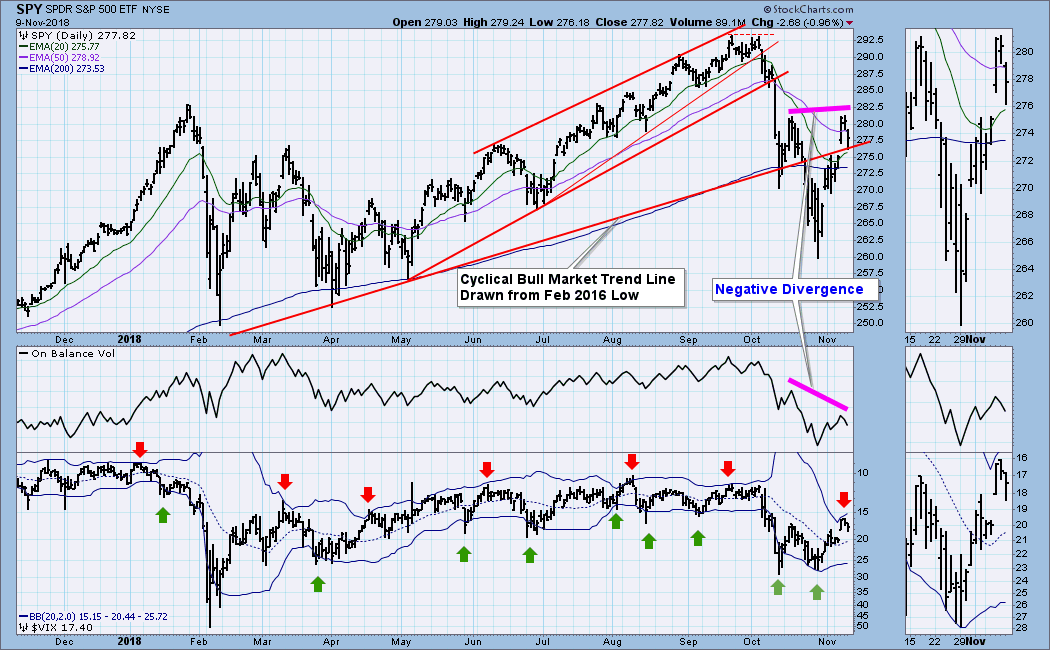

Last week SPY was below the cyclical bull market rising trend line. This week there was a post-election pop on Wednesday that caused SPY to recapture that rising trend line. Will that breakout hold, or is it a fakeout? There are two features on the daily chart that say to me that the latter is the case. First, the OBV line has formed a negative divergence, and, second, the VIX has topped at the top Bollinger Band, an event that in the last year has usually signaled a price top. At this point I'll be looking for a second trend line failure and lower prices.

The DecisionPoint Weekly Wrap presents an end-of-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds.

https://stockcharts....ak-or-fake.html