Junk bonds are in alternate universe

#1

Posted 24 November 2015 - 07:04 PM

#2

Posted 24 November 2015 - 07:27 PM

klh

#3

Posted 25 November 2015 - 07:29 AM

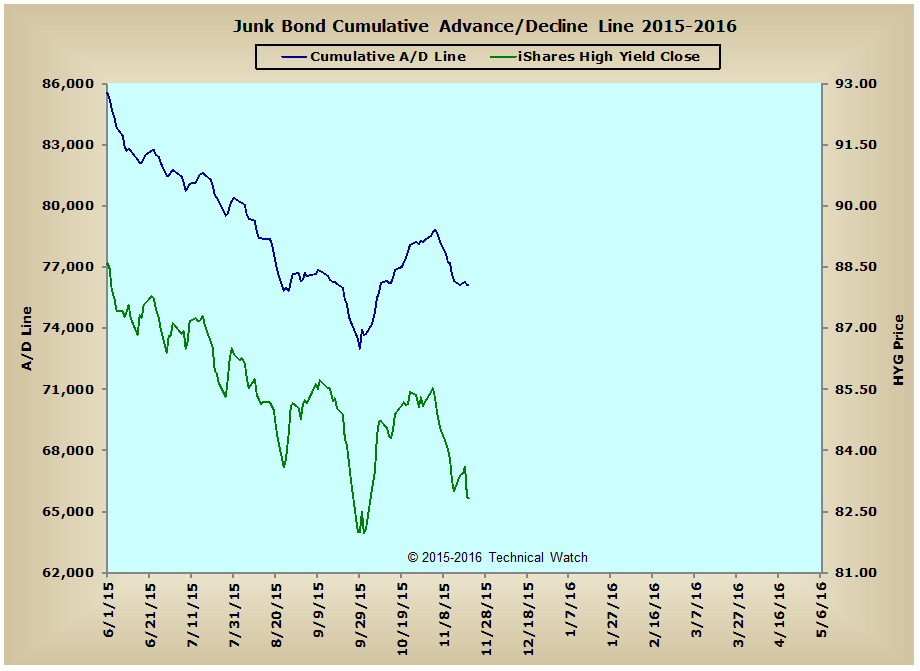

What it means is that market liquidity is very poor right now...even with the harbinger of the FED tightening in December hanging over our proverbial heads.

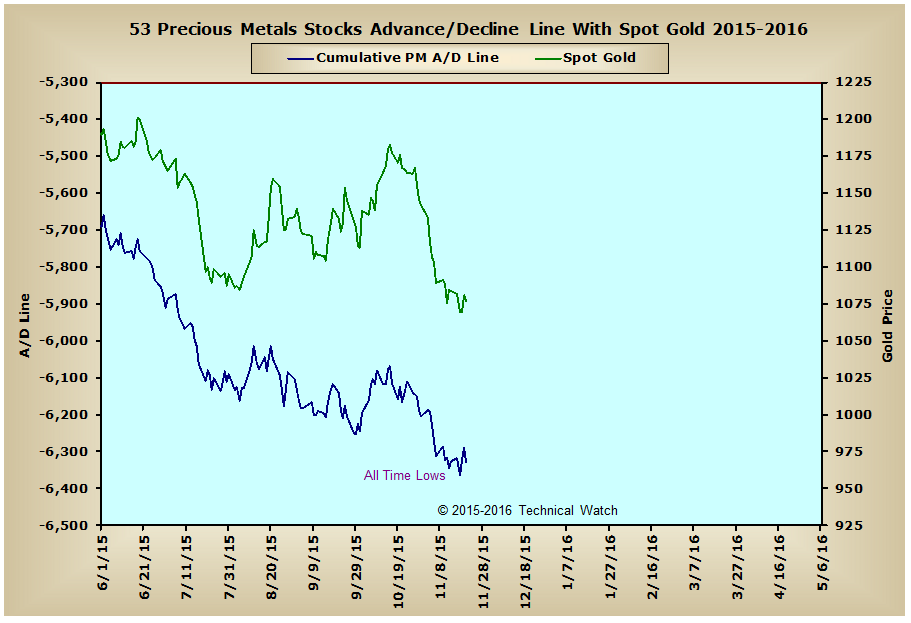

Then again, we've already known for years now that liquidity has been drying up by the path of which gold has been taking since 2011.

Fib

Charts through Friday and are reviewed each week in the "Weekly Breadth Review":

Edited by fib_1618, 25 November 2015 - 07:33 AM.

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#4

Posted 25 November 2015 - 08:10 AM

What it means is that market liquidity is very poor right now...even with the harbinger of the FED tightening in December hanging over our proverbial heads.

I don't have any experience in this field. Can you explain?

I have a bonds book which I probably should have read a long time ago.

"When your position is underwater, average down" - Professional Trader

#5

Posted 25 November 2015 - 08:35 AM

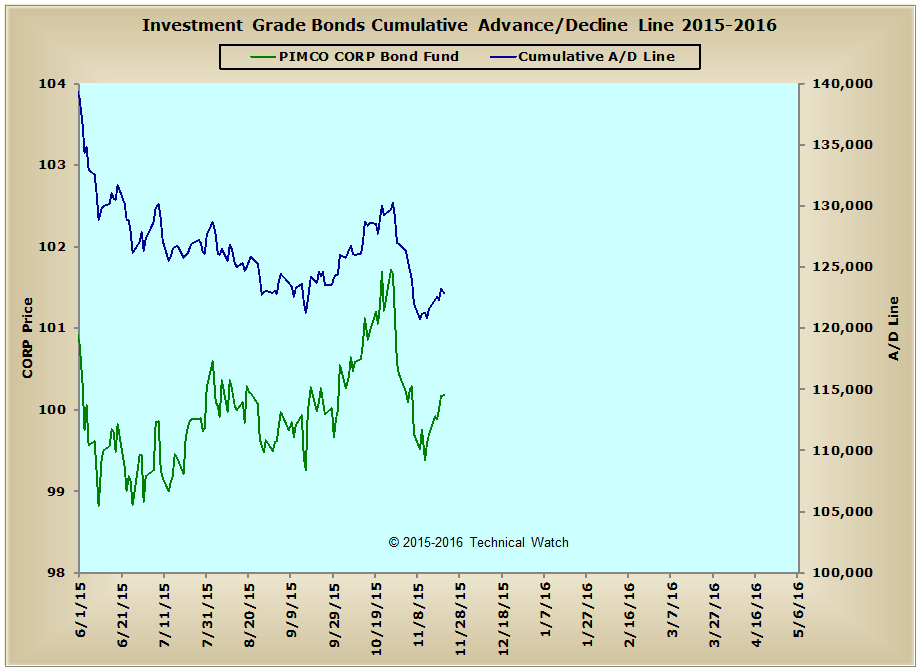

As you know, when liquidity is poor, it hurts high yield bonds, and by extension secondary growth issues, in two ways. First, companies that are high in debt are more likely to default. Second, there is less money (liquidity contraction) around to invest in everything, and so it tends to move more toward higher quality instruments...like Government backed bonds and equity issues that provide value by paying a dividend (and why the NYSE Preferred A/D line is at all time highs). Problem though right now is that we're also dealing with a competition factor where investment capital is chasing the maximum total return on this same capital. This would help explain (at least partially) the latest run up in stock issues while the underlying data of cumulative money flow remains in a weakened condition. Eventually, something will have to give...either the FED floods the market with fresh liquidity, or the vacuum created by this lack of underlying support will be filled with equity prices moving sharply lower.I don't have any experience in this field. Can you explain?What it means is that market liquidity is very poor right now...even with the harbinger of the FED tightening in December hanging over our proverbial heads.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#6

Posted 25 November 2015 - 09:25 AM

klh

#7

Posted 25 November 2015 - 09:51 AM

#8

Posted 25 November 2015 - 11:00 AM

19 percent of junk bonds is in the energy sector. The average yield on those bonds is around 14 percent now.

14 percent... naaaaaah

"When your position is underwater, average down" - Professional Trader

#9

Posted 25 November 2015 - 01:39 PM

either the FED floods the market with fresh liquidity, or the vacuum created by this lack of underlying support will be filled with equity prices moving sharply lower.

I think we both know whats going to happen.

They were worried about deflation a few months ago. It drives me nuts that it changed.

Edited by orange, 25 November 2015 - 01:40 PM.

"When your position is underwater, average down" - Professional Trader

#10

Posted 26 November 2015 - 11:04 AM

either the FED floods the market with fresh liquidity, or the vacuum created by this lack of underlying support will be filled with equity prices moving sharply lower.

I think we both know whats going to happen.

Please tell us.

Here is my update after yesterday. While NYSE breadth was still anemic, especially considering volume. Russell and NASDAQ was solid. I am now ready to draw T based on early Oct McOsc high and mid Nov McOsc low. That would project this strength into Dec 21/22. I would still like to see where the McOsc up thrust is going to finish to get some additional projections but this is what I have as of this moment. Junk also found some bid yesterday.

Beware that I am a good fade and that my short got stopped overnight. Happy Thanksgiving everyone.