http://timeandcycles.blogspot.com/

Forecast from my last public blogpost on 11/4/16, "The 47 TD Cycle is still suggesting a 11/8 Low +/-3 TD"

From the 11/9 Update: "A solid close above 2155 SPX confirms the 11/4 major Low as the 180 TD/9 Month major Low and we now rally into the next 1-2 months"

Actual: The Cash SPX Low was on 11/4L at 2083.79 SPX, which was a quintuple time CIT, while the Globex SP futures made its Lowest Low on 11/8-9.

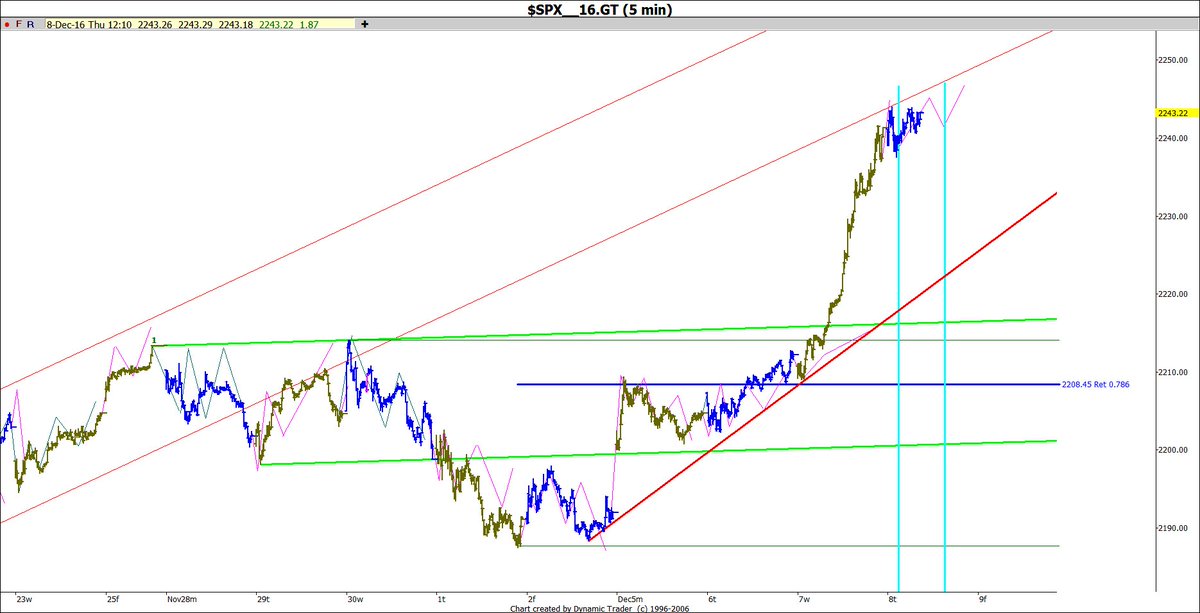

From the 11/22 Update: "it is best to use any short term pullbacks to add to longs and just be long until around 12/XX. There is a “Tunnel” Price target at 2239 SPX"

From the 12/1 Update: "There is long term trend line resistance at 2245 SPX+/-5"

Actual: From the 11/4 Low, we rallied so far a whopping 157.84 SP's in one month into 12/7H at 2241.63 SPX, which reached our 2239 SPX Tunnel Price target.

We have rallied into major long term 19 year old major trend line resistance that started from the10/28/97L, touched 10/8/98L, 3/22/01L, 3/19/02H, 10/11/07H, 5/20/15H, all major Highs and Lows! and now 12/07/16H at 2241.63 SPX. Of course it can pierce this trend line a little, but it suggests limited upside potential as 2242-45 SPX +/-5 should be major resistance.

Thursday 12/8 is a major long term proprietary Geometric Time CIT, that dates back 5 1/2 years ago, from the 5/2/11H. 12/9 is the next Solar CIT and the "Ezekiel Wheel" next CIT is on 12/9.

There is also a 45 week cycle due this 12/9/16 week that started from the 3/6/09L.

What's next: We should make a Dec 8 High+/-1, targeting 2245 SPX +/-5 and start a retrace, we should then retest these Highs at a long term projected future major High date.