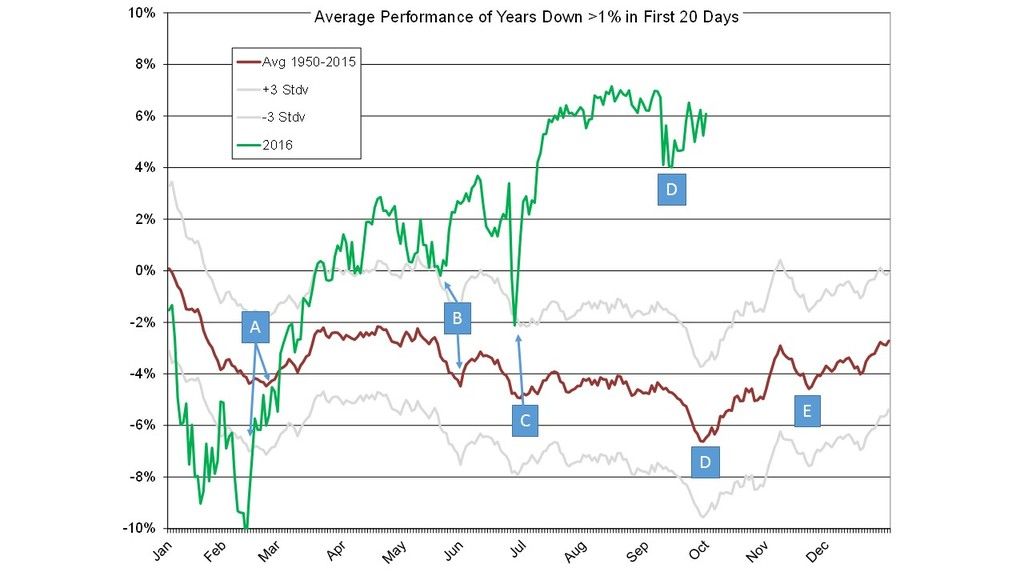

According to the seasonal analog (based on the average SPX performance in years where the market was down 1% or more in the first 20 days of year) a seasonal low was expected on Tuesday, Oct 4. Unless we see a big selloff next week, it appears that the seasonal low (point D) occurred on Sep 14. The seasonal analog will turn bullish after Oct 4, and should remain bullish the rest of the year. The only remaining seasonal low of significance this year is projected for late November (point E). Maybe a post election hangover?? The analog suggests that low should be bought for a year end rally.

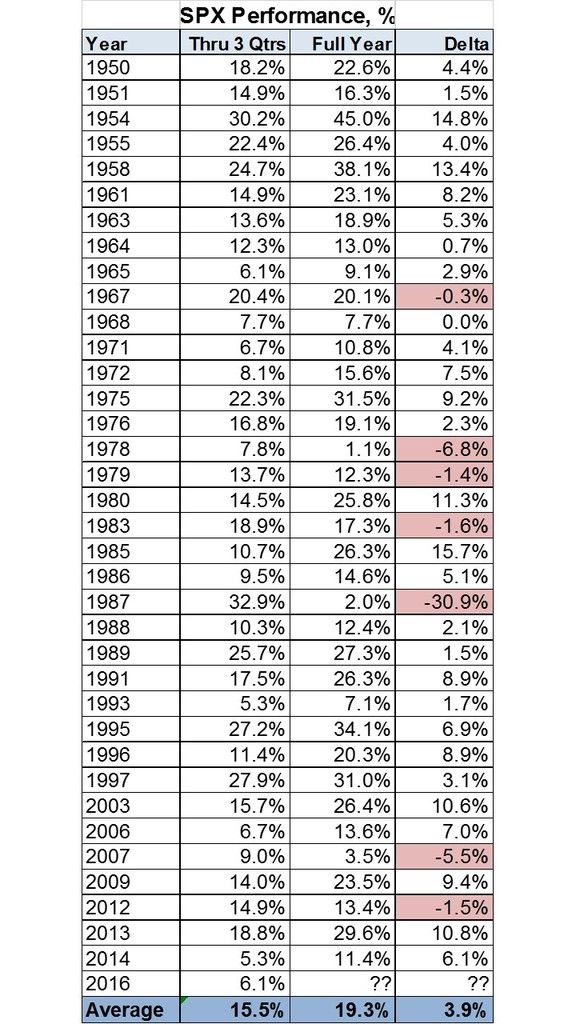

I also took a look at all years since 1950 where the SPX was up more than 5% in the first 3 quarters. There are 36 years listed in the table below, and in 29 cases (81%), the SPX ended the year higher by an average of 3.9 percentage points. If 2016 follows the average, the SPX will end the year with a 10% gain, putting it at 2248.

I covered all my hedges last week. I am still long Dec puts on individual stocks like DB, BCS and other EU banks. As always, corroborate this analysis with your own.