So, I am looking for good candidates for my LT portfolio; I sold all APPLE & AMAZON last month but do not want to re-invest in these.

Chip stocks? Any bank stock?

Market Gyrations Set Stage for Buyback Bounce

By Corrie Driebusch, stocks reporter

There’s a silver lining to this month’s gyrations in the stock market: companies can buy back more of their own shares.

The amount of shares companies are allowed to repurchase is dependent on recent trading volumes. Under SEC rules, a company’s repurchase of shares on any given day cannot exceed 25% of its stock’s average daily trading volume over the past four weeks.

That’s good news for equity investors who have been hit by falling stock prices in October. The S&P 500 is poised for its worst month since August 2015. But while share prices have suffered, trading volumes have rebounded, with the market turmoil spurring investors to get in and out of positions.

In September, 6.7 billion shares changed hands on average each day, according to Dow Jones Market Data. That’s slightly under the year-to-date average of 6.8 billion shares a day.

But volumes have jumped in October as the market has swooned. Roughly 7.9 billion shares have changed hands across exchanges each day this month through Friday. In the week ended Oct. 12, volumes spiked to an average 8.8 billion shares a day.

This opens the door for companies to aggressively buy back their own shares—a potential big boost for stock prices.

Right now, many companies are in the middle of a buyback blackout. Corporations are typically blocked from repurchasing shares in the period leading up to when they report quarterly results.

However, with earnings coming to a close, and that restriction soon lifting, these companies are positioned to resume share repurchases at a faster clip—all thanks to the selloff that brought about higher volumes.

Around Labor Day and the back-to-school period this year, trading across the market was slow, said Justin Wiggs, managing director in equity trading at Stifel Nicolaus.

“Now, it’s interesting,” he said. “It’s bound to be most meaningful for mid-size or smaller companies.”

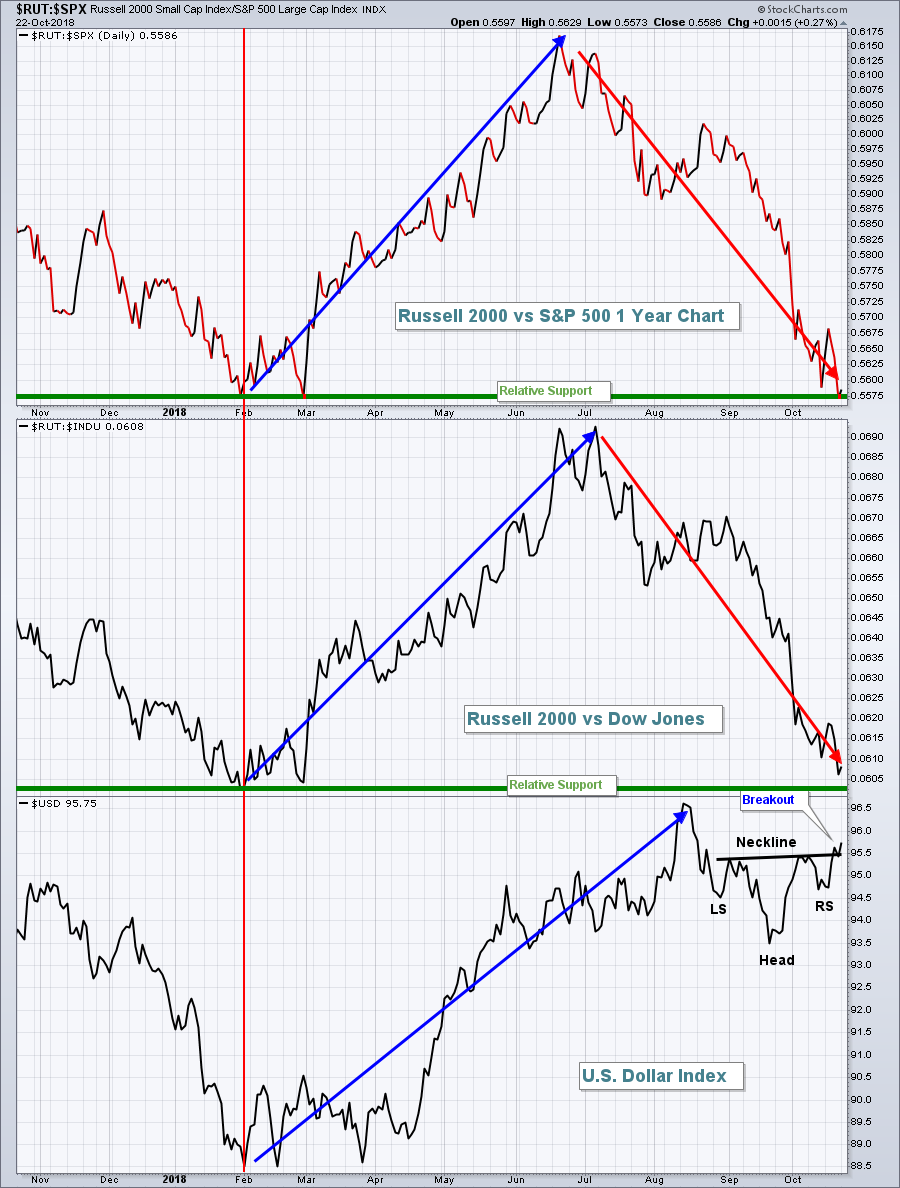

These companies are most affected by the rule tying buyback activity to volumes. For instance, big corporations whose shares change hands eight million times a day are less likely to be impacted by a short-term volumes boost than a small-cap company that sees on average two million shares traded daily, according to Mr. Wiggs.

In the nine years since the financial crisis, share buybacks have risen significantly, and some analysts say this has helped support the stock-market’s rally in that period.

Companies are rapidly coming out of the buyback blackout period. The bulk of corporate earnings results are typically reported by mid-November. That means the stock-market stimulant could be just around the corner.

Do you expect to see companies do more buybacks after recent volatility? Let the author know your thoughts at corrie.driebusch@wsj.com. Emailed comments may be edited before publication in future newsletters, and please make sure to include your name and location.