If this market can't get off it's butt after the election.....then we will know with certainty that the Fed is far down the path toward blowing it again. It's not exactly rocket science when you can look at the EEM and EMB emerging market charts for this year as just one example. Imagine if the SPX chart looked like EEM.....

Buffett lost $4 billion in single day on APPLE, who will come to his rescue?

#11

Posted 03 November 2018 - 04:41 PM

#12

Posted 04 November 2018 - 06:17 AM

For a surprise

#13

Posted 04 November 2018 - 08:32 AM

Possible, in this way:

The FED may try to inject some dovishness in their statement etc....that could be the surprise

#14

Posted 04 November 2018 - 10:42 AM

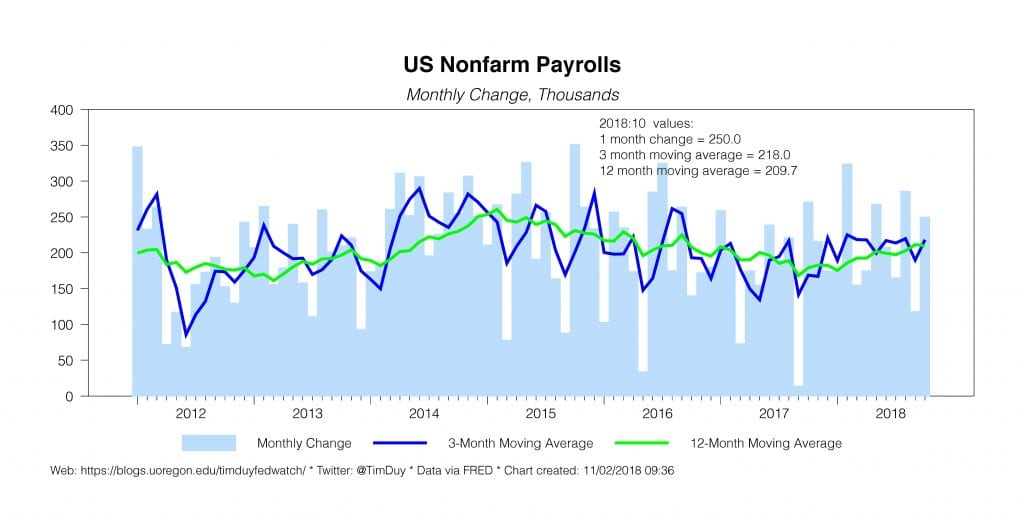

The US economy hit it out of the park in October. Rapid economic growth continues to fuel a labor market that delivers the enviable combination of job growth, labor force growth, and now faster wage growth. So far, this also continues in a low inflation environment. The Fed, however, doesn’t believe that situation will continue forever in the absence of tighter monetary policy. Expect the rate hikes to continue. Furthermore, I think you can make an argument that the labor market is close to the point where inflationary pressures will intensify. Something that everyone seems to think can’t happen anymore.

Nonfarm payrolls rose 250k, a solid above-consensus pace of job growth. Both the three- and twelve-month moving averages are above 200k. Fairly impressive growth for an expansion that is over nine years old. The pace still exceeds the Fed’s estimate of sustainable growth after the cyclical forces driving labor force growth give way to demographics.

That day, however, is not yet at hand. Labor force participation ticked up, which helped hold the unemployment rate at 3.7%. Remember, the Fed anticipates this rate to hold through the end of the year, a bet that looks better this month than last. At least in the near-term, central bankers are labor force optimists.

https://blogs.uorego...ber-and-beyond/

#15

Posted 04 November 2018 - 10:45 AM

Bottomline: These charts suggest that while a retest is possible we may have either seen a meaningful low or are in process of making a meaningful low. That’s the Wall Street line.

But here’s the big BUT and there’s a lot of buts and I want everyone to be aware of the counterarguments, because I did not see them outlined by the bottom calling teams and from my perch investors and traders should be very much aware of them.

In the interview above and last week I outlined the similarities to previous major market tops. What we are currently witnessing may simply be the counter rally we’ve seen following the initial drops from new highs on negative divergences.

https://northmantrad...-vengeance-but/

#16

Posted 04 November 2018 - 11:44 AM

#17

Posted 04 November 2018 - 01:06 PM

Think of all the $Gazillions IBM spent on buybacks... what was the point? They sacrificed their credit rating for what?

$AAPL is about to burn up all their capital on trying to defend the undefendable...

190 is just the first stop.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#18

Posted 05 November 2018 - 10:29 AM

Lots of denial about a long term top. I'm firm in my opinion that all rallies should be sold going forward. Surprises will come to the downside.

NYA Monthly certainly looks like long term top at this point in just about every respect...

Like I said before, now treating this a LT bear, unless NYA 13K can be reclaimed by bulls...

The real key will be to see what the Margin numbers look like when released later this month. If they show a massive drop off, that will likely be the nail in the coffin of the Bull.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy