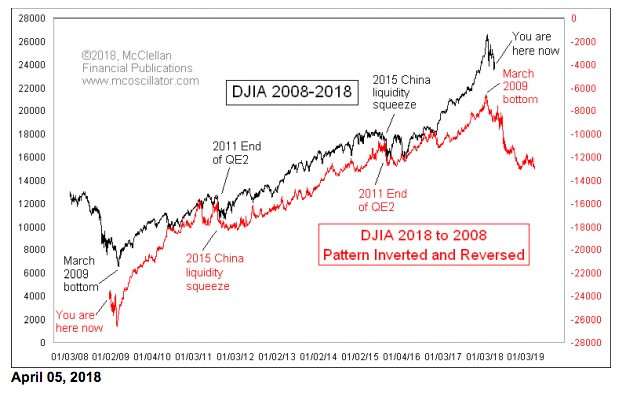

I am a bull, but I don't feel good so far ... this picture is from Tom McClellan

#1

Posted 16 April 2018 - 12:21 PM

#2

Posted 16 April 2018 - 12:52 PM

Feeling not so good is exactly what you want ![]()

Stop looking at all those time comparisons, they mean nothing IMO.

#3

Posted 16 April 2018 - 12:58 PM

good ewavers ignore the mclellan stuff

#4

Posted 16 April 2018 - 01:22 PM

ummm, lower lows (above statement)

must get coffee

#5

Posted 16 April 2018 - 03:14 PM

#6

Posted 16 April 2018 - 03:48 PM

Well, nothing has changed since the January high, SP-1500 remains on a buy signal, odds are the wave pattern is a wave four off the 1810 low and 3200 is still a solid wave five target. Wave "D" window at 2707 to 2750 remains my focus.

LT...d:^)

#7

Posted 16 April 2018 - 04:40 PM

The best bet for something like that would be in 2019. The FRB+ECB+BOJ net injections will turn negative in Q1.. Meanwhile, it took 6 months of teasing the 200-day moving average in 2000 and 2007 to build a top. It's not there yet.

#8

Posted 16 April 2018 - 05:10 PM

It is just as likely that we follow a 1998-2000 pattern.

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#9

Posted 17 April 2018 - 05:10 AM

down Tuesday?

#10

Posted 17 April 2018 - 05:53 AM

down Tuesday?

Maybe after a Gap UP opening that is faded. We have two cycle turns over the next week, TODAY, 4/17 and next week 4/27....afterwards are turns on 5/7 and 5/27 (direction of turns is left up to the trader, I don't forecast turns, however I will fade the market at the turn. This two-day rally I'll fade with tight stops.