Don't worry, yet.....

Still, there’s reason not to get too worried yet, say some. JPMorgan ’s Jason Hunter thinks we may have seen the worst of the news from the bond market, as recent action leaves him “looking for yields to form a bullish reversal pattern near current levels and define the cheaper end of the fourth-quarter 2018 to first-quarter 2019 range.”

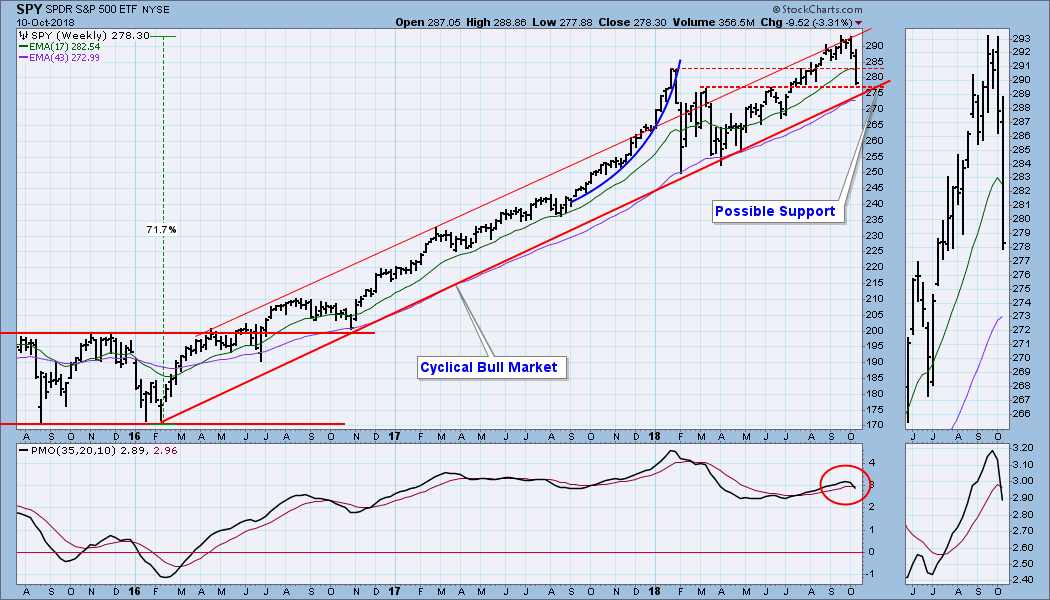

In addition, Fundstrat’s Robert Sluymer argues that in the near term, stocks look oversold and “due for a rebound,” as the S&P tests its first support at its 50-day moving average, and the Nasdaq, at its 100-day moving average. “An oversold rally is likely to develop in the coming few days,” he says. Earnings season should improve investors’ moods through the end of the year, he writes, with a cycle peak in 2020 and the next major low not due until 2020.

Earnings were a major driver of the market last quarter, and analysts see more robust results ahead, even if companies face growing issues like the yet-to-be-resolved trade war and higher raw-materials costs.

Then there’s the fact that we were probably due for a bit of a shake-up. As LPL Financials’ Ryan Detrick notes, the S&P 500 just came off its least volatile third quarter since 1963, has been up for six consecutive months, and hasn’t closed up or down more than 1% for more than three straight months, “one of the longest streaks ever.” Thus, it isn’t surprising that we’re finally getting a bit of volatility. “It might feel bad when it happens, but pullbacks are a normal part of bull markets.” And if history is any guide, we won’t have to endure too much, as the S&P has been up an average of 14.5% a year after all midterm elections going back to 1946, while all 18 midterms saw higher returns 12 months later, he notes.

https://www.barrons....-yet-1539190193