Weekly Breadth Data, Week Ending April 10, 2015

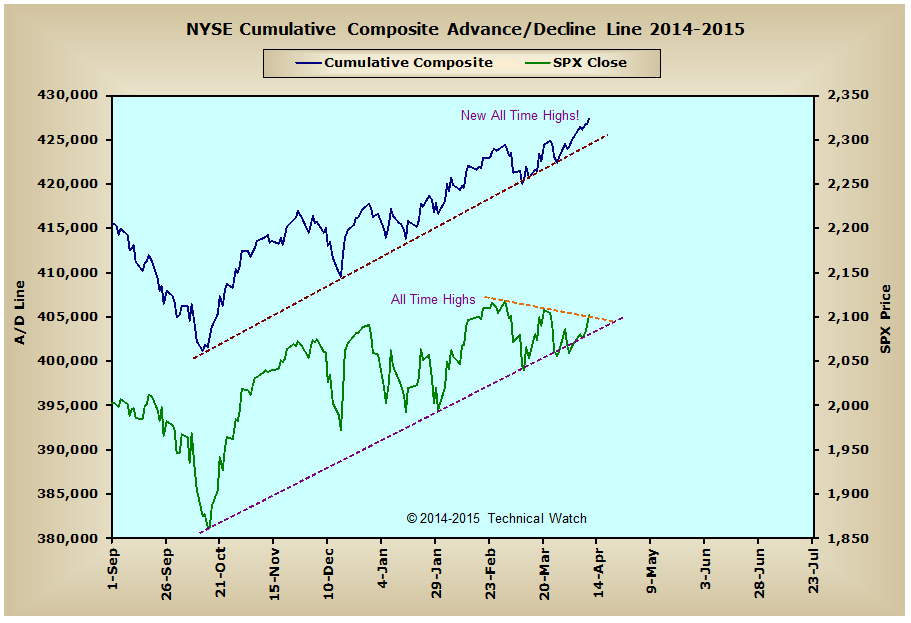

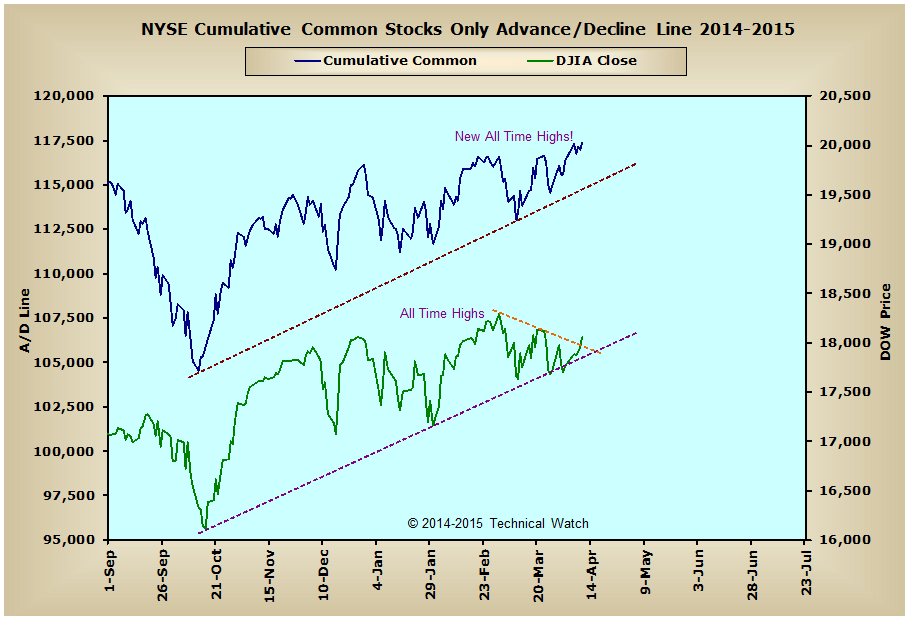

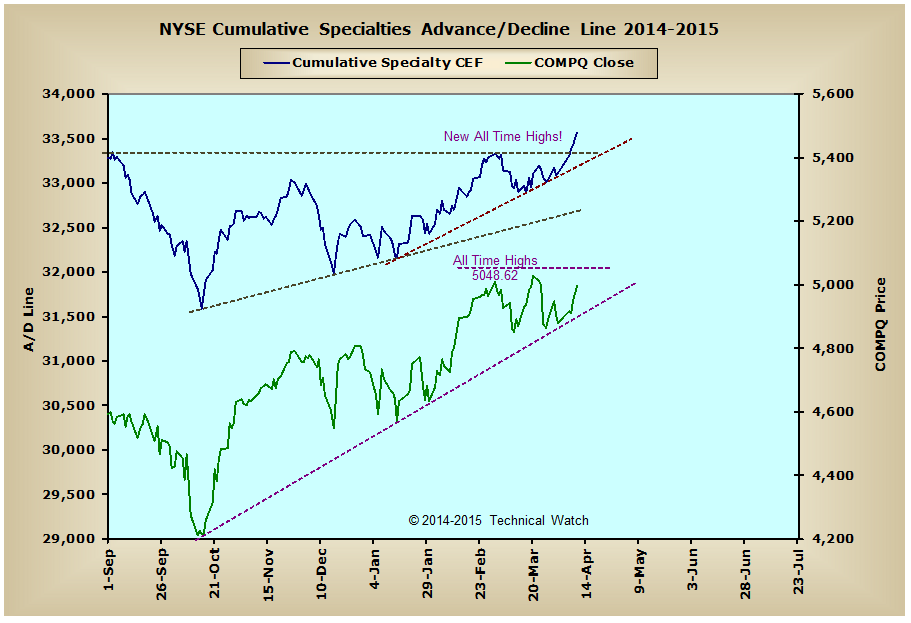

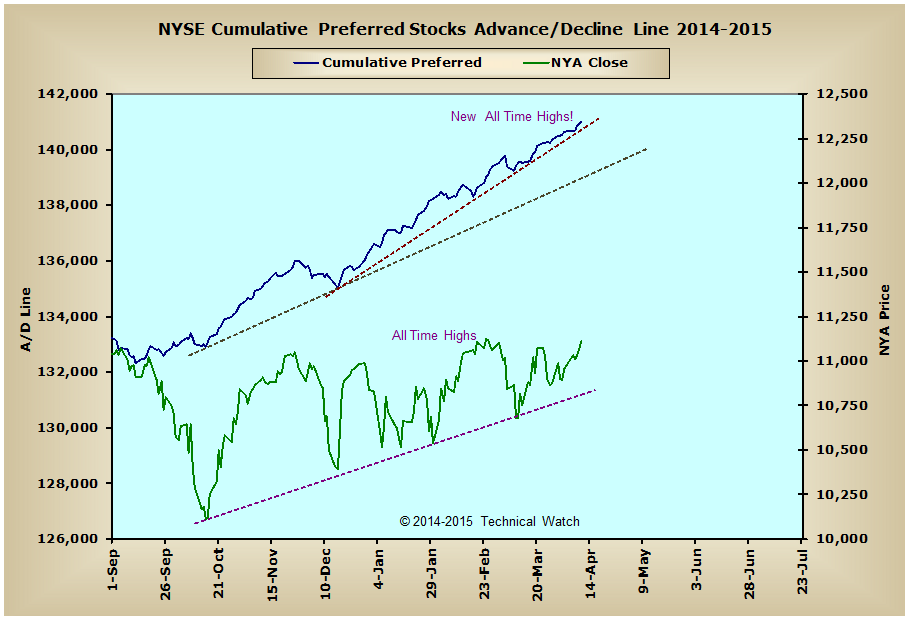

It was a solid week for U.S. equities overall as the major market indices closed up by an average 1.33% from the previous Friday close, with the NASDAQ Composite Index showing the largest gain of 2.23%, while the Small Caps brought up the rear with an average gain of only .47%. It should also be duly noted that the New York Composite Index, the broadest measure of stock market activity on the NYSE, closed at new all time price highs on Friday on a weekly basis and it's now less than 10 points away from matching this historic level on a daily basis as well.

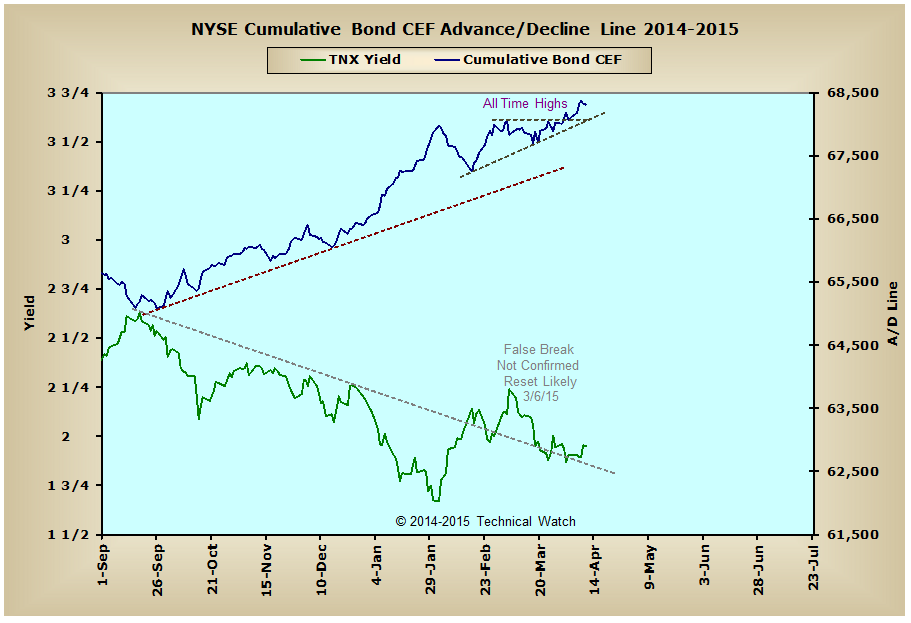

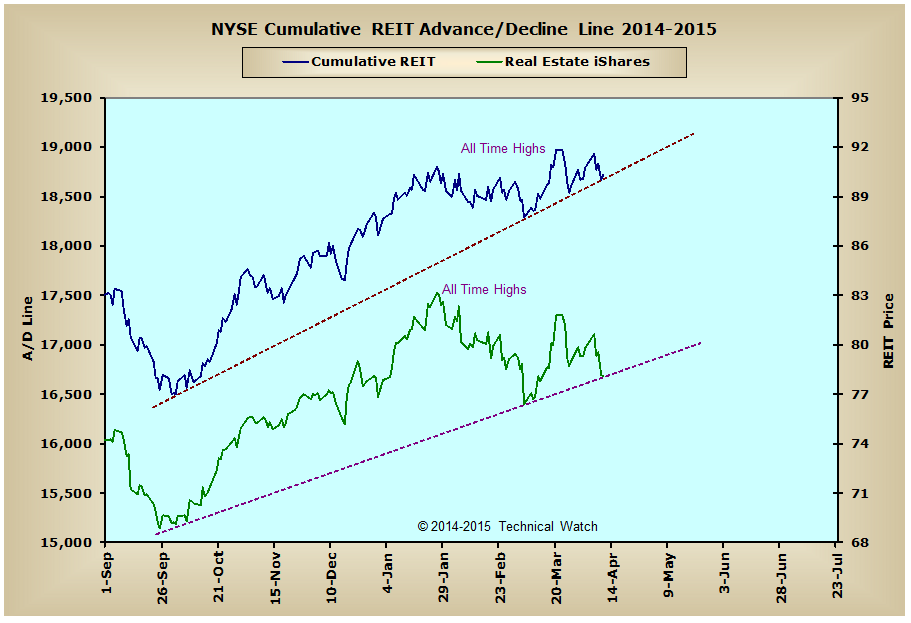

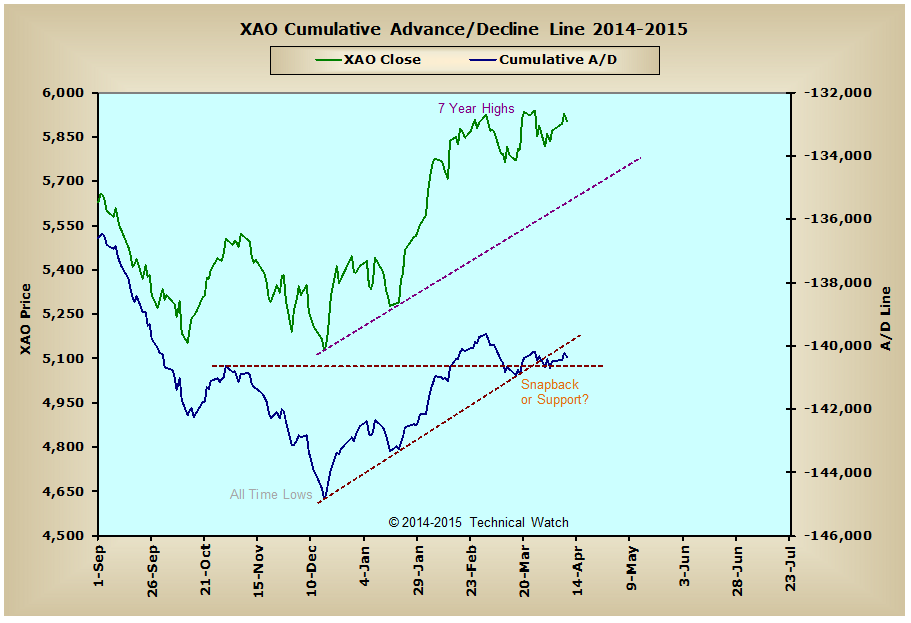

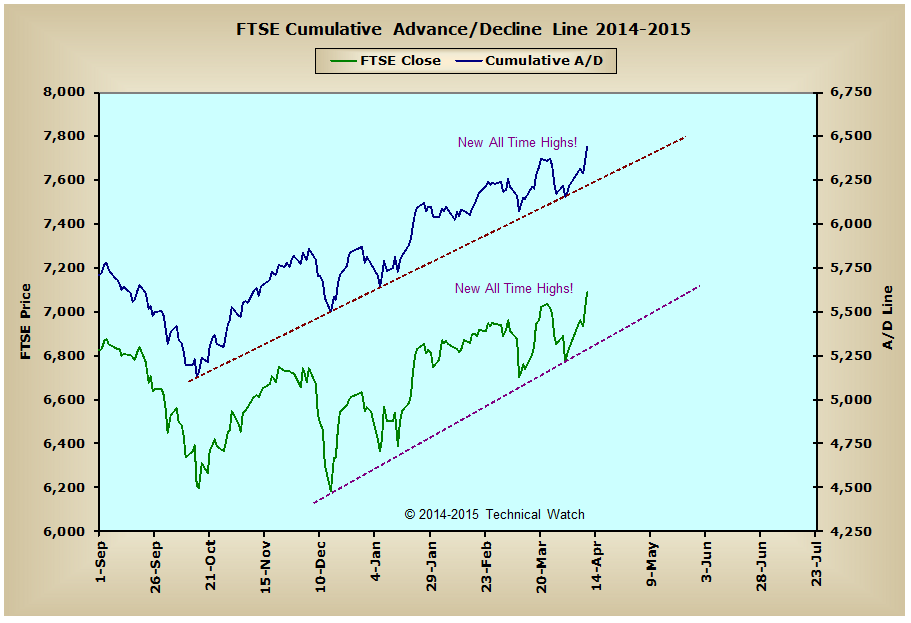

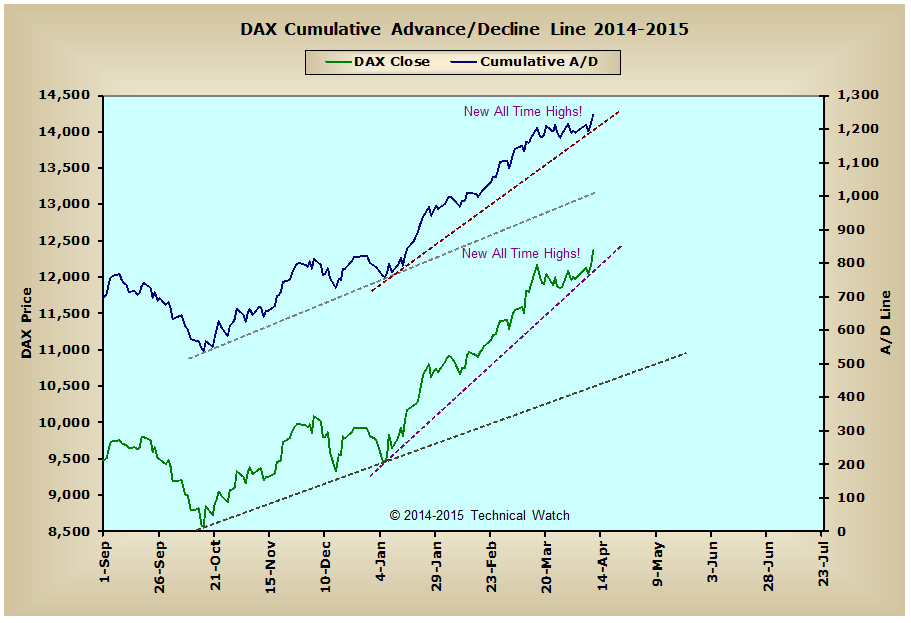

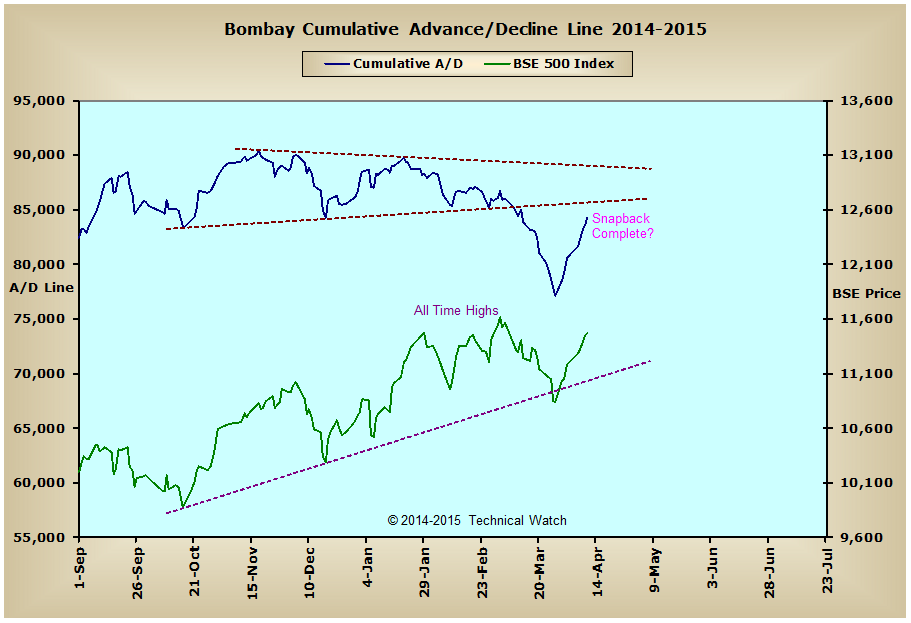

Looking at this weeks breadth charts array and we see that, with the exception of the NYSE REIT advance/decline line which settled the week at its rising bottoms line, all of the cumulative breadth lines we follow closed at new all time highs on Friday with the NYSE Bond CEF advance/decline line doing so on Wednesday. Over in Europe, both the DAX and FTSE advance/decline lines also closed at new all time highs on Friday, while the Aussie advance/decline line continued to move within a narrow range of horizontal support. This strong showing of money flow in both the U.S. and European markets also spilled over to India's BSE advance/decline line which continued its snapback to what was previous support in early March. All in all then, it would now appear that the buyers have regained firm control of the global action, and that the path of least resistance for the next several weeks will be higher until proven to the contrary.

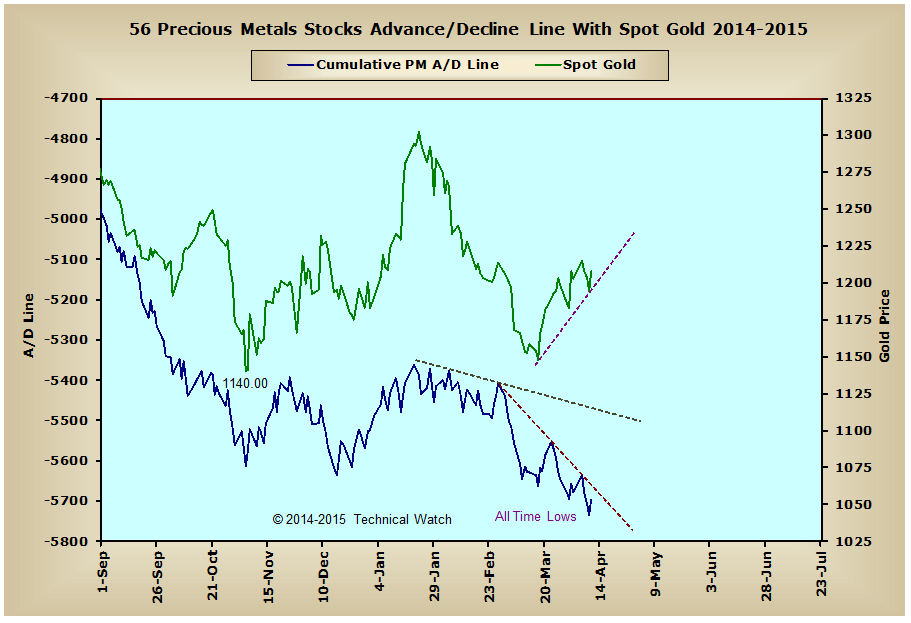

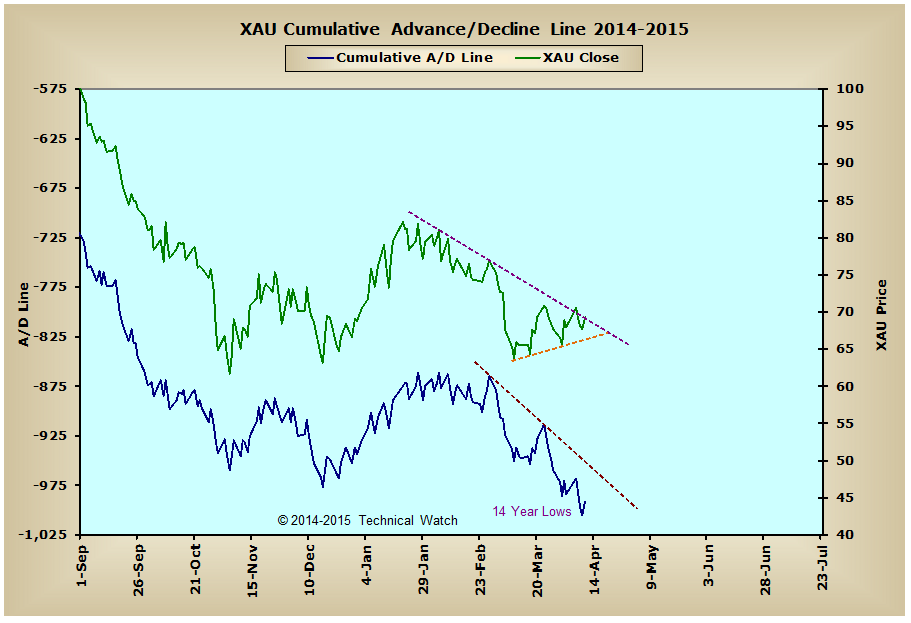

On the flip side of the coin, money flow in the precious metals markets continues to look very weak in the face of the spot price of gold and silver continuing to show firm price bids by traders. However, this gaping inconsistency between precious metal money flow in equities and the price of the metals themselves increases the likelihood of a brutal accident just waiting to happen as this vacuum is eventually filled between these two diverging structures. Because of this, a fully defensive posture toward this asset class continues to be recommended until a technical reset is finally remedied to correct this incongruous situation.

So with this week's BETS indicator finally breaking above its multi month declining trendline with a +40 reading, along with breadth of market moving to new highs on a broad based basis, the expectation for next week is for continued market strength as we move into next week's OPEX period and beyond that into the 1st week of May. Any continued strength that we may see in the commodity weighted Canadian markets during this time will likely push this early May timeline out into the beginning of June. For now, the buyers have wrestled away control of the market...how far they take it will only be known in the fullness of time.

Have a great trading week!

US Equity Markets:

US Interest Rates:

US Real Estate:

Precious Metals:

Australia:

England:

Germany:

India:

Technical Watch's Breadth Data Review includes a weekend recap of hard to find breadth measurements from the New York Composite Index, the London exchange (FTSE), the Frankfurt exchange (DAX), Sydney's All Ordinaries index, and India's Bombay exchange (BSE). Charts are provided with a market narrative by Dave Breslaw and are annotated for additional clarity and suggested positioning. Also included with this service are occasional special posts of longer term data charts to provide a comparable historical context of how internal action of the markets (money flow) can have a direct effect on the direction of price itself. This service works hand in hand with the Chatting the Market subscription service as it provides additional global money flow insights found nowhere else on the internet. More information on subscribing to either or both services can be found by clicking here.