https://www.ise.com/...ata/isee-index/

isee

#2

Posted 25 September 2017 - 10:20 AM

What are you finding noteworthy?

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#3

Posted 25 September 2017 - 10:56 AM

sentiment is such that any decline just intensivfies defensiveness...this proccess is just more mortar in the wall of worry

#4

Posted 25 September 2017 - 06:32 PM

Buckle up Don,

As I said the end of Sept thru the middle of Oct will be a bloody month for equities. Several things I chart has this coming the ST top at minimum is forming IMHO... I am positioned for it on many fronts with stops in place thanks to the downturn today. I will not post my positions here as I swear every single time I do I jinx myself. Don't know if it will be NK, or the fed pulling back on buying... or another news event but its coming. Bouncing around here would not surprise me, but after noon Wends I would not be long anything but bonds and gold.

Best

#5

Posted 25 September 2017 - 07:06 PM

Buckle up Don,

As I said the end of Sept thru the middle of Oct will be a bloody month for equities. Several things I chart has this coming the ST top at minimum is forming IMHO... I am positioned for it on many fronts with stops in place thanks to the downturn today. I will not post my positions here as I swear every single time I do I jinx myself. Don't know if it will be NK, or the fed pulling back on buying... or another news event but its coming. Bouncing around here would not surprise me, but after noon Wends I would not be long anything but bonds and gold.

Best

>As I said the end of Sept thru the middle of Oct will be a bloody month for equities,,< oh really?

#6

Posted 26 September 2017 - 06:52 AM

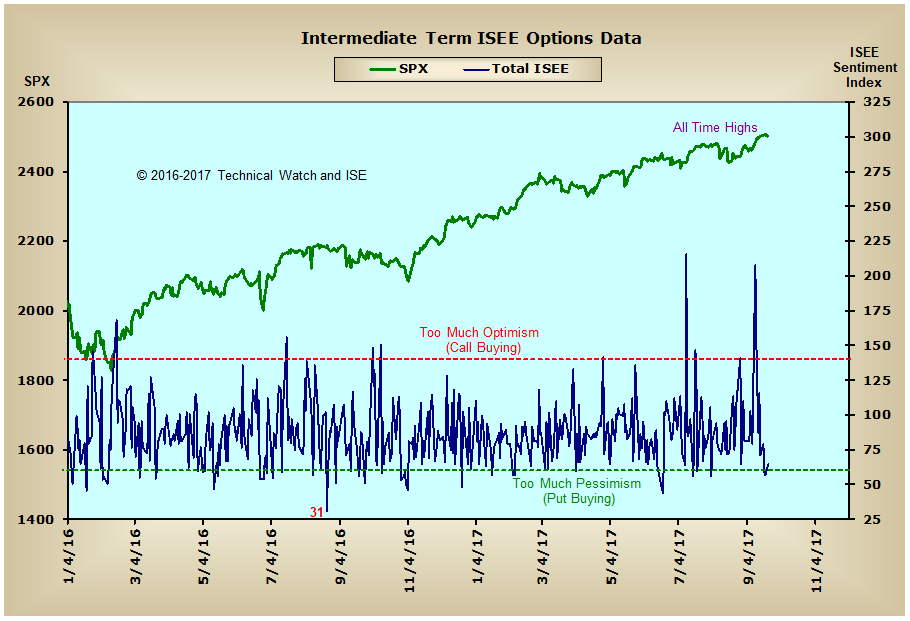

Through 9/22/17:

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#7

Posted 26 September 2017 - 10:40 AM

Buckle up Don,

As I said the end of Sept thru the middle of Oct will be a bloody month for equities. Several things I chart has this coming the ST top at minimum is forming IMHO... I am positioned for it on many fronts with stops in place thanks to the downturn today. I will not post my positions here as I swear every single time I do I jinx myself. Don't know if it will be NK, or the fed pulling back on buying... or another news event but its coming. Bouncing around here would not surprise me, but after noon Wends I would not be long anything but bonds and gold.

Best

hate to break it to you, but you will be seriously wrong

let's start with bonds: the bond market is about to IMPLODE. The 10yr yield chart is BULLISH(bear bond prices) with the great looking bull flag. Expecting yield to got to just about 3%, then next launch to 5%.

equities are and continue to be bullish. r2k is leading this higher and will continue to do so. ACCUMULATION

get set early next week the talking head media drones about the 30th anniversary of the 87 crash. I can assure you, there will NOT be a crash, just the reverse in OCT of this year

approaching the MOST BULLISH TIME OF THE YEAR

#8

Posted 26 September 2017 - 10:44 AM

and as i said before, the fed reduction in the balance sheet is MEANINGLESS

just like the ending of QE

when the sheeple start waking up and buying this market, it will be well above the 10b reduction/month in the balance sheet, which btw, is link in the pocket and a joke

Edited by gameover, 26 September 2017 - 10:45 AM.

#9

Posted 27 September 2017 - 07:43 AM

Buckle up Don,

As I said the end of Sept thru the middle of Oct will be a bloody month for equities. Several things I chart has this coming the ST top at minimum is forming IMHO... I am positioned for it on many fronts with stops in place thanks to the downturn today. I will not post my positions here as I swear every single time I do I jinx myself. Don't know if it will be NK, or the fed pulling back on buying... or another news event but its coming. Bouncing around here would not surprise me, but after noon Wends I would not be long anything but bonds and gold.

Best

hate to break it to you, but you will be seriously wrong

let's start with bonds: the bond market is about to IMPLODE. The 10yr yield chart is BULLISH(bear bond prices) with the great looking bull flag. Expecting yield to got to just about 3%, then next launch to 5%.

equities are and continue to be bullish. r2k is leading this higher and will continue to do so. ACCUMULATION

get set early next week the talking head media drones about the 30th anniversary of the 87 crash. I can assure you, there will NOT be a crash, just the reverse in OCT of this year

approaching the MOST BULLISH TIME OF THE YEAR

Now theres an interesting subject! I remember back in the day when the stockmarket would go up when bonds went down in price and yields went up and vice versa but for years now they have moved in sync which I believe is because the big companies have been borrowing money to use to buy there own stock back and finance their dealing thus why we see record debt and margin levels. I think if yields move higher the stockmarket will plummet if they get to high because it will be to expensive to borrow, so they'll quit making their buybacks! Not to even mention housing will crash as people are mortgaged to the max! Anyhow interesting..... and yay GO, your sounding like a trader not an arrogant jerk!!

#10

Posted 27 September 2017 - 08:17 AM

Buckle up Don,

As I said the end of Sept thru the middle of Oct will be a bloody month for equities. Several things I chart has this coming the ST top at minimum is forming IMHO... I am positioned for it on many fronts with stops in place thanks to the downturn today. I will not post my positions here as I swear every single time I do I jinx myself. Don't know if it will be NK, or the fed pulling back on buying... or another news event but its coming. Bouncing around here would not surprise me, but after noon Wends I would not be long anything but bonds and gold.

Best

hate to break it to you, but you will be seriously wrong

let's start with bonds: the bond market is about to IMPLODE. The 10yr yield chart is BULLISH(bear bond prices) with the great looking bull flag. Expecting yield to got to just about 3%, then next launch to 5%.

equities are and continue to be bullish. r2k is leading this higher and will continue to do so. ACCUMULATION

get set early next week the talking head media drones about the 30th anniversary of the 87 crash. I can assure you, there will NOT be a crash, just the reverse in OCT of this year

approaching the MOST BULLISH TIME OF THE YEAR

Now theres an interesting subject! I remember back in the day when the stockmarket would go up when bonds went down in price and yields went up and vice versa but for years now they have moved in sync which I believe is because the big companies have been borrowing money to use to buy there own stock back and finance their dealing thus why we see record debt and margin levels. I think if yields move higher the stockmarket will plummet if they get to high because it will be to expensive to borrow, so they'll quit making their buybacks! Not to even mention housing will crash as people are mortgaged to the max! Anyhow interesting..... and yay GO, your sounding like a trader not an arrogant jerk!!

yes, but this won't make a difference in equities until 10yr hits that 5% area, then equities turn down