The incredibly intense selling during the past few sessions may hammer out a bottom or be a precursor to even more selling on the way to the BIG LOW.

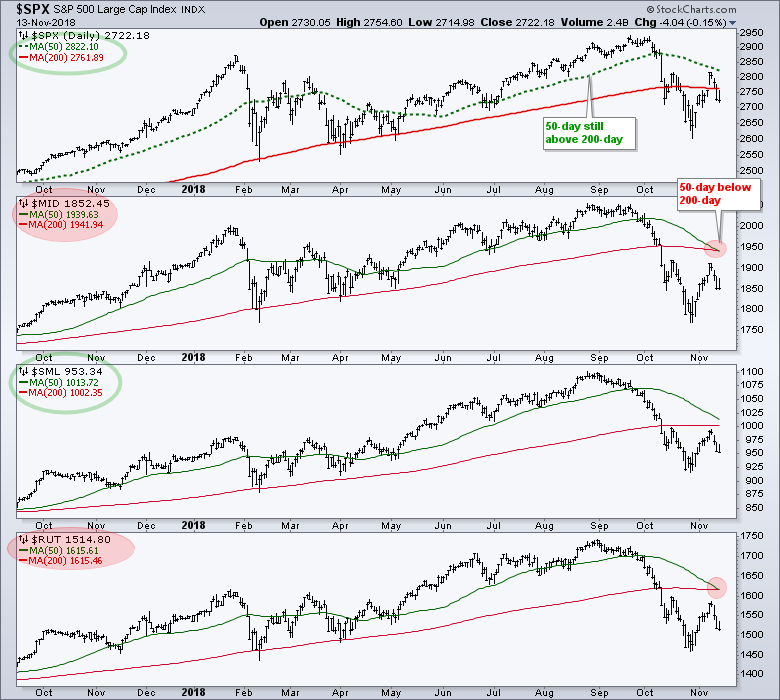

DUH, what's new there? Nothing, except, the bulls must make a stand here or else there could soon be NEW 2018 SPX lows.

Basic TA tells us, on a LT basis, SPX cannot break the October 2600 lows or else it goes LT bearish. So, that's one major level we must monitor.

Next, we have the SPX 200ma above current SPX close so the market has to move above that to remove the bearish tone..

Between those two levels above, it appears as if the ST and IT bull or bear status must be determined by sentiment and POLITICS, US and GLOBAL. That's how it has been for a few weeks, no significant change in fundamentals, but the market has been influenced by political instability, insecurity, anxiety, and unpredictability. In such situations, you have to try to filter these external factors and focus on TA and the fundamentals - easier aid than done. That;s why I trade ST because I prefer to focus on what is happening now and during the next few minutes in the life of a ST trade than on longer periods. But, others have developed successful IT and LT strategies.

Here is where I got that BIG LOW phrase:

Stay bearish because the ‘Big Low’ for stocks hasn’t arrived yet, says Bank of America

“We remain bearish, as investor positioning does not yet signal ‘The Big Low’ in asset markets,” says Hartnett, in the bank’s closely watched November fund manager survey (the capitalization isn’t lost on us, nor Wall Street, we presume).

For one, the bank’s Bull & Bear indicator, which tracks investor sentiment is hanging around 3.1, meaning no “contrarian buy signal” is being flagged, he says. The gauge runs from 0 to 10, with the high end representing extreme bullishness and the low end extreme bearishness.

https://www.marketwa...rica-2018-11-13