Powell was anything but dovish although some are already trying to spin it as "it's data-driven" so forget his statement about 2 more hikes in 2019.

Expect more spin and lots of walking back by FED people.

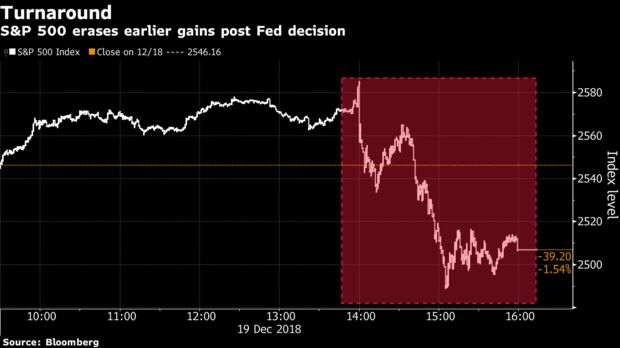

Market bounced off the SPX 2490 level but even though I mentioned this as a downside target recently and possibility of a SPX 2400 handle I did not expect it this week!

There will be attempts at rallying, there will be rallies as high as 2750, but unless there is a definitive change in FED tone and intentions, the bear is here to stay. In such an environment, sell the rallies but you must be very patient and also trade long during the rallies because as we all know: bear market rallies can be short, sharp, and brutal.

So, will Trump fire Powell? No. Seriously, no.

In summary, unless there is credible and definitive change in the FED's stance, markets will be down with sharp rallies.