But Why?

Posted 12 September 2017 - 08:11 AM

But Why?

My comments are for entertainment/educational purpose only. All posted trades are fake (aka. paper) trades.

Posted 12 September 2017 - 08:27 AM

Posted 12 September 2017 - 08:36 AM

Harpa,

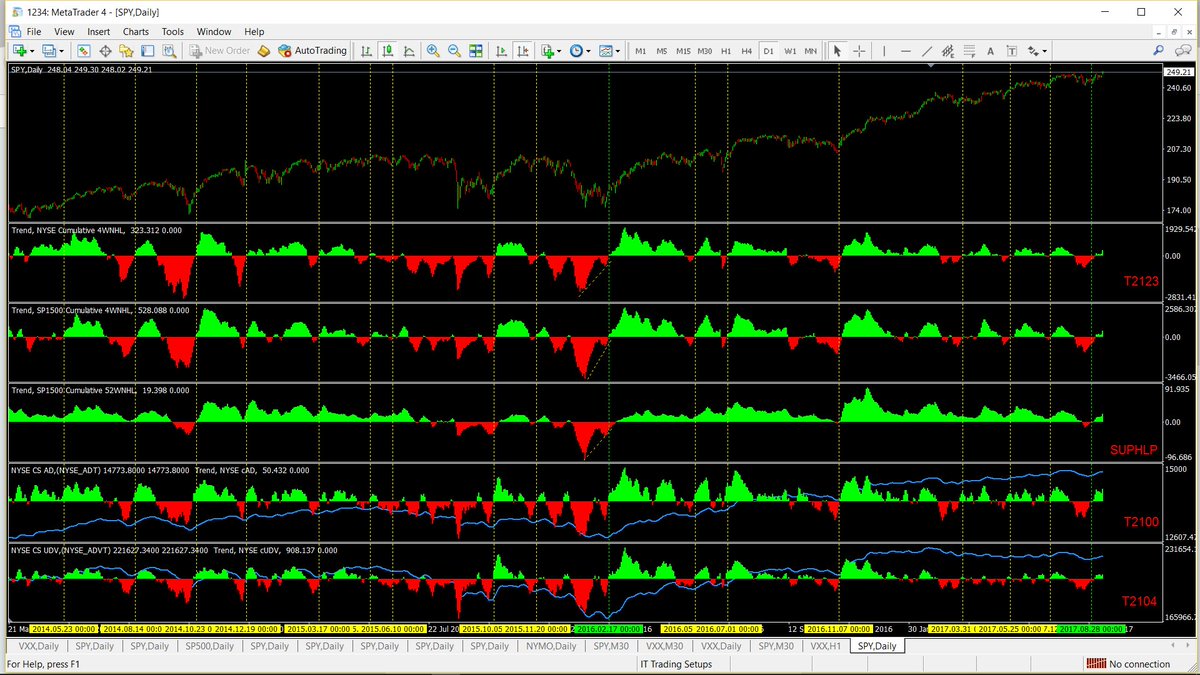

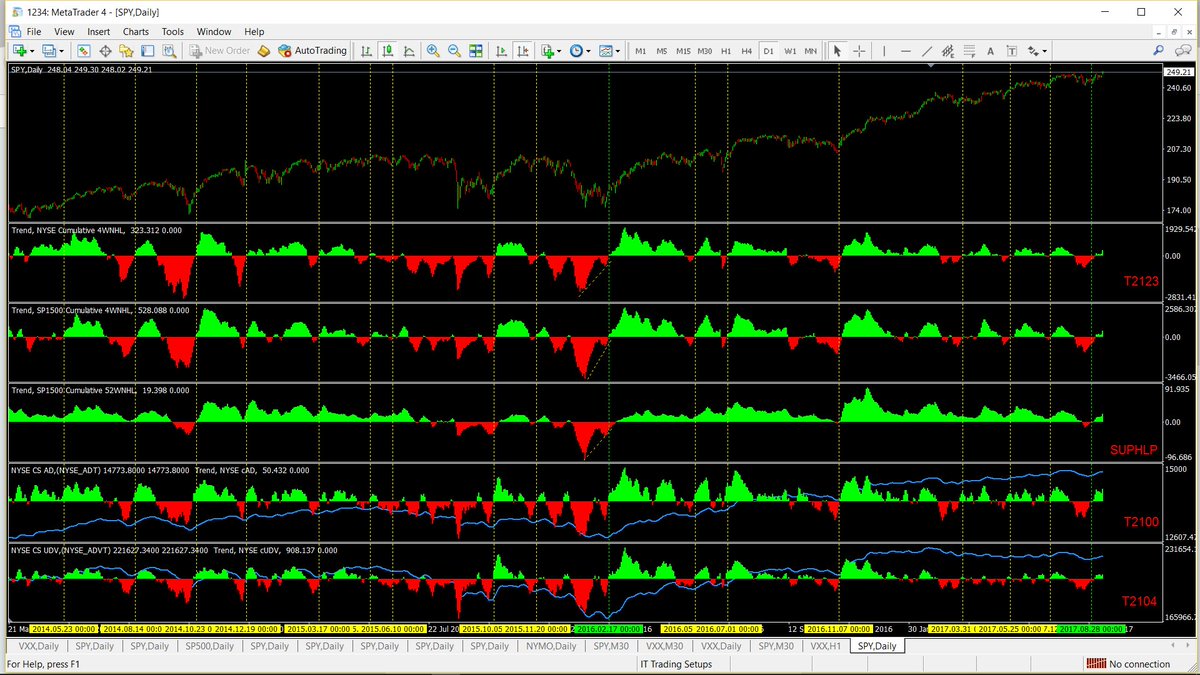

Grant it the breadth indicators you provide show positive (green) but aren't they also showing negative divergences?

Anthony

Divergences are for suckers. Remember, divergences can be erased.

Posted 12 September 2017 - 08:36 AM

...but aren't they also showing negative divergences?

Anthony

How much money did you leave on the table if you followed SUPHLP negative divergences since Feb. '17?

Divergence can go on much longer than your imagination!...not a good tool!

My comments are for entertainment/educational purpose only. All posted trades are fake (aka. paper) trades.

Posted 12 September 2017 - 08:49 AM

Guess I don't get it, I don't see doom and gloom, just volatility and traders looking at different levels to trade from! Personally what I find most interesting is that with everything going on positive and negative that were not seeing volatility! I would agree with all the bulls here to look to the sky if we took the easier path higher so we don't get worn out instead of going straight up Everest! In those cases your so tired when you get to the top, you fall off the cliff because you can't hold yourself up. Thats what I worry about....

Posted 12 September 2017 - 09:01 AM

Posted 12 September 2017 - 11:11 AM

The market has already gone up from Friday, as a trader you have to ask would you be willing to initiate a position at this level and or carry it

overnight ? Stops do no good on a gap down. The QQQ divergence is still in place, maybe it gets taken out but I don't see a good risk/reward

long here, at the least, cash should be the position.

Edited by CLK, 12 September 2017 - 11:12 AM.

Posted 12 September 2017 - 11:18 AM

The market has already gone up from Friday, as a trader you have to ask would you be willing to initiate a position at this level and or carry it

overnight ? Stops do no good on a gap down. The QQQ divergence is still in place, maybe it gets taken out but I don't see a good risk/reward

long here, at the least, cash should be the position.

That's why it's important to catch the swing trades near the swing turning points. They never make it easy to get in the middle of the swing. Even if they let you in, like you said, they will gap up/down on you and throw you off balance.

For those of us long from lower levels (2467 in my case), partial position it is - NOT cash.

Edited by NAV, 12 September 2017 - 11:21 AM.

Posted 12 September 2017 - 11:23 AM

But what if the market runs another 50 points ? Will you stand watching from the sidelines? I would say taking a long is still not risky, if your position is in green by the EOD with a buffer of 5-10 SPX points, which can offset any gap-down risks. Markets are all about managing risks. There are low risk entry points and high risk entry points, but there are no zero-risk entry points.

And it wasn't easy last week to get long and stay long. Last 3 days of last week all had gap-down signatures. But thanks to my trendicators, it kept me on the right side of the trade.

Edited by NAV, 12 September 2017 - 11:25 AM.

Posted 12 September 2017 - 02:42 PM

I wouldn't say there's a lot of doom and gloom. A lot of people have seen this article by now.

The turn happened about three weeks ago. There hasn't been enough decline by the close to turn down trend indicators. The countertrend indicators have been toppy for about a week. Yesterday's rally is very similar to Nov 2, 2015 when the debt ceiling was extended and the government was forced to buy back $225 billion in securities it borrowed for funding operations.