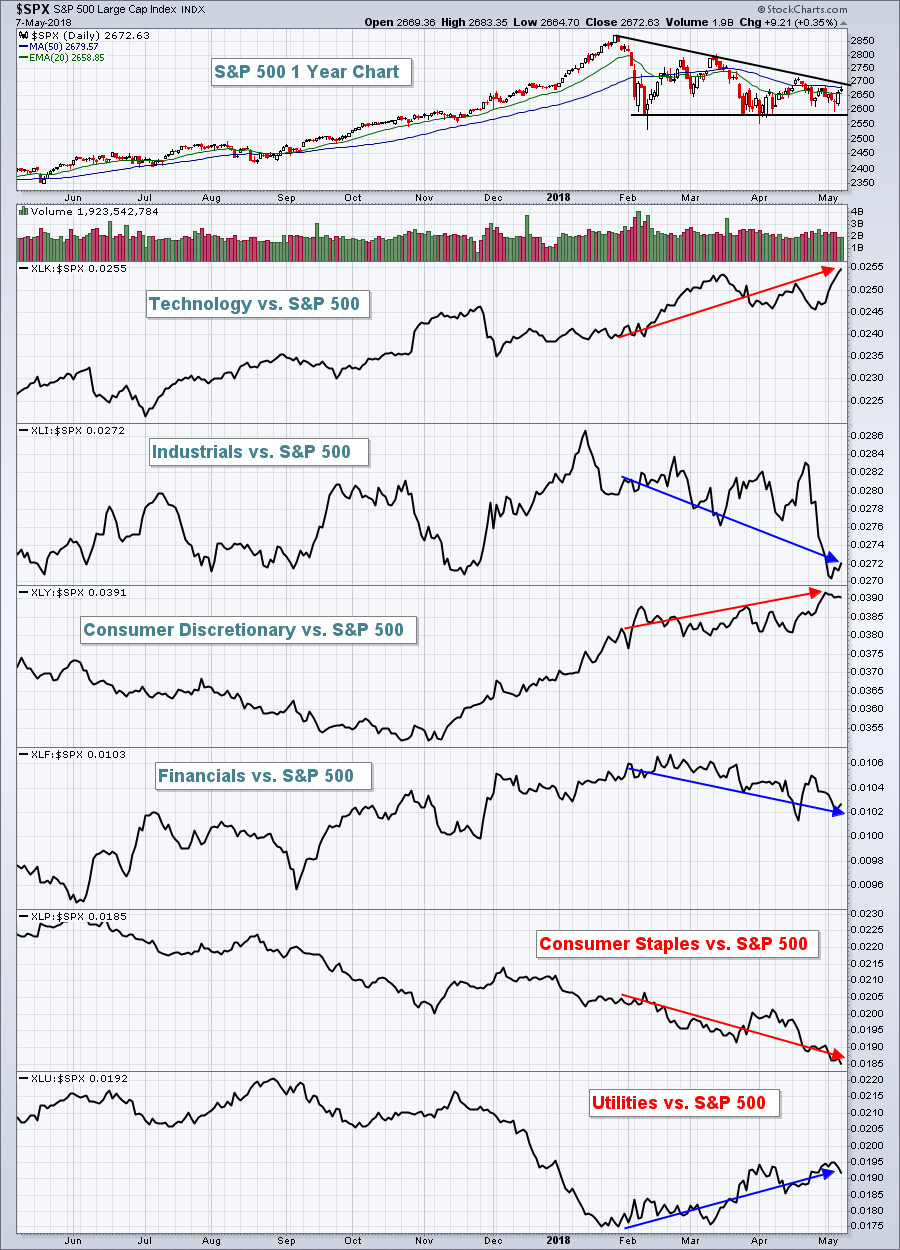

Consolidation is good, can lead to sustained rallies or declines, but consolidation has a limited shelf-life and can soon go bad. e.g. current SPX consolidation below the 50ma.

You cannot deny the bullish tone in the markets and the bounce off the initial spike down after the Iran announcement demonstrates the strength of buyers and weakness and vacillation of sellers. That market tone, that mood, that characteristic of the market can change if the bulls cannot close this market above the 50ma @ 2678 or prevent a daily close below the critical 2645/50 support zone.

Looking for that 37 VXX handle and QQQ closing above 169 sometime this week to start accumulating QQQ PUTS and VXX longs.

This SPX daily chart shows the key levels today --- 2689 to 2647 with 2668 pivot point and 50ma at 2678

Market have been compressing and that condition does not last. The bulls have the edge but can quickly lose it it they do not mvoe hte markets above critical levels.

See link below for SWENLIN's post on PMO buy for SPX & OEX.

DP Bulletin #2: SPX and OEX Garner New Short-Term Trend Model BUY Signals

http://stockcharts.c...uy-signals.html