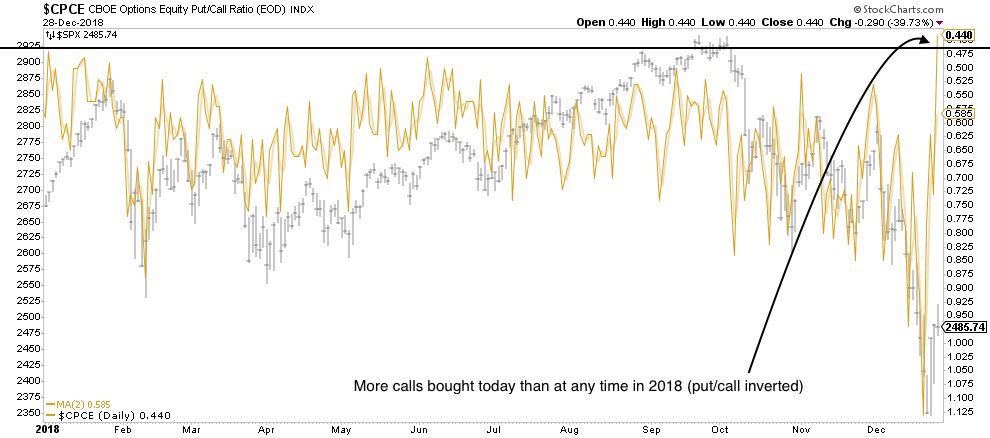

Many years ago as the market was giving up its Internet boom euphoria, I had taken a long position intraday and was feeling pretty good about it at the close. Motorola was reporting after the close, and in those days, that was a BIG report in the tech space. The semis had been getting killed and everything was oversold. Motorola's report was horrible. They missed by a mile and issued a warning that looked absolutely terrible. Genius me went into action. I sold my longs and went short the semis on leverage. I was gonna win big time. Overnight, some bongo-head analyst who, at the time was the big name analyst in the space, UPGRADED the semis because......get this....."the news can't get any worse". The semis were up HUGE at the open and my position was crushed at the open as well. If the internals hadn't been so terrible lately, I could easily see the same result here because...….once again......the market is overreacting to everything......as it is so prone to do.

To illustrate, Apple's big warning was for revenues to be 8% below consensus estimates. Holy Cow! But wait, the stock closed today at 157.92 and that price is 32.3% lower than its high on October 3rd. AND, the last after-hours price was another 7.5% below that price and 37.5% below that same October 3rd price. Now, at what point would a reasonable person say that this news had been priced into the stock?

As another example, on July 31, 2018 Apple closed at 190.29 (down about five bucks from three trading days earlier). Funny thing happened. Apple guided HIGHER on July 31st. That guidance was for revenues of $60-62 billion and the street's consensus had been $59.4 billion. The stock gapped OPEN the next day at 199.13 and didn't look back. Let's see...…..traded it up HUGE (over 200) on the upward guidance of $60-62 billion. After hours today the stock traded at in the 146 area because...…..get this......revenues are going to fall all the way to $84 billion. Opened at 199.13 (August 1st) on guidance to $60-62 billion.....traded down huge after hours (today) to the 146 area on guidance of $84 billion. Sometimes, it just gets stupid.

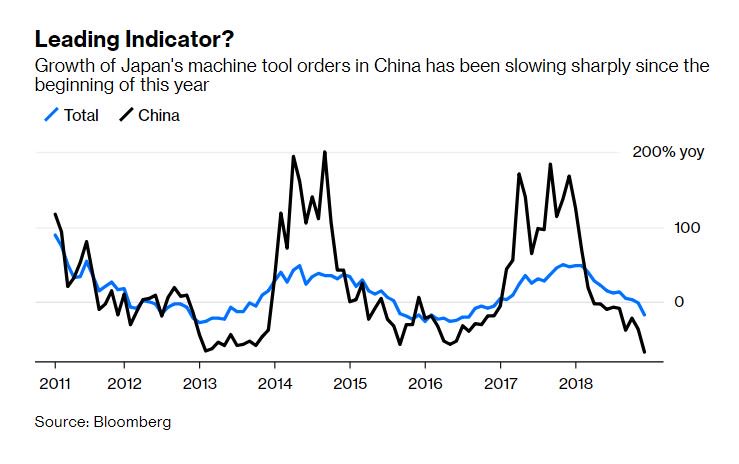

Oh, I forgot, this is all the FED's fault......dummy me! (And no. I am not mad because I am long. I sold longs today shortly before 2:45 PM.) Just pointing out an obvious absurdity. Even considering the clearly maturing replacement cycle and stretched retail pricing, it is still on the absurd side. Cook said it was all about China and iPhone sales there. I bet the Chinese people are pissed and are taking it out on Apple......Huawei had apparently achieved iconic status with the Chinese people. This could easily be more about that than overall Chinese weakness.

Edited by Iblayz, 02 January 2019 - 10:26 PM.