Seeking Alpha analyst Oleh Kombaiev predicted 1230 Gold in October, today's low was 1238.40.

"The UST 10-year yield is likely to continue growing, which is a key pressure factor for the gold price."

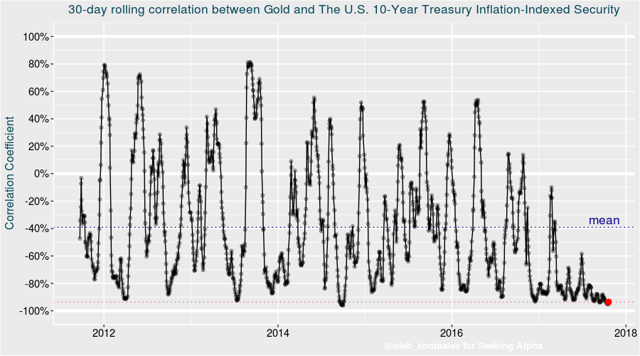

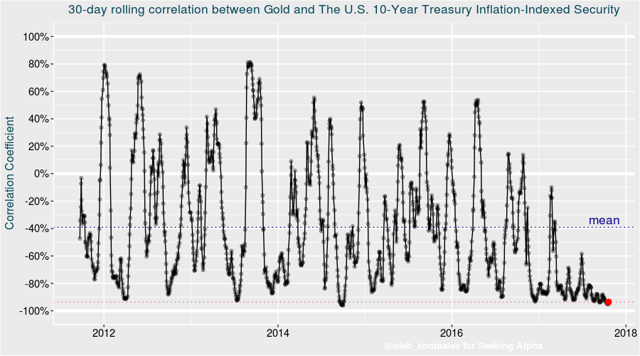

(1) the dynamics of the U.S. real interest rate remains the determining factor in the gold market, and a number of assumptions related especially to the probable future monetary policy of the Fed allows to expect further growth rates, which is negative for gold;

(2) the geopolitical risks support the gold market, but their relevance reducing;

(3) the actions of funds at least do not support the gold market.

All the above considered, my forecast remains the same - the gold prices will decrease to a level of $1,230 in the next two months.

Note: as of Dec. 12 the UST 10 year has not come up to his projected level but his Gold price lever prediction of 1230 is very close.

https://seekingalpha...a765b&dr=1#alt1

Oleh Kombaiev

Edited by Russ, 12 December 2017 - 05:12 PM.

"Nulla tenaci invia est via" - Latin for "For the tenacious, no road is impossible".

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/