Dougie, I show the following stock market positive indicators and divergences on Friday March 23: extreme closing tick, extreme put option buying, extreme TRIN, on-balance volume divergence, new lows divergence, A-D divergence, up volume - down volume divergence and an advance decline line divergence. That being said, I had almost all of these divergences on Thursday too, and the market still went down on Friday. As indicators, they appear to work a bit like old hand brakes on a bike that take a while to grab and stop you.

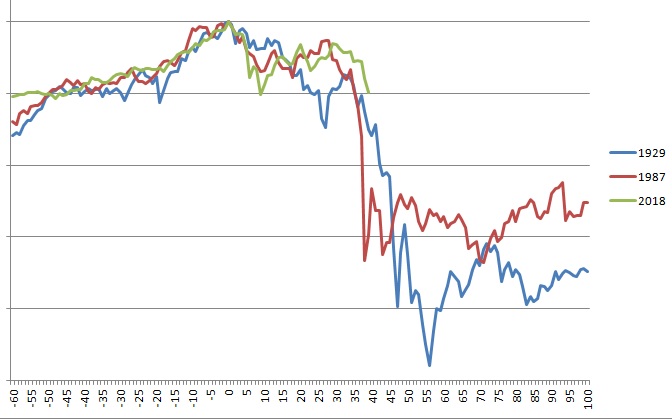

Geomean, as to a crash next week, I guess it's possible, but that falling feeling I had back on Friday the 16th of October 1987 just wasn't there this past Friday. Maybe I'm just a lot older and more jaded, who knows. I still remember Friday the 16th of October 1987 like it was yesterday. I was trading OEX options back then using Elliott Wave and other technical analysis. After the price action that Friday, I knew the market would crash on Monday. That Friday night I was literally scared to death we were about to experience a 1930's style collapse.

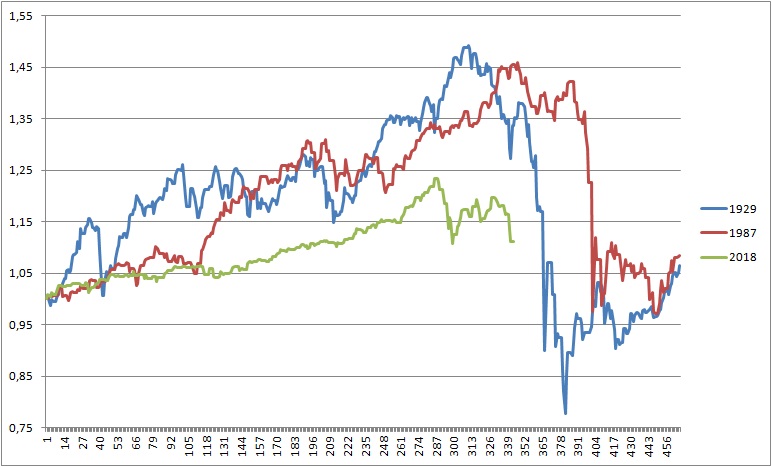

The FED market put was born that Monday the 19th of October 1987. Rather than let the market punish the portfolio insurance stupidity that caused the crash, Alan Greenspan flooded the banking system with money preventing a contraction which could have gotten out of hand, but would have instilled some market discipline. Central bankers have all always worried more about Wall Street than Main Street by printing money to drive creeping inflation which in the long term impoverishes salaried workers but helps drive asset prices higher. Alan Greenspan just took it to a new level It will be interesting to see if Chairman Powell is cut from the same cloth. Maybe you are right and the market will test him soon just to be sure he's on their team.

Regards,

Douglas