Bulls selling?

This guy says he is selling now... see link below

It's Time To Be A Stock Seller

Jul. 20, 2018 4:10 AM ET

Fewer Dip Buyers Is A Big Deal

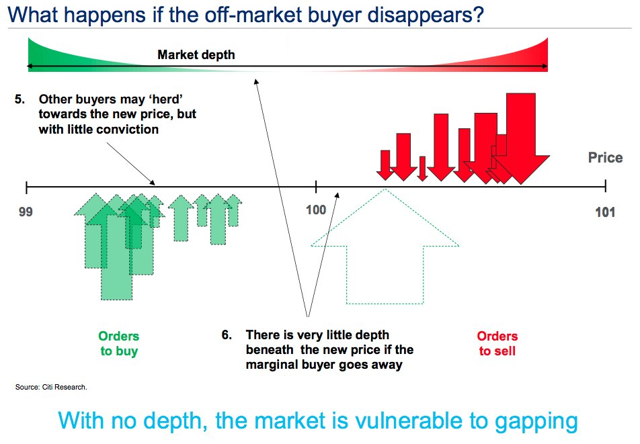

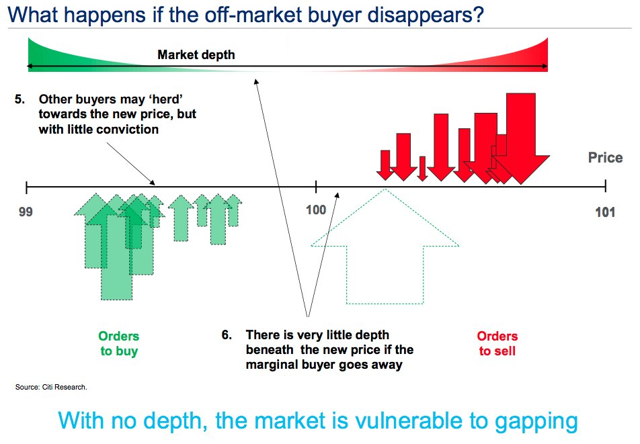

Business Insider published a chart from Citigroup analyst Matt King. He pointed out in a note that "the wall of money driving markets has stopped." He published this chart to demonstrate that the "dip buyers" (my term) are disappearing.

These marginal buyers are disappearing for two reasons. First, easy money is less easy. As I discussed in the video, less QE (quantitative easing) cash is flowing to primary banks which means less money is finding its way into the stock market. Simply put, there's less money originating from central banks to buy stocks.

These marginal buyers are disappearing for two reasons. First, easy money is less easy. As I discussed in the video, less QE (quantitative easing) cash is flowing to primary banks which means less money is finding its way into the stock market. Simply put, there's less money originating from central banks to buy stocks.

https://seekingalpha...me-stock-seller