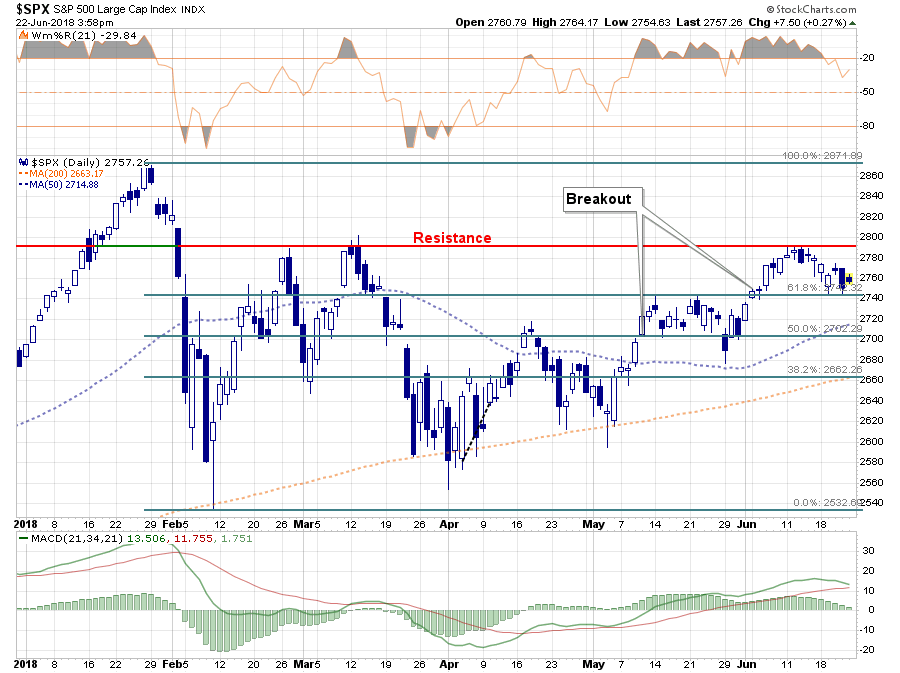

This could be the start of a significant decline or merely another minor pullback before this very impressive rally resumes.

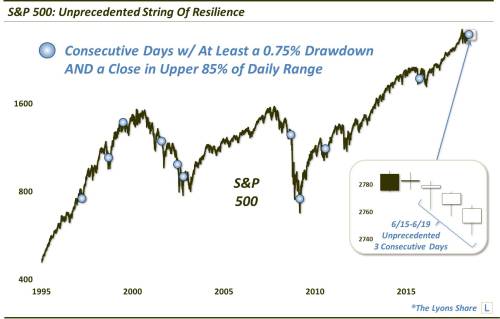

Bulls have been extraordinarily resilient, there are more and more buyers stepping in after every pullback, they have come back after every think has been thrown at them, and one should be ready to close ad/or exit any SHORT positions when rally gets going again.

CARL thinks we may have some more downside:

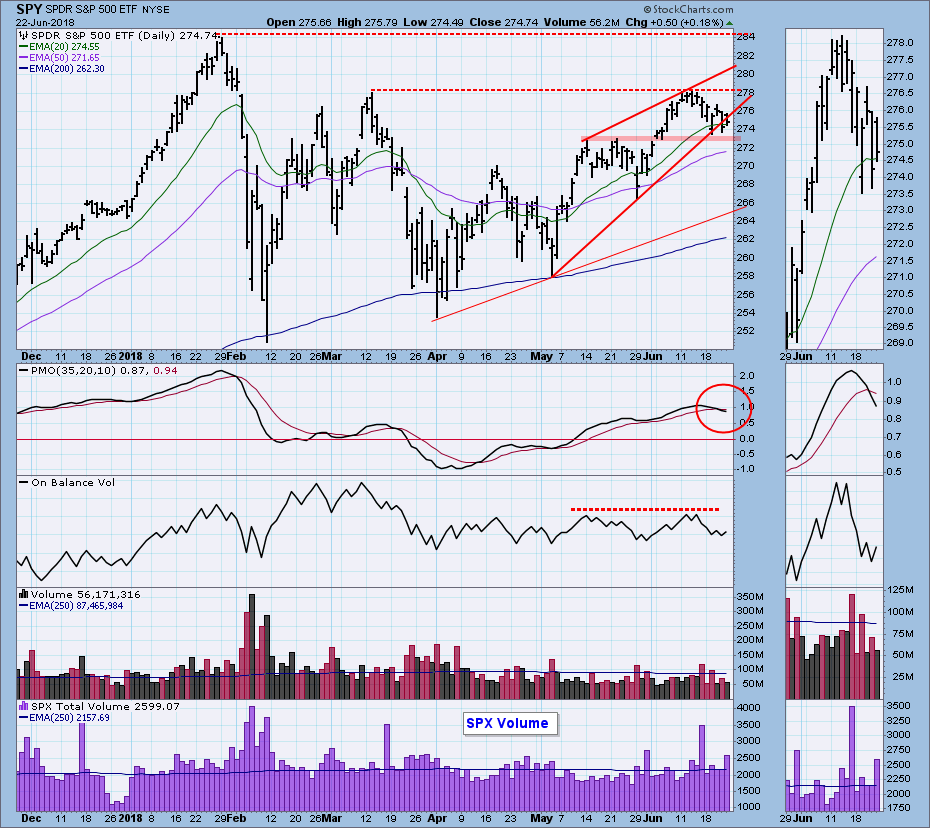

The market has been turned back from the horizontal resistance drawn across the March top, but it has managed to stay above the support drawn across the May tops. However, there is still the mechanism of the bearish rising wedge pattern, which is reinforced by an OBV negative divergence, and the PMO SELL signal. This setup is not immutable, but, as it stands right now, the evidence is saying to look for more downside. Let's see how that might get.

http://stockcharts.c...ell-signal.html