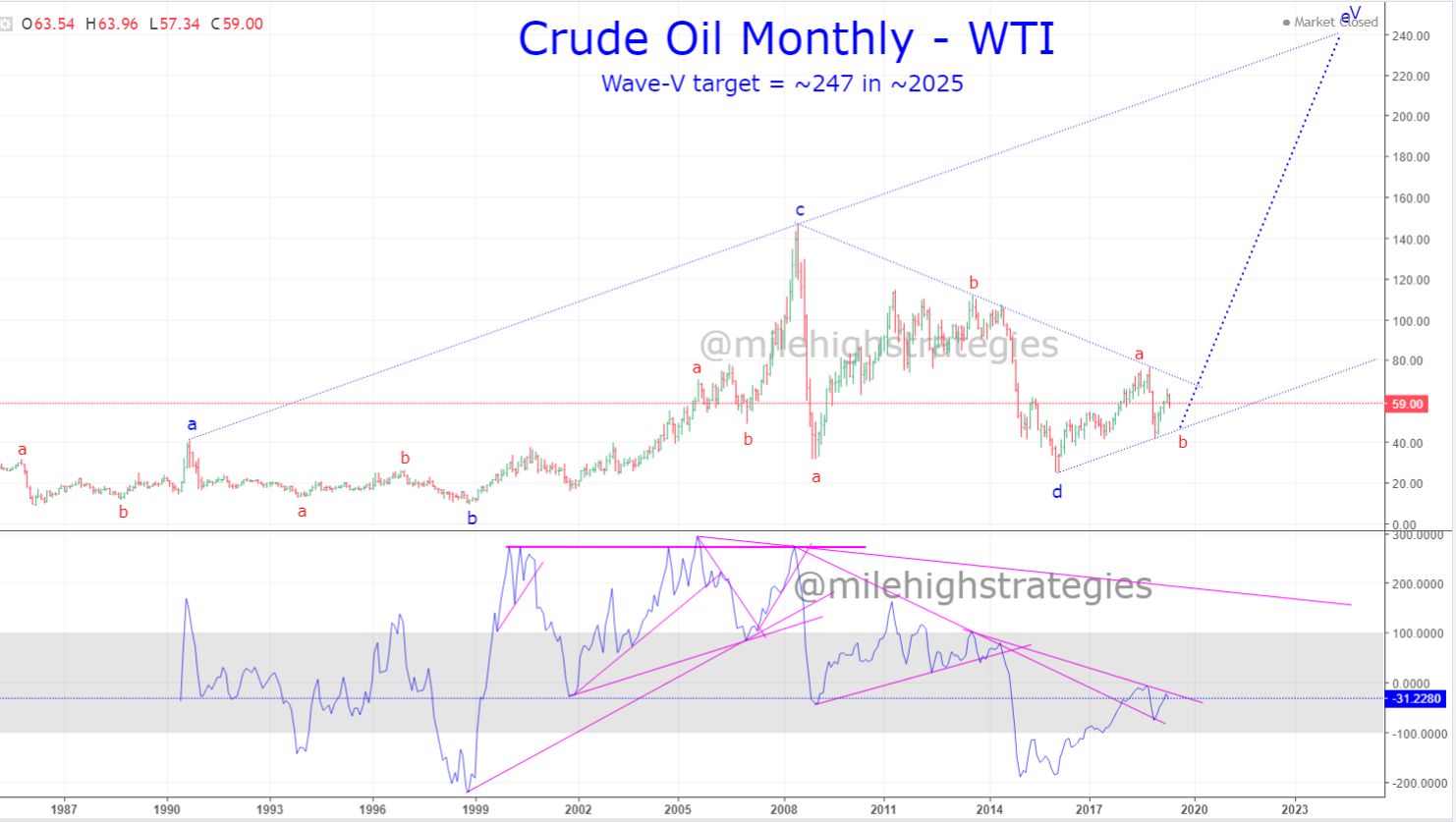

Last week I said this about Crude Oil:

CRUDE OIL - any trading strategy with crude oil will require much patience and a decent view of its long-term trend...

In 1990, the Wave-A:V high of a developing ending diagonal triangle Wave-V completed at about ~41...

In 1999, the Wave-B:V low of the developing EDT completed at about ~10...

In 2008, the Wave-C:V high, and present ATH of that same EDT completed at about ~147...

In 2016, the Wave-D:V low of the developing EDT completed at about ~26...

And now, Wave-E:V is in work with a likely completion target date in the mid-2020s, and with price targets of ~203 - ~247...

Due to the previous symmetry within each of the waves, it seems one more drop in a wave-b:E to the ~40ish range would be in order, before the move to new ATHs gets going... watching.

This week I follow-up with this:

CRUDE OIL - last week I mentioned the potential for a pull back in price to complete wave-b:E:V to as low as ~40, then a push upward to ~247 into mid-2020...

This is the chart of WTI Crude monthly with how I see this scenario could play out... watching.