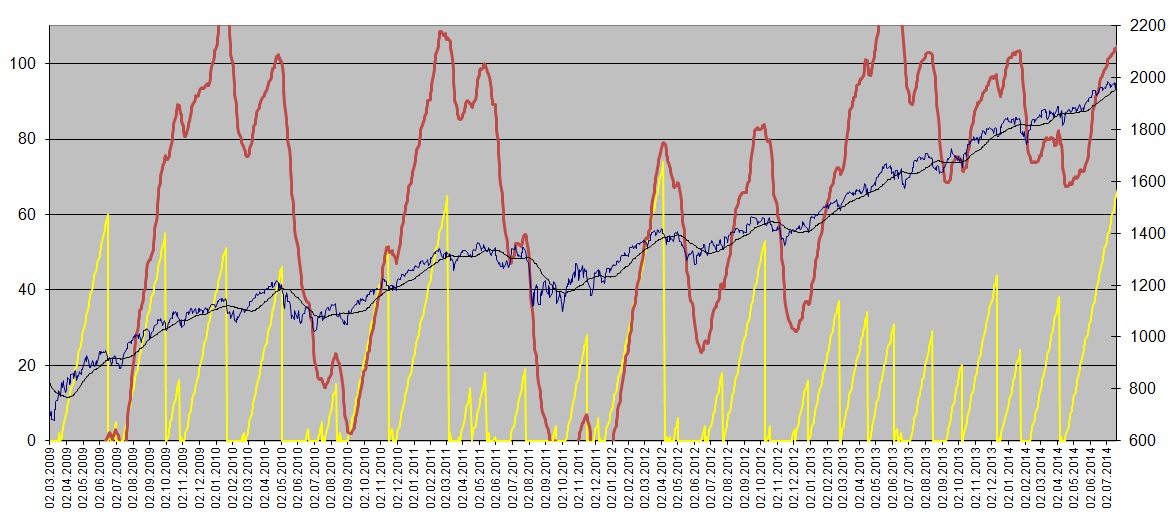

In any case, we couldn't get the SPX to move 1% in either direction in 13 long weeks. And once it's made the move, it's given us two 1% days in a row. The second 1% move today has taken it back up to the top of the range while volatility continues to rise - the apple of my eye.

Again, based on my count, it's unsustainable above 1970s without going through a correction first. Now that OpEx week's over, I'd expect another trip back to the bottom of the range to start the new week.

Edited by TechMan, 18 July 2014 - 05:24 PM.