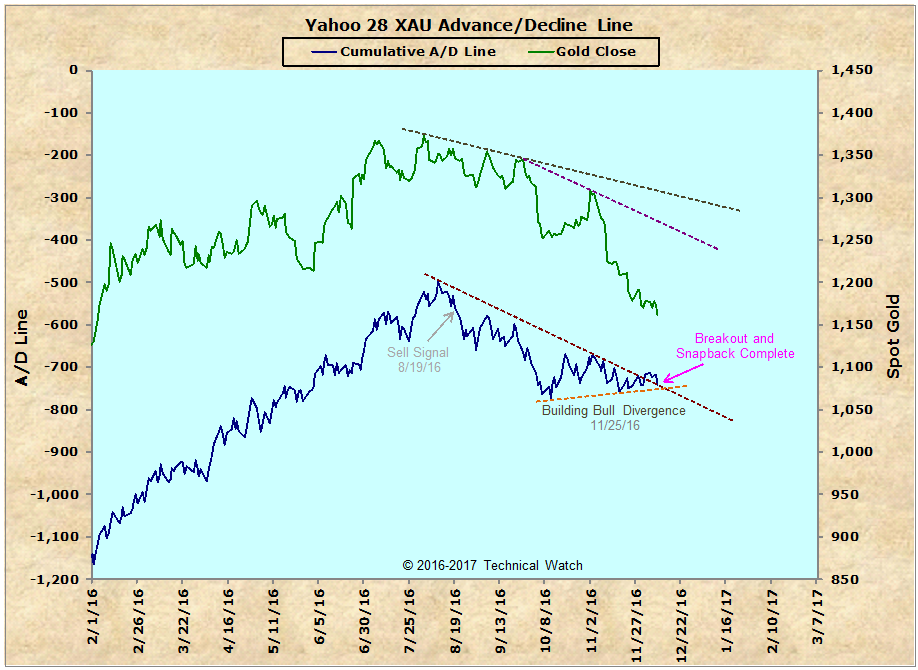

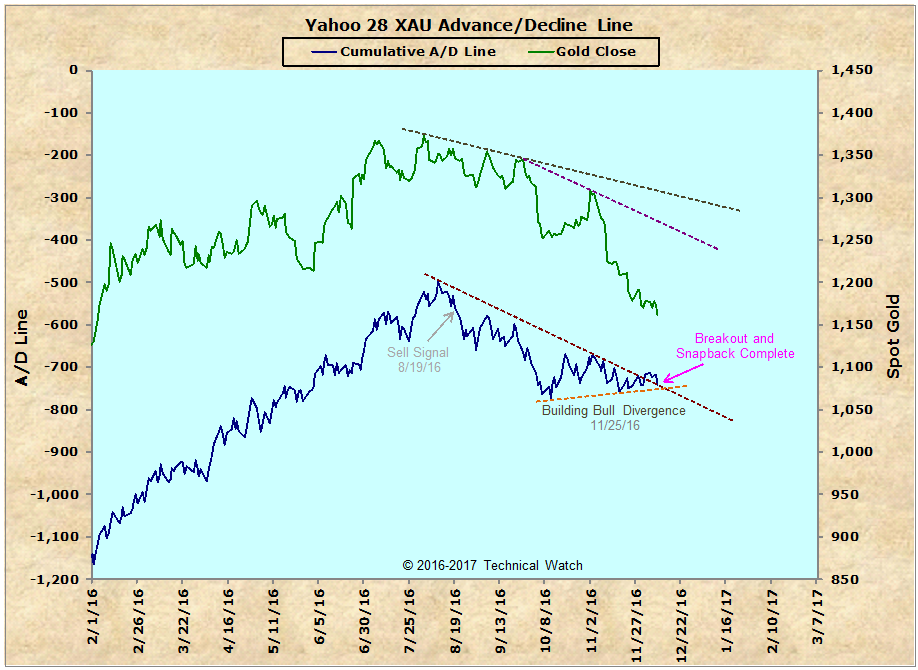

(in my best whisper tone)..."snapback complete".

Fib

Posted 10 December 2016 - 11:21 AM

(in my best whisper tone)..."snapback complete".

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

Posted 10 December 2016 - 12:30 PM

(in my best whisper tone)..."snapback complete".

Fib

interesting how well the gold stock internals have been. If and I stress "if" these and other technical divergences hold the potential low we make here could easily be as good or better than last yrs Jan lows buy. Could be one helluva wave dos low, but we can't rule out the breakdown potential either, next week with the Fed meeting and how we closed this week may tell one of the more important chapters of this unfolding story

Senor

Posted 10 December 2016 - 02:34 PM

The timing of next week's FED meeting seems to be one of those important confluence points since...

Gold has a propensity of seeing price bottoms late in the 4th quarter;

Daily prices continue to have below average/low volume declines over the last two weeks indicating selling exhaustion;

The price of silver continues to diverge with the recent weakness in the yellow metal;

The PM breadth McClellan Summation Index is now rising and challenging its reaction highs from its October lows at the -300 level;

And above all else the compressed rising divergent angle ascent of the XAU/Yahoo A/D line suggests a large move is imminent;

On the cautious side...the .618 retracement level of $1171-$1173 was broken on Friday, but that could had been the final capitulation point.

Anyway...everything seems to be leading up to a final scrimmage between those who believe this to be corrective and those of bear market continuation.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

Posted 10 December 2016 - 04:34 PM

Thanks Dave.

Posted 10 December 2016 - 05:14 PM

The timing of next week's FED meeting seems to be one of those important confluence points since...

Gold has a propensity of seeing price bottoms late in the 4th quarter;

Daily prices continue to have below average/low volume declines over the last two weeks indicating selling exhaustion;

The price of silver continues to diverge with the recent weakness in the yellow metal;

The PM breadth McClellan Summation Index is now rising and challenging its reaction highs from its October lows at the -300 level;

And above all else the compressed rising divergent angle ascent of the XAU/Yahoo A/D line suggests a large move is imminent;

On the cautious side...the .618 retracement level of $1171-$1173 was broken on Friday, but that could had been the final capitulation point.

Anyway...everything seems to be leading up to a final scrimmage between those who believe this to be corrective and "

"Anyway...everything seems to be leading up to a final scrimmage between those who believe this to be corrective and those of bear market continuation"

Couldn't agree more and exactly the way I see it

NO BS

Senor

Posted 11 December 2016 - 12:18 PM

Posted 11 December 2016 - 06:34 PM

Thanks for the update and last but not least don't forget that gap of 1157.80 , closed at 1157.50 on Friday.

Gold Futures - Feb 17 (GCG7) http://www.investing...ommodities/gold

Posted 11 December 2016 - 06:46 PM

Good article here too... http://seekingalpha....b5ec164be6&dr=1

Posted 11 December 2016 - 11:13 PM

notice the divergence on the oscillators on this slightly different chart of gold miner's volume a/d percent...

Posted 12 December 2016 - 09:05 PM

(in my best whisper tone)..."snapback complete".

Fib

Hello Fib,

could you please (or maybe somebody else) teach me how to make/draw a chart like that? With a cumulative A/D line?

many thanks, gis

TTHQ Directory →

Fearless Forecasters →

Market UpdateStarted by fib_1618 , 15 Feb 2024 |

|

|

||

TTHQ Directory →

Market Analysis Area →

Weekly Breadth Data - 1/19/24Started by fib_1618 , 28 Jan 2024 |

|

|

||

TTHQ Directory →

Market Analysis Area →

Weekly Breadth Data - 12/23/22Started by fib_1618 , 30 Dec 2022 |

|

|

||

TTHQ Directory →

Market Analysis Area →

Weekly Breadth Data - 10/28/22Started by fib_1618 , 03 Nov 2022 |

|

|

||

TTHQ Directory →

Market Analysis Area →

Weekly Breadth Data - 10/7/22Started by fib_1618 , 15 Oct 2022 |

|

|