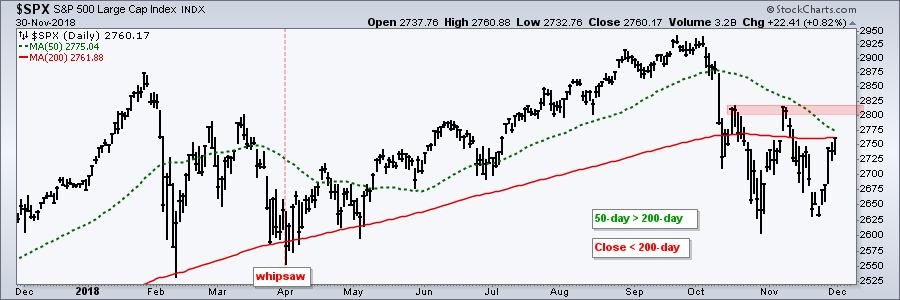

Actually, I don't think the BULL is fully energized as it was in 2017 and earlier this year. It is still in ICU and needs

more strength if it can rally in December.

Here's one opinion on the Cavalry riding to rescue the Bull when it was on the verge of collapse:

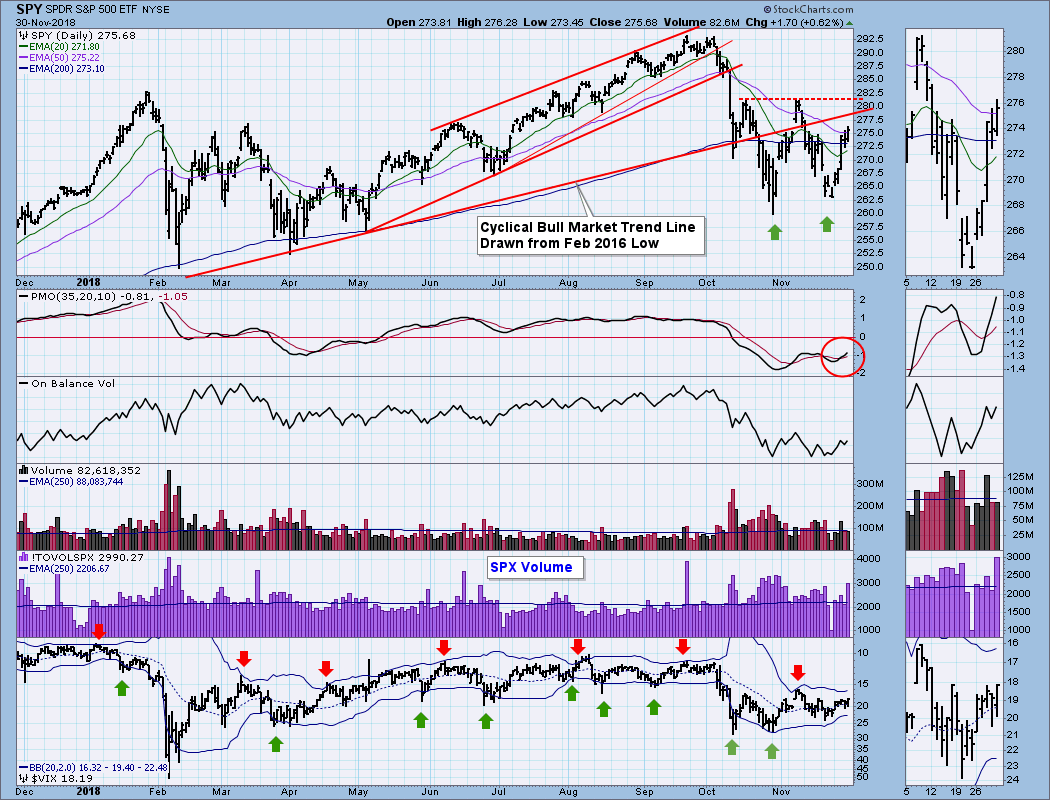

Saved again. For a second month in a row markets were on the verge of breaking their bull market trends. For a second month in a row they were saved again into month end. I’ll publish a proper Weekly Market Brief tomorrow, but I wanted to take a moment to highlight in a few charts the precision, and one might say, coordinated fashion with which all these trends were saved.

And one has to stand in awe. Just a week ago everything once again looked at the verge of breaking down, but the Bear Trap was set and stocks responded with their best week in 7 years to close out the month greatly aided by the US Federal Reserve who, like in February 2016, once again caved on their projected rate hike schedule.

The timing is impressive.

https://northmantrad...01/saved-again/