Personally, I prefer a rally from these levels that will drive down volatility and allow me to short at much higher levels and buy lower cost QQQ puts. But I don't want volatility to go too low since I want good intra range to daytrade.

Here are two interesting opinions:

Here we are at the most important trading week of the entire year

http://www.futuresma...eek-entire-year

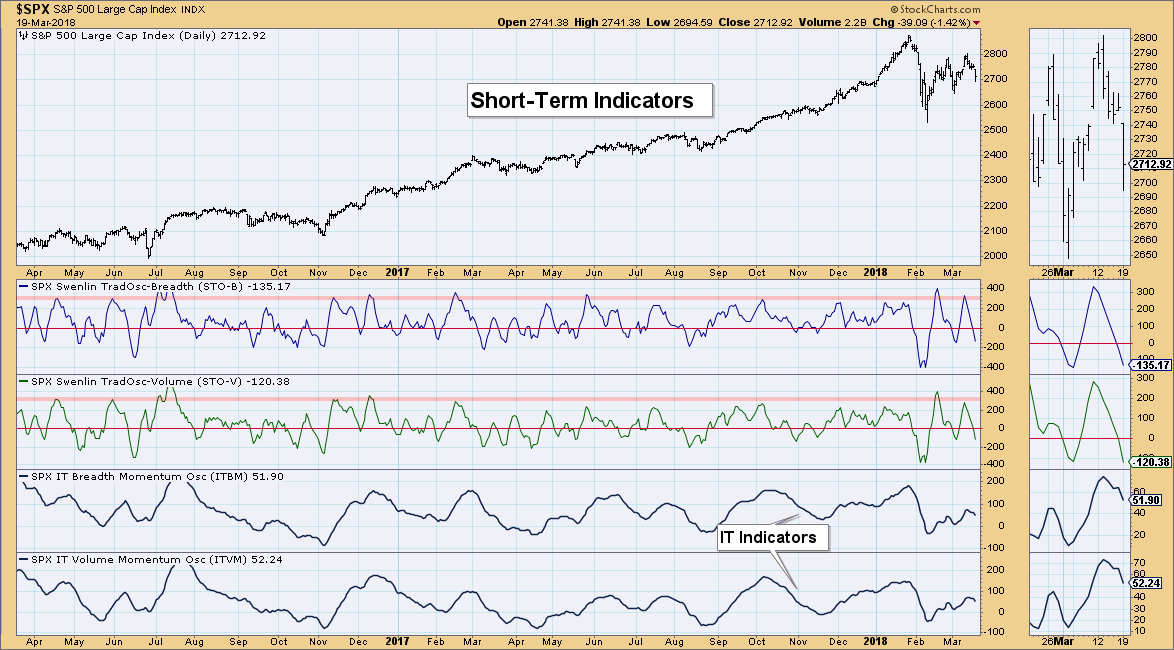

Dow Troubles: New IT Trend Model Neutral Signal - OEX Triggers ST Bearish Signals - Indicators Bearish"Unfortunately, the short and intermediate-term indicators are bearish. Short-term indicators have been falling for some time and they do not look interested in moving back up yet. There is plenty of downside room for them before they become oversold"

http://stockcharts.c...rs-bearish.html