Edited by prognosticator, 30 January 2015 - 08:37 PM.

Limit down Monday.............

#1

Posted 30 January 2015 - 08:33 PM

#2

Posted 30 January 2015 - 10:18 PM

#3

Posted 30 January 2015 - 11:12 PM

I love the big moves and volatility. Nothing more boring than a dead market.

I remember you are (were) still bullish and you take only a couple of positions each year. Are you positioned for long or short?

#4

Posted 31 January 2015 - 12:00 AM

Edited by pdx5, 31 January 2015 - 12:06 AM.

#5

Posted 31 January 2015 - 02:49 AM

#6

Posted 31 January 2015 - 05:20 AM

#7

Posted 31 January 2015 - 09:41 AM

So do I!I love it.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#8

Posted 31 January 2015 - 09:55 AM

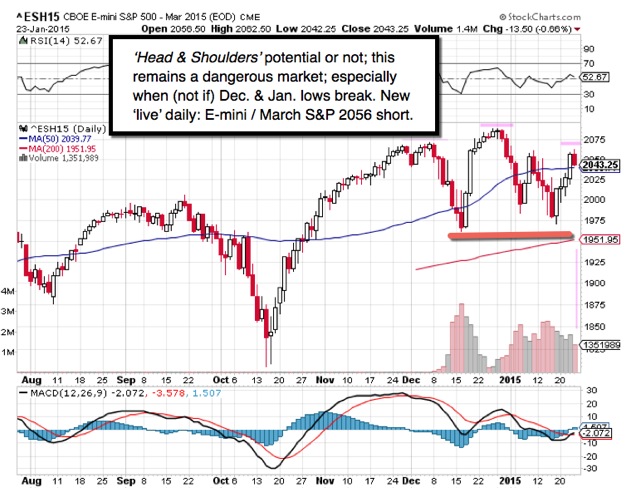

In the past, whenever the Confidence index was declining as it has been all year, the big drop didn't come until the last support was taken out.

As Inger commented:

Let me reiterate a potential 'vacuum' awaits that penetration.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#9

Posted 31 January 2015 - 10:11 AM

#10

Posted 31 January 2015 - 10:58 AM

if that happens that is the call of the year. .you certainly have my attention

Obviously, with the group of ES buyers located deep in the bowels of the Federal Reserve, it is an extremely unlikely scenario.

It does seem as though markets have come back to life. I mean just take a look at the daily trading range of the Q's over the past two months. Good times for sure.

Seriously, I see nothing but short term negative setups across MOST of the issues I follow. Typically, futures are green on a Monday morning although the time is ripe for this pattern to change.