I am in agreement with TIM ORD but I must admit this very resilient market does not like to go down and badly wants to go up up up.....

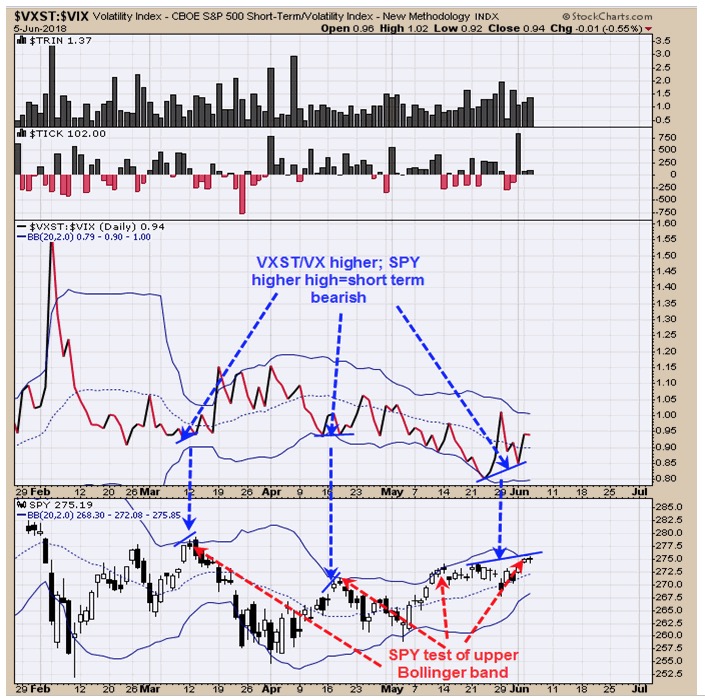

"We have updated this chart from yesterday. The middle window is the VXST/VIX (Short term VIX/Volatility index). It has been a bearish short term sign when the VXST outperforms the VIX (rising ratio). The SPY traded above its previous high and the VXST/VIX ratio made a higher low suggesting a short term pull back is possible. Also this is the week before option expiration week which can produce whipsaws. Next Wednesday (June 13) is the FOMC announcement and a cycle low is due June 13. The SPX 2800 higher target is still insight but a pause short term is possible. The last three highs in the SPY topped at its upper Bollinger band and its back at that level again. There is an unfilled gap in the 2700 range which is a possible pullback target. Neutral for now."

See LINK below chart.

http://stockcharts.c...ne-7-2018-.html