Since that will never happen, you are saying this bubble will never end. It will never happen as the reason its not going up is the amount owed yearly on interest yearly is already too much (like 15% of total GDP), and debt is going up parabolically. Rates will go negative at some point in the US.

Anyone who has been trading the markets for any length of time knows that there will always be some sort of fundamental worry that will keep you from making money on a consistent basis. The market makers bank on this emotionalism each and every day. This is why some turn to technical analysis as it provides the necessary insight to execute trades without second guessing yourself. Unfortunately though, these same people either don't fully take the time to understand (analytically) their choice of indicators, to trust what they show, or allow their "instincts" to keep them from their objective in making profits and cutting losses.

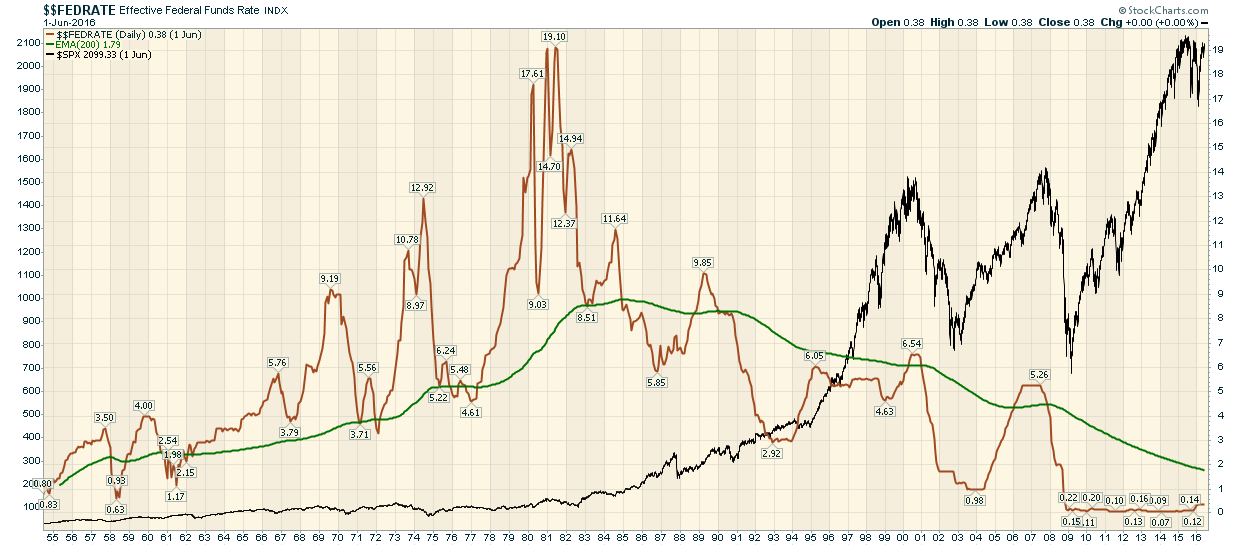

It's important to remember in all of this is that prices for any product can only rise and fall based solely on monetary supply and demand. The lower the cost of (investment) capital, the more there is to put to work. Increase the cost of capital, and most areas of investment (or purchase) struggle. So as long as the cost of money is cheap and plentiful, not only will it seek out the best areas of total return, but it will also expand into areas of which don't deserve this same support (junk bonds, pink sheets, etc...or even impulse buying at the cash register). This is the basis of Keynesian economics, and as long as Global Treasury Departments continue to support this economic theory, this is what we're left to work with...good or bad...with the underlying ugliness only shown once the make up kit is taken away.

Anyway...I pulled together a FED Funds chart for you to review to reach your own conclusions...you can see that anytime the rate is above its 200 month EMA, the stock market suffocates, below it and it prospers ...bubbles be damned.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions