Unless SPX closes below 2700, this market will rally.

The market has had several reasons to decline but has been extremely resilient.

No, this is not a permanent state, but on a ST basis the bias is towards the upside target of SPX 2760.

Intraday, an hourly close below 2700 is bearish; daily close below 2700 is bearish, and the 20ma cross below 50ma on daily SPX is bearish.

But, it's UP until the market proves otherwise.

by Carl Swenlin

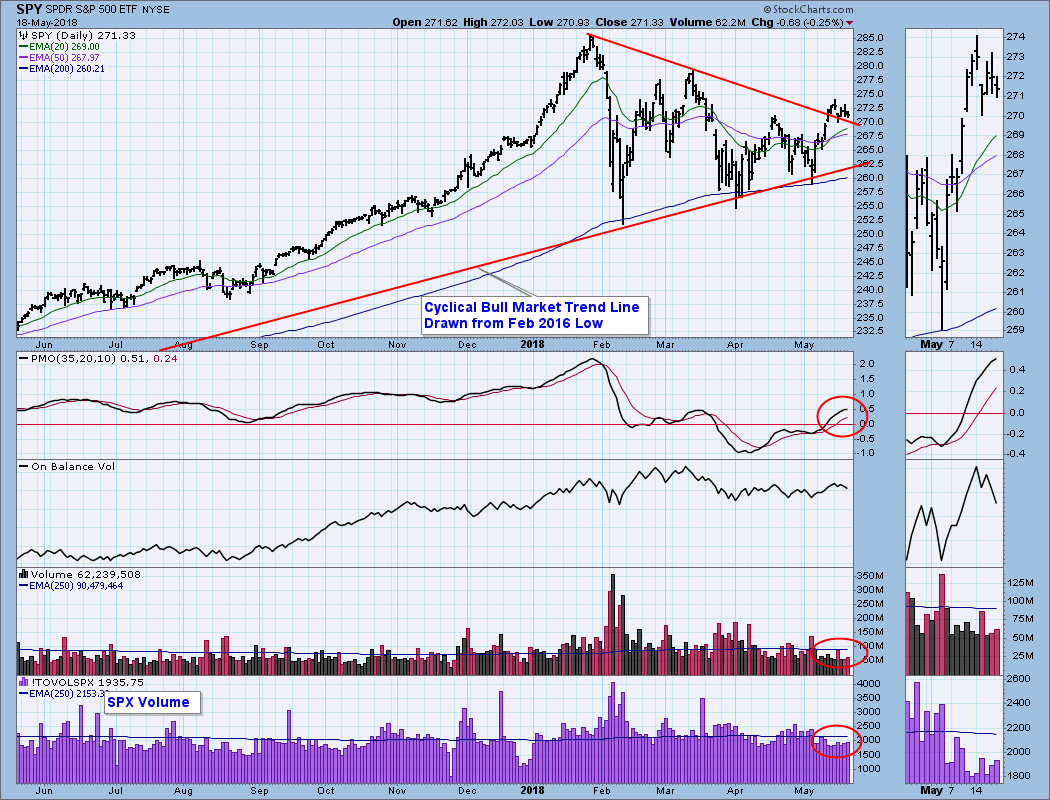

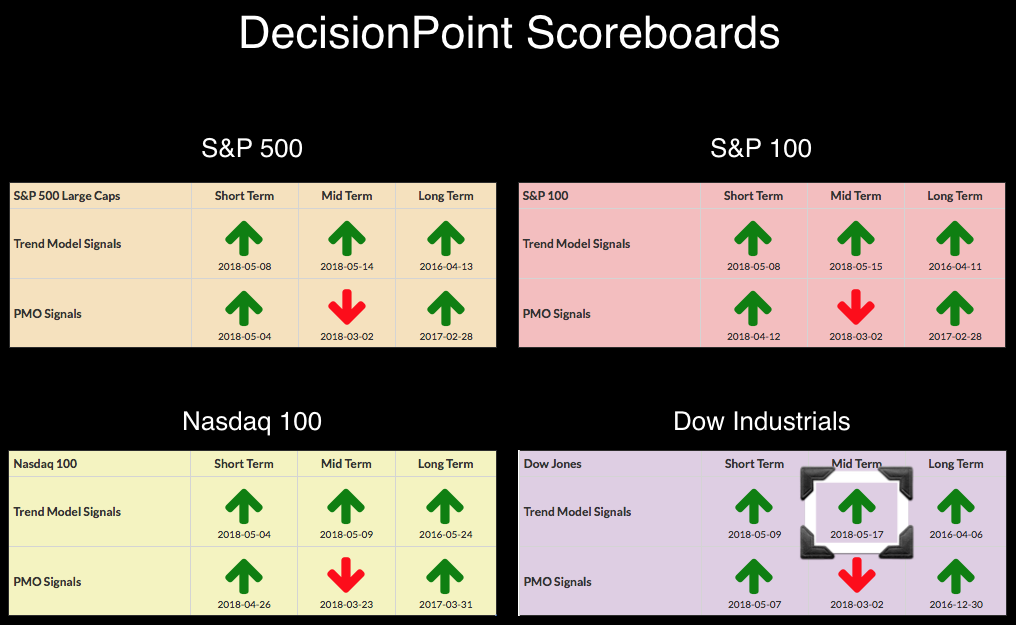

Back in the day, options expiration days were characterized by high volatility and exceptionally high volume; however, in recent years the market stays relatively calm, and the high volume only appears at the end of each quarter. These expectations were not disappointed in today's trading. In fact, the entire week was calm, as price worked sideways into a flag formation. Volume for the last two weeks has been somewhat thin, which implies that market participants are not fully committed to the rally. Nevertheless, from the April low a rising trend has been established (a bottom above aRead More