courtesy of Decisionpoint.com and www.stockcharts.com]

Back in 1983, Bearishness fell to similarly low levels, and the market rallied on for a while and then only paused--no crash ensued. Back in 1986, we also saw very low levels of Bearishness, and again, the market only paused before rallying much higher. Even in 1987, when we again saw that similar paucity of Bears, the market held up for months before finally collapsing. The data show that if you had bailed at the first sign of trouble in 1983, you would have missed nearly doubling your money before the real trouble hit, while sidestepping very little serious weakness.

Does this mean that we should ignore the low levels of Bearishness? Absolutely not. Low levels of Bearishness have marked some important tops. It's important to remember, though, that the correlation between a paucity of Bears and the steepness of declines is nowhere near perfect. Sometimes we get almost no weakness (or much delayed weakness) from low Bears, and other times we get absolute collapses with greater numbers of Bears. After the low readings at the end of 2009 we barely saw any weakness, while in 2011 the correction was much more respectable. At the top in 2007, we had many more Bears than we have now.

What we know is that typically, we get some extended high readings from the Investors Intelligence Bull/Bear going into a top of any import. We know that often, Bearishness will increase or Bullishness will decrease prior to a decline of greater magnitude--it will look like the risk is abating but actually it's increasing! Most importantly, we know that having some form of trend confirmation, as well as some other sentiment measures to confirm, will greatly lessen the instances of jumping the gun and help keep us from getting too Bearish, too soon.

Mark Young publishes Wall Street Sentiment Daily and Weekly and manages Traders-Talk.com, an online community for traders, analysts, and investors. If you would like to receive a trial subscription to Wall Street Sentiment Daily to sample the unique and proprietary sentiment indicators that we use to make outsized gains, simply go to this link and sign up. http://wallstreetsen...t.com/trial.htm