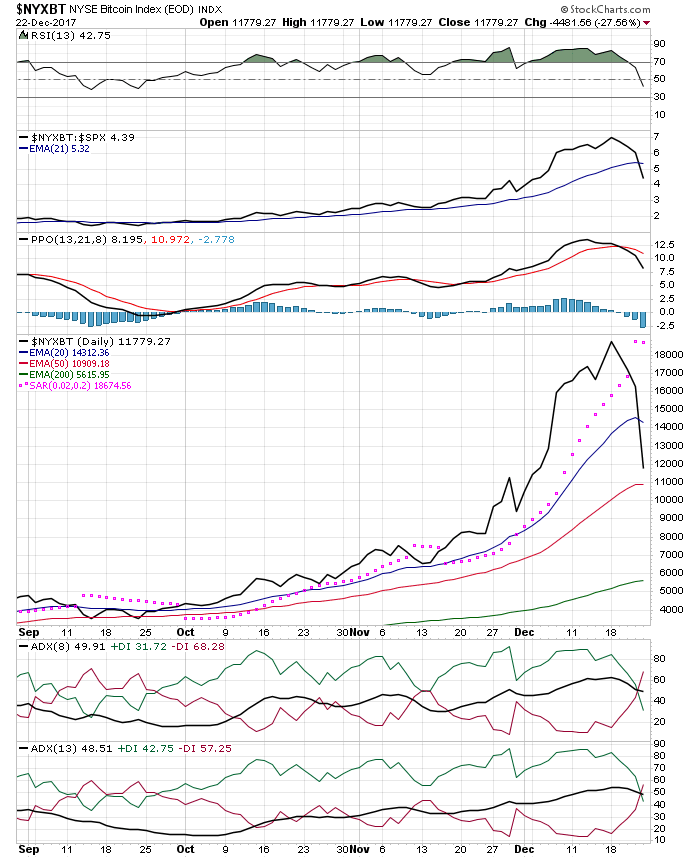

Bitcoin 11,632.0 -4795.0 -29.19%

Day low : 10600

Edited by NAV, 22 December 2017 - 10:06 AM.

Posted 22 December 2017 - 10:04 AM

Bitcoin 11,632.0 -4795.0 -29.19%

Day low : 10600

Edited by NAV, 22 December 2017 - 10:06 AM.

Posted 22 December 2017 - 10:35 AM

See, there's the problem in a nutshell... His quote showed a low of 10600, I show 11273... but before they "settled" on that number, there were some other "lows" under it...

They didn't get consensus on those lows and now we show the 11273...

Nice... so you won't know in any semblance of real time if your trade went through or not...

Makes ya feel all warm n fuzzy don't it?

![]()

Posted 22 December 2017 - 10:47 AM

See, there's the problem in a nutshell... His quote showed a low of 10600, I show 11273... but before they "settled" on that number, there were some other "lows" under it...

They didn't get consensus on those lows and now we show the 11273...

Nice... so you won't know in any semblance of real time if your trade went through or not...

Makes ya feel all warm n fuzzy don't it?

Average confirmation time for a transaction is anywhere from 100-1200 minutes.

https://blockchain.i...timespan=30days

Posted 22 December 2017 - 11:10 AM

They can't recapture a pivot of any kind, every bounce gets sold right before.

Posted 22 December 2017 - 11:10 AM

There was still a large concentration of initial investors who owned 40%. Recent reports are that they've been cashing out in the last month or so.

Regulation doesn't ensure that the investment isn't a fraud. As we saw in the prior two bubbles, there is deregulation and then there is regulatory nonfeasance. Most of the dot-coms were gone within 3-5 years of IPO. Some of them were able to survive longer than others because they traded IPO allotments to suppliers in exchange for cash. Other service providers engaged in vendor financing where equipment sales were marked up by 125% to get cash for operations.

Posted 22 December 2017 - 11:26 AM

Regulation doesn't ensure that the investment isn't a fraud.

True. But, with regulation comes, accountability. You can't just take the money and disappear and not held accountable.

Posted 22 December 2017 - 11:45 AM

Not really. Who went to jail? Investment banks were calling lenders pushing them to make loans to bad credits so they could short the MBS using CDS's. Where were the regulators on the supposed Chinese firewall between the investment banking and the consumer lending side of the business? Where were they on the CDO's which were rated investment grade despite holding mostly subprime loans? Where was the attempt to rein in exotic loans such as pick-a-payment mortgages and interest-only loans?

Posted 22 December 2017 - 01:36 PM

Not really. Who went to jail? Investment banks were calling lenders pushing them to make loans to bad credits so they could short the MBS using CDS's. Where were the regulators on the supposed Chinese firewall between the investment banking and the consumer lending side of the business? Where were they on the CDO's which were rated investment grade despite holding mostly subprime loans? Where was the attempt to rein in exotic loans such as pick-a-payment mortgages and interest-only loans?

And if you think its no longer going on just as it did before 2008 think again. Highly inflated purchase prices, mostly on multi family buildings, recorded on Warranty deeds - but no money changes hands - not until they securitize it and sell it as a mortgage backed security. Its a little more complicated - but can even involve fake mortgage documents recorded on land records. The FED is still buying MBS's like there is no end in sight. If even 10% are found to have suspicious paper backing them - the whole lot will go to $0 and they will have paid top dollar with brand new money. And yes - not one of the MFers will go to prison.

Posted 23 December 2017 - 02:53 AM

Coin base was literally closed for all transactions yesterday as they were overwhelmed. Can you imagine the plight of these exchanges, if they have to wait for 1000 minutes for transaction confirmations ? Customers would be going nuts !

This is what happens when you deploy a project in a real world without any scalability considerations. Remember the arrogance of these guys on making VISA and Mastercard obsolete and disrupting the entire payment industry? With 8 transactions per second ? VISA has 50000 transactions per second.

Now they have another idea (ON PAPER of course) - lightening network, to make transactions faster. Making off chain transactions and transferring them to the main blockchain. I don't think the idea is peer reviewed. There are some smart folks who have mathematically invalidated the idea.

https://medium.com/@...on-1b8147650800

Edited by NAV, 23 December 2017 - 02:54 AM.

Posted 23 December 2017 - 09:15 AM

Ouch.

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions