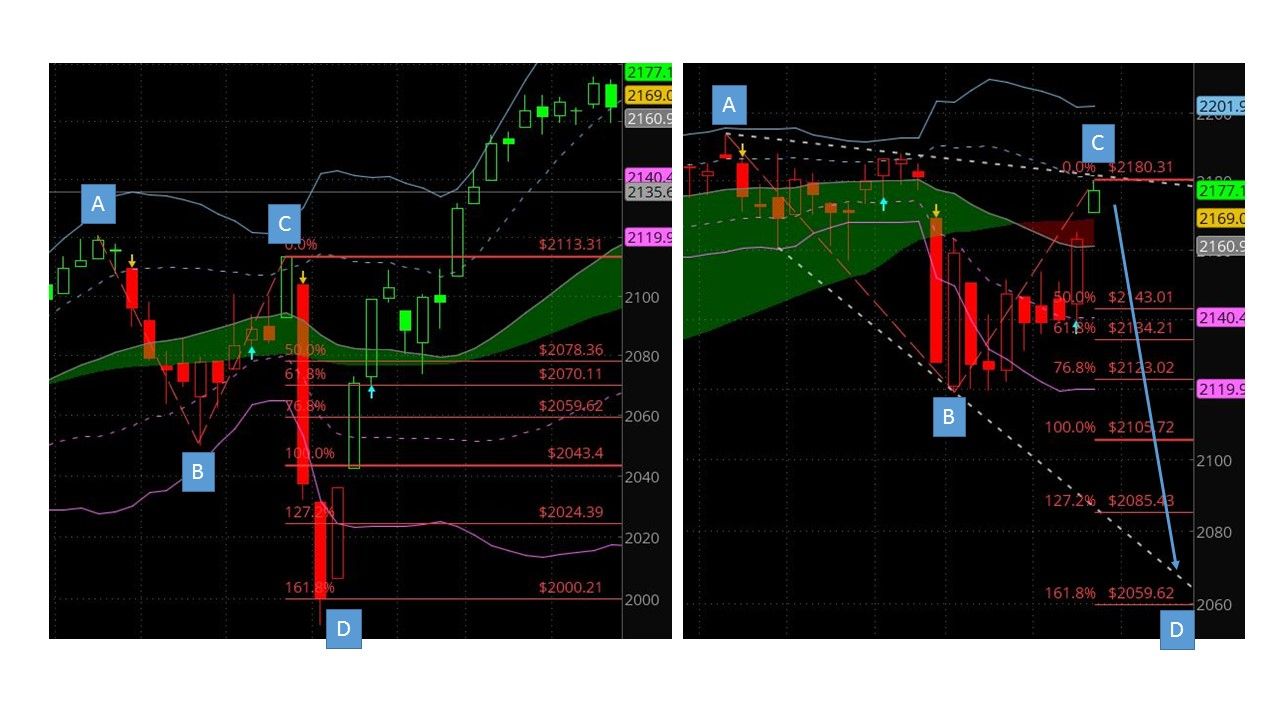

No, this is not inside information from Bberg. I am looking at a possible decline in the SPX to a 161.8% Fib extension. Take a look at the chart on the left. The Brexit low at point D closed at an exact 161.8% extension of the A-B-C pattern labeled in the chart. Now look at the current A-B-C setup in the chart on the right. If today's high at 2180 is point C, that projects a 120 point decline to the 161.8% extension at 2060 (point D). That target also would test the lower trend line.

Tomorrow's action is critical. If the SPX rallies and closes above 2190, the projection is invalidated. But, if the SPX declines below Thursday's low, I am going short via SPXU.