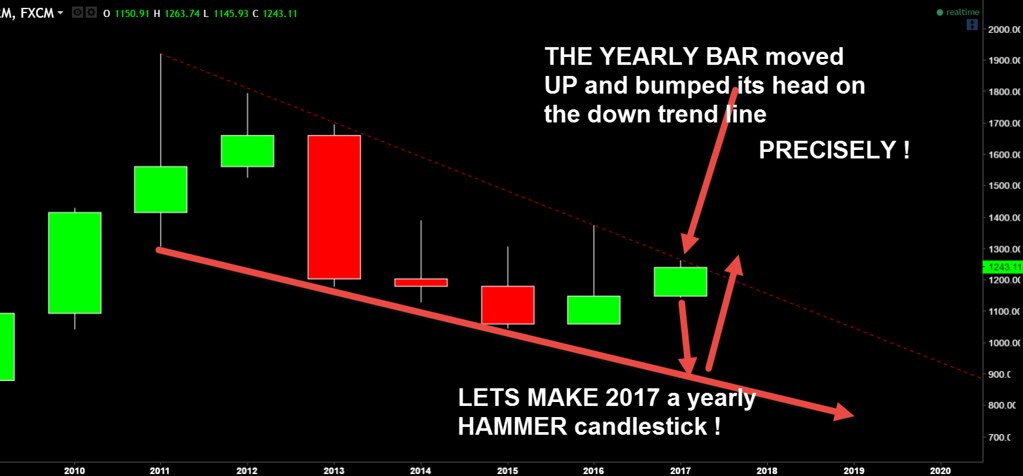

I dont think gold is quite ready for prime time. 1260 or so is right at the point of the YEARLY price bar down trendline. I dont see us breaking above that yet. The year is still early.

I think they are going to take gold down again into the french elections end of April. The Euro will likely plunge into the french elections and the US dollar will probably skyrocket into the french elections. Then on the news of Lepen winning, will cause a final low in gold price and a top in the dollar.