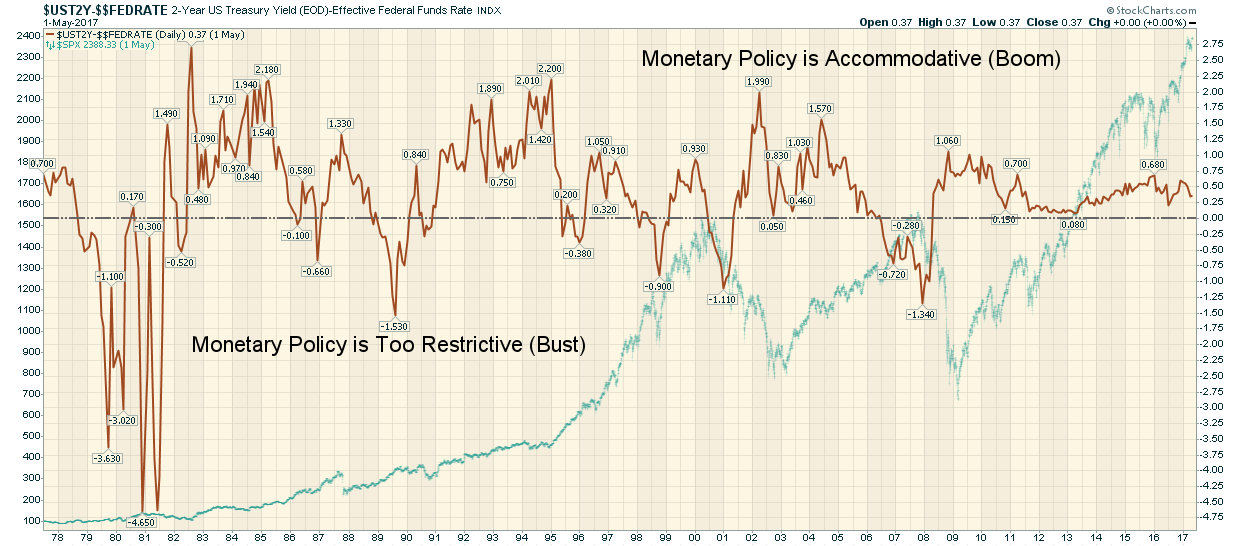

There's only one thing that matters to the markets. Liquidity !

It was that monstrous liquidity injection by the Fed that kickstarted this rally in 2009. Those who did not listen to the Fed, then, paid the price. Now the cycle has turned. Once the Fed starts the tightening cycle, it will not end with one or two increases. They will look at the employment numbers and the CPI inflation and continue to raise the rates. Not to mention the unwinding of the balance sheet that has begun. They will continue with the tightening until the back of the economy is broken. They have made it loud and clear. Are you listening ? The fundmental trend has changed.

All this Trump rally, tax cuts, healthcare reform, infrastructure spending, obstruction of justice blah blah are irrelavant.

Now we just need to wait for the technical picture to change. The S&P and DOW trends are still intact. But the Nasdaq is broken. I will update when the technical picture changes, with IT sells. For now i am in cash and will not trade until Nasdaq breaks into new ATHs, which i doubt will happen.

Edited by NAV, 23 June 2017 - 12:48 AM.