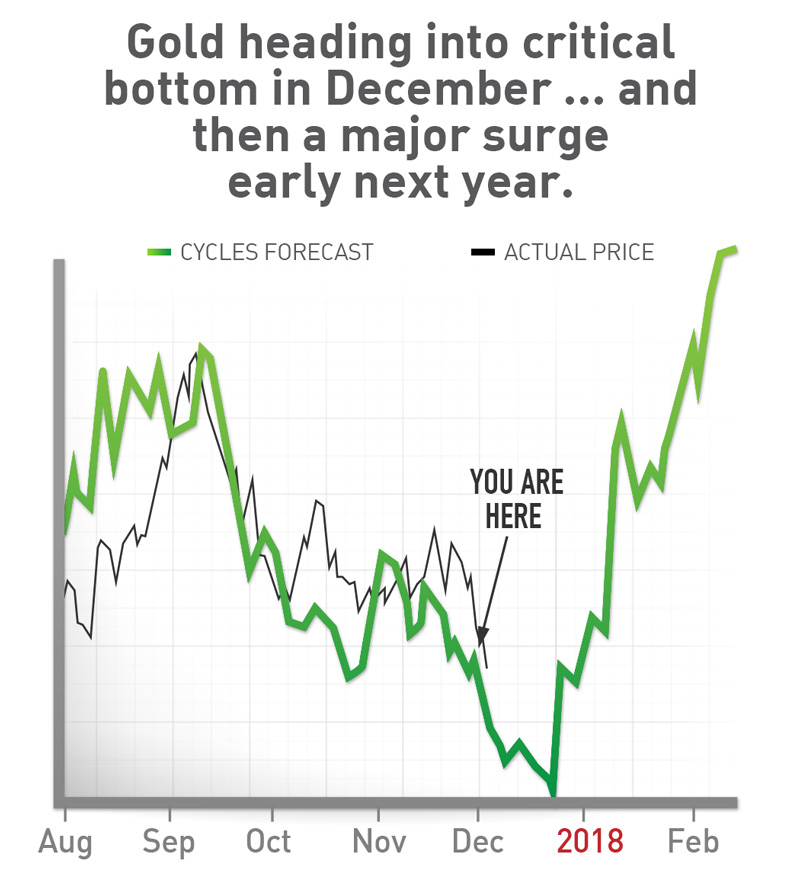

i dont think this is the low for the metals , i think this rally fails lets some pressure off and then in elliott terms wave 5. which should end next week, based on some cycles i am looking at. we are now in the window for the lows to occur. yesterday , the miners hit an extreme vs gold i do think there is a really good possibility that the miners hit there lows yesterday. but , they wont go very far until the metals bottom. we are very close here in price and time.

dharma

there are those in the gold community who dont think the gold price is manipulated. they think the commercials ie the banksters are hedgers. well even on a trade by trade basis the banksters can be found on the other side of the large specs. this has been going on for years. and for years it seems the large specs get the fuzzy end of the stick . once in a very big while (brexit comes to mind) the banksters are on the wrong side of the trade. folks until the market becomes more physically oriented the paper market in new york and london will wag golds tail. dont think the commercials manipulate. watch the cots closely. then tell us your discoveries. i have for years. and they work closely w/the exchange members ( just ask the hunts)