...and SYSTEM wins more often than INTUITION.

In this case, I go for the easy (& cowardly) choice and over-rule both of the above: FLAT !

Well, those super big-ly daily and hourly ranges & True Ranges have been processed by my system and it

says to BUY. One major factor is this:

Friday's SPX low & high were higher than the previous day.

My intuition says SELL and more than 75% of my trades in Friday were SHORTs.

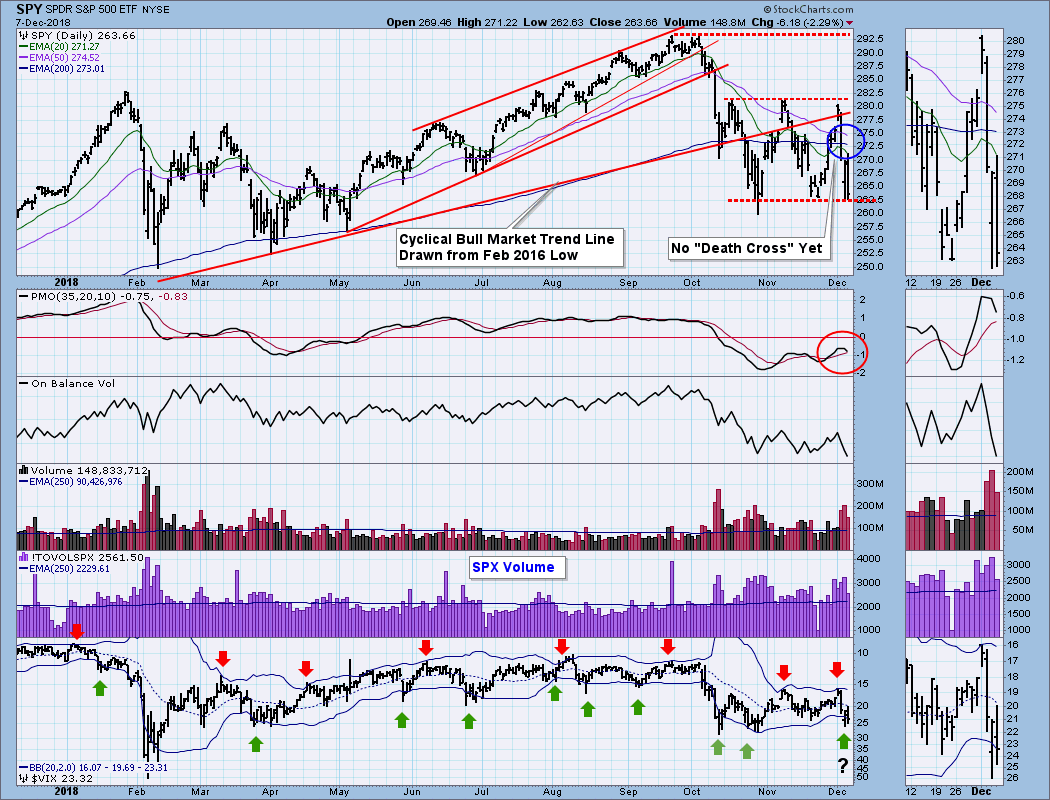

And, how can you BUY when the dreaded death cross just happened? (Carl has a different take on this, he may be right!, see below)

If the SPX daily close is below Thursday's close then the SYSTEM will go SHORT

If the SPX daily close is above Friday's close then the SYSTEM will continue to be LONG

----

CARL:

There will probably be a lot of people mentioning that today there was a "Death Cross" on the S&P 500 chart, and this is important because a Death Cross means that the price index has entered a bear market. Specifically, on the $SPX chart (not shown) the 50-day simple moving average crossed down through the 200-day simple moving average (SMA). I don't use SMAs because I believe exponential moving averages (EMAs) behave more rationally. And for signal generation and trading decisions I track SPY instead of $SPX, which can actually be traded. Also, like stocks, SPY is adjusted for distributions, which reflects the total return of the index. As you can see on my chart, there has been no 50/200EMA downside crossover yet. I think that it is inevitable, but it could quickly be avoided if SPY were to rally above the EMAs, because that would cause the EMAs to turn up and begin separating again. That wouldn't necessarily happen with an SMA because of the way they are calculated. (See the Chart School article on moving averages for more info.)

https://stockcharts....-fireworks.html