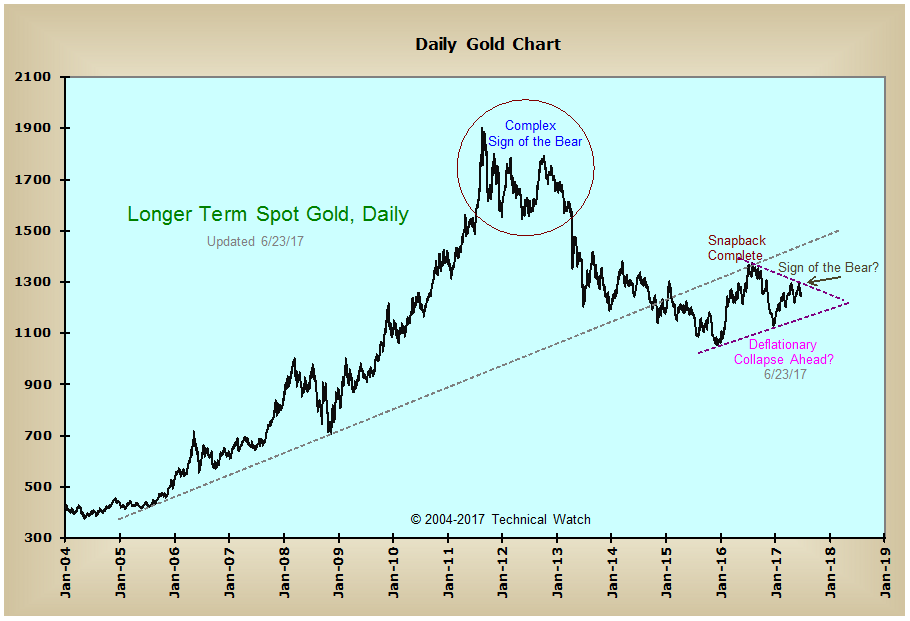

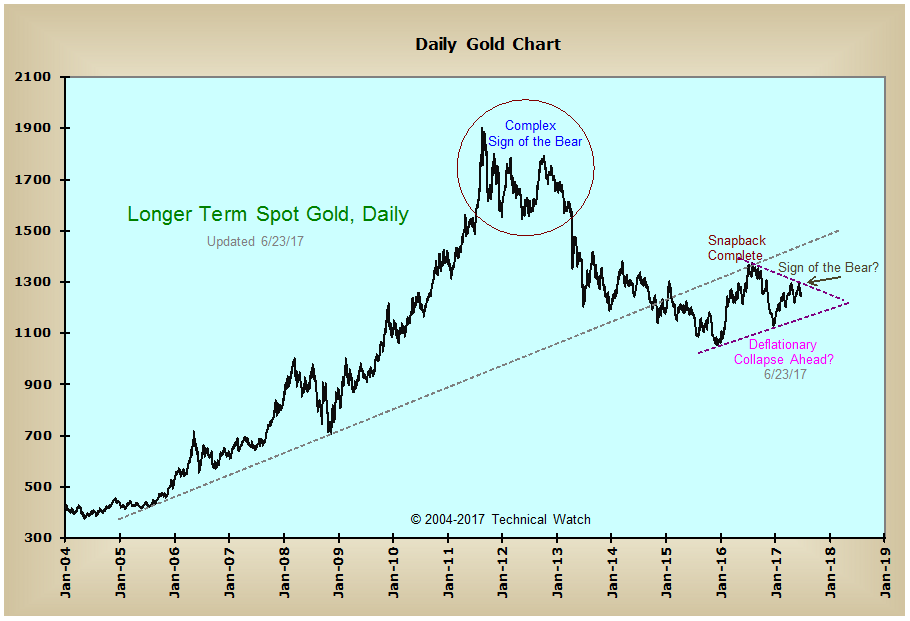

With commodities collapsing, and interest rates continuing to trend lower in spite of the FED's "best intentions", is the price of gold indicating that we're in a period of disinflation...or worse??

Fib

Posted 24 June 2017 - 12:54 PM

With commodities collapsing, and interest rates continuing to trend lower in spite of the FED's "best intentions", is the price of gold indicating that we're in a period of disinflation...or worse??

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

Posted 24 June 2017 - 05:23 PM

gold imo does well during deflationary times as interest rates collapse that is good for gold

Posted 24 June 2017 - 06:17 PM

gold imo does well during deflationary times as interest rates collapse that is good for gold

That is not what happened in 1980, there was strong inflation and interest rates skyrocketed hitting the 20% level.

According to Armstrong gold will not start to really move until after 2018 and what will drive gold up is a loss of confidence in the major governments of the world, a full blown debt crisis is just around the corner, we can see the cracks starting to happen already, Greece was the start of it and now two banks in Italy have been declared bankrupt, it is a contagion that is just going to keep getting worse and worse.

https://www.armstron...ks-have-failed/

Posted 25 June 2017 - 12:34 AM

With commodities collapsing, and interest rates continuing to trend lower in spite of the FED's "best intentions", is the price of gold indicating that we're in a period of disinflation...or worse??

Fib

Fib: are you leaning strongly bearish on GOLD here?

Posted 25 June 2017 - 10:32 AM

i actually was trading in 1980 . what actually happened is the exchange members, and they were short silver changed the rules. no buying of silver allowed., and this killed the silver/gold bull

the 2 yr tr in gold can be seen as consolidation or indecision. so anything or everything is on the table. in the 70s bull commodities in general were in a bull market. this lent great support to gold. the commodity indexes clawing to hold on is not a good sign. however , gold is a little different, not saying "its different this time", gold is a monetary metal . so if the financial system starts to endure great stress it will have a bullish outcome for gold

as previously stated, forgive me i am getting on in years., the dna of the 70s bull is highly correlated to this bull. so , while i agree w/marty 18 should be a very good year for the metals, the fractal begins an ascent this summer , which gains momo into 18

for me , i am bullish here , but w/qualifications. the market needs to prove it is in an uptrend by taking out 1300 . if not then its wait and see in a scaled back mode. the shorts hit the market when there is ebb in physical demand, its not random. we are coming into diwali buying season. and last month the figures indicated turkey emerged as a 3 rd large buyer w/50 tonnes of sharia buying. this buying helped to keep gold firm and push it to near 1300. so their buying needs to be monitored. when gold physical buying ebbs the shorts come out to play, but in this last case it was a 60 dollar smack down from the highs. so either the range is getting tighter, and or the physical buying is coming in at higher support #s. the definitive answer will be what the market does. stay tuned

dharma

TTHQ Directory →

Market Analysis Area →

Weekly Breadth Data - 1/19/24Started by fib_1618 , 28 Jan 2024 |

|

|

||

TTHQ Directory →

Market Analysis Area →

Weekly Breadth Data - 11/24/23Started by fib_1618 , 29 Nov 2023 |

|

|

||

TTHQ Directory →

Fearless Forecasters →

Annual Services Inflation Rages at New Four-Decade High, Monthly Overall CPI Hottest since JuneStarted by skott , 14 Feb 2023 |

|

|

||

TTHQ Directory →

Market Analysis Area →

Weekly Breadth Data - 12/30/22Started by fib_1618 , 03 Jan 2023 |

|

|

||

TTHQ Directory →

Market Analysis Area →

Weekly Breadth Data - 12/9/22Started by fib_1618 , 15 Dec 2022 |

|

|